GameStop 2008 Annual Report Download - page 89

Download and view the complete annual report

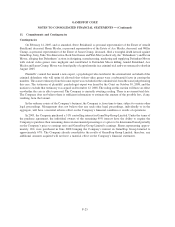

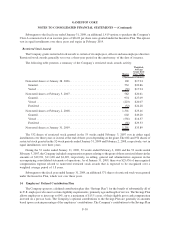

Please find page 89 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 2008, in connection with the acquisition of Micromania, the Company entered into a Term Loan

Agreement (the “Term Loan Agreement”) with Bank of America, N.A and Banc of America Securities LLC. The

Term Loan Agreement provided for Term Loans in the aggregate of $150,000, consisting of a $50,000 secured term

loan (“Term Loan A”) and a $100,000 unsecured term loan (“Term Loan B”). The Term Loan Agreement provided

that the principal of Term Loan B was to be repaid in four equal installments of $25,000 a week for four consecutive

weeks, commencing on December 3, 2008. Term Loan A was scheduled to mature on March 31, 2009. Amounts

borrowed under the Term Loan Agreement may not be reborrowed once repaid. Borrowings made pursuant to the

Term Loan Agreement bore interest, payable quarterly or, if earlier, at the end of any interest period, at a per annum

rate equal to either (a) the prime loan rate, described in the Term Loan Agreement as the higher of (i) Bank of

America N.A.’s prime rate or (ii) the federal funds rate plus 0.50%, in each case plus 1.75%, or (b) the LIBO rate (a

publicly published rate) plus 3.75%. The effective interest rate on Term Loan A was 5.75% per annum and the

effective rate on Term Loan B ranged from 5% to 5.75% per annum.

The Term Loan Agreement contained customary affirmative and negative covenants, including limitations on

GameStop and its subsidiaries with respect to indebtedness, liens, investments, distributions, mergers and acqui-

sitions, dispositions of assets, changes of business and transactions with affiliates. In addition, the Company was

subject to a fixed charge coverage ratio covenant of 1.5:1.0. The covenants permitted the Company to use proceeds

of the Term Loans for working capital, capital expenditures, payment of transaction costs and a portion of the

consideration in connection with the acquisition of Micromania and for all other lawful corporate purposes.

In November 2008, the Company borrowed $275,000 under the Revolver and borrowed $150,000 under the

Term Loans in order to complete the acquisition of Micromania. As of January 31, 2009 the Revolver and the Term

Loans were repaid in full.

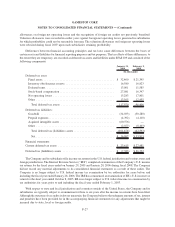

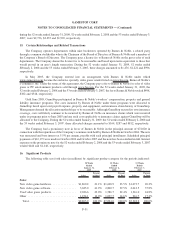

In September 2007, the Company’s Luxembourg subsidiary entered into a discretionary $20,000 Uncommitted

Line of Credit (the “Line of Credit”) with Bank of America. There is no term associated with the Line of Credit and

Bank of America may withdraw the facility at any time without notice. The Line of Credit will be made available to

the Company’s foreign subsidiaries for use primarily as a bank overdraft facility for short-term liquidity needs and

for the issuance of bank guarantees and letters of credit to support operations. As of January 31, 2009, there were

$5,618 of cash overdrafts outstanding under the Line of Credit and bank guarantees outstanding totaled $4,948.

In September 2005, the Company, along with GameStop, Inc. as co-issuer (together with the Company, the

“Issuers”), completed the offering of $300,000 aggregate principal amount of Senior Floating Rate Notes due 2011

(the “Senior Floating Rate Notes”) and $650,000 aggregate principal amount of Senior Notes due 2012 (the “Senior

Notes” and, together with the Senior Floating Rate Notes, the “Notes”). The Notes were issued under an Indenture,

dated September 28, 2005 (the “Indenture”), by and among the Issuers, the subsidiary guarantors party thereto, and

Citibank, N.A., as trustee (the “Trustee”). The net proceeds of the offering were used to pay the cash portion of the

merger consideration paid to the stockholders of EB in connection with the EB merger. In November 2006,

Wilmington Trust Company was appointed as the new Trustee for the Notes.

The Senior Notes bear interest at 8.0% per annum, mature on October 1, 2012 and were priced at 98.688%,

resulting in a discount at the time of issue of $8,528. The discount is being amortized using the effective interest

method. As of January 31, 2009, the unamortized original issue discount was $4,288. The Issuers pay interest on the

Senior Notes semi-annually, in arrears, every April 1 and October 1, to holders of record on the immediately

preceding March 15 and September 15, and at maturity.

The Indenture contains affirmative and negative covenants customary for such financings, including, among

other things, limitations on (1) the incurrence of additional debt, (2) restricted payments, (3) liens, (4) sale and

leaseback transactions and (5) asset sales. Events of default provided for in the Indenture include, among other

things, failure to pay interest or principal on the Notes, other breaches of covenants in the Indenture, and certain

events of bankruptcy and insolvency. As of January 31, 2009, the Company was in compliance with all covenants

associated with the Revolver and the Indenture.

F-22

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)