GameStop 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

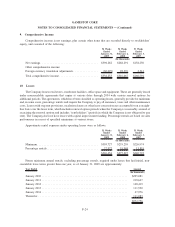

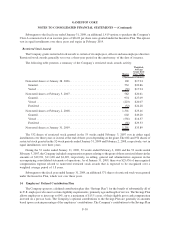

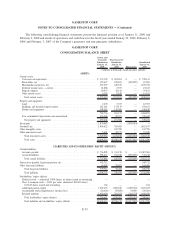

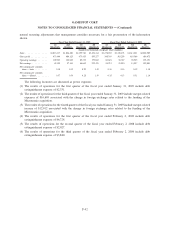

Fiscal Year Ended February 2, 2008

United

States Canada Australia Europe Other Consolidated

Sales............................. $5,438.8 $473.0 $420.8 $761.4 $ — $7,094.0

Depreciation and amortization .......... 100.0 7.9 8.3 14.1 — 130.3

Operating earnings .................. 391.2 35.8 41.8 32.6 — 501.4

Interest income ..................... (21.9) (2.0) (3.2) (12.6) 25.9 (13.8)

Interest expense..................... 61.0 — 0.3 26.2 (25.9) 61.6

Earnings before income tax expense...... 364.9 26.9 35.0 14.3 — 441.1

Income tax expense .................. 129.7 9.6 10.4 3.1 — 152.8

Goodwill.......................... 1,096.6 116.8 147.2 41.8 — 1,402.4

Other long-lived assets ............... 377.5 35.8 34.6 130.8 — 578.7

Total assets ........................ 2,742.0 274.7 251.1 508.1 — 3,775.9

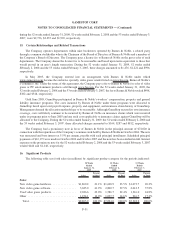

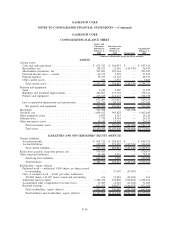

Fiscal Year Ended February 3, 2007

United

States Canada Australia Europe Other Consolidated

Sales............................. $4,269.5 $319.7 $288.1 $441.6 $ — $5,318.9

Depreciation and amortization .......... 85.3 6.6 6.3 11.7 — 109.9

Operating earnings .................. 285.4 20.0 27.3 1.0 — 333.7

Interest income ..................... (16.8) (0.8) (1.5) (8.5) 16.3 (11.3)

Interest expense..................... 84.3 — 0.1 16.6 (16.3) 84.7

Earnings (loss) before income tax

expense ......................... 211.8 20.9 28.7 (7.1) — 254.3

Income tax expense .................. 78.6 7.4 8.8 1.2 — 96.0

Goodwill.......................... 1,098.1 116.8 147.2 41.8 — 1,403.9

Other long-lived assets ............... 343.2 32.5 25.4 104.2 — 505.3

Total assets ........................ 2,618.9 210.4 210.7 309.6 — 3,349.6

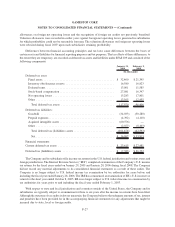

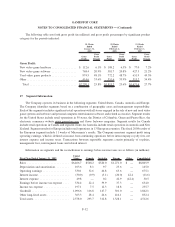

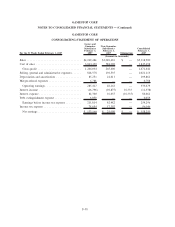

18. Supplemental Cash Flow Information

52 Weeks

Ended

January 31,

2009

52 Weeks

Ended

February 2,

2008

53 Weeks

Ended

February 3,

2007

(In thousands)

Cash paid during the period for:

Interest .............................................. $ 45,252 $59,357 $81,732

Income taxes .......................................... 204,776 47,792 59,620

Subsidiaries acquired:

Goodwill............................................. 459,287 (1,061) 8,083

Cash received in acquisition............................... 45,650 — 41

Net assets acquired (or liabilities assumed) .................... 171,419 — 3,220

Cash paid .............................................. $676,356 $ (1,061) $11,344

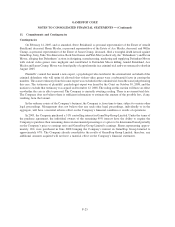

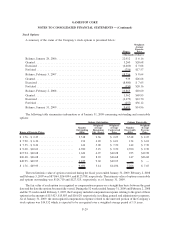

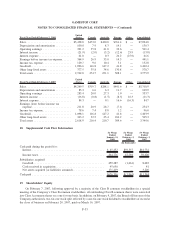

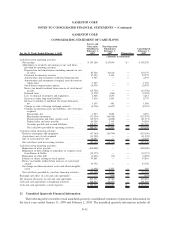

19. Shareholders’ Equity

On February 7, 2007, following approval by a majority of the Class B common stockholders in a special

meeting of the Company’s Class B common stockholders, all outstanding Class B common shares were converted

into Class A common shares on a one-for-one basis. In addition, on February 9, 2007, the Board of Directors of the

Company authorized a two-for-one stock split, effected by a one-for-one stock dividend to stockholders of record at

the close of business on February 20, 2007, paid on March 16, 2007.

F-33

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)