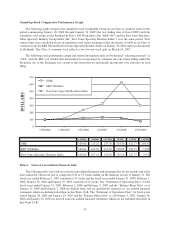

GameStop 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

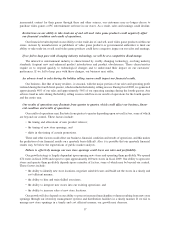

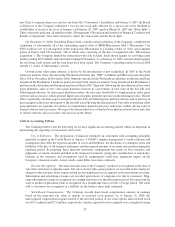

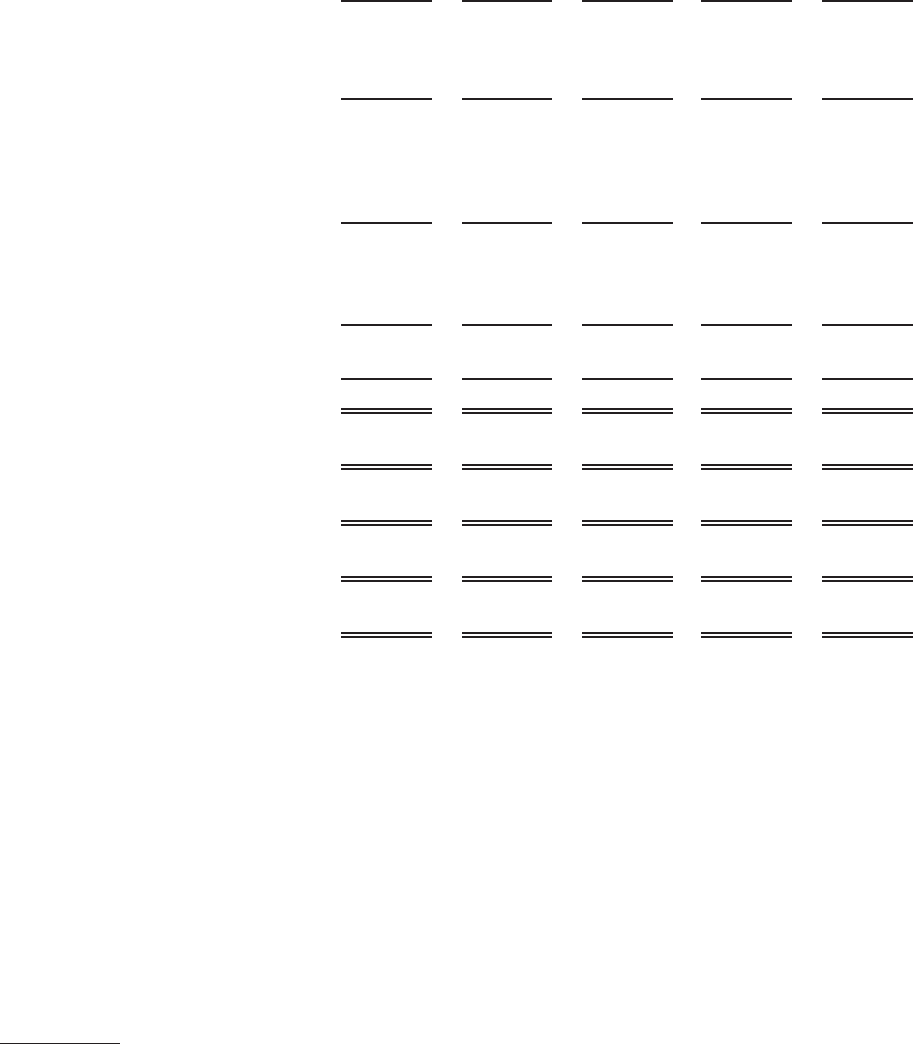

Our selected financial data set forth below should be read in conjunction with “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes

thereto included elsewhere in this Form 10-K.

52 Weeks

Ended

January 31,

2009

52 Weeks

Ended

February 2,

2008

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006(1)

52 Weeks

Ended

January 29,

2005

(In thousands, except per share data and statistical data)

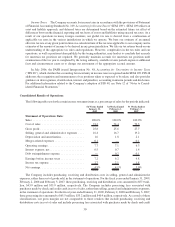

Statement of Operations Data:

Sales ......................... $8,805,897 $7,093,962 $5,318,900 $3,091,783 $1,842,806

Cost of sales .................... 6,535,762 5,280,255 3,847,458 2,219,753 1,333,506

Gross profit .................... 2,270,135 1,813,707 1,471,442 872,030 509,300

Selling, general and administrative

expenses(2) ................... 1,445,419 1,182,016 1,021,113 599,343 373,364

Depreciation and amortization ....... 145,004 130,270 109,862 66,355 36,789

Merger-related expenses(3) ......... 4,593 — 6,788 13,600 —

Operating earnings . . ............. 675,119 501,421 333,679 192,732 99,147

Interest expense (income), net ....... 38,837 47,774 73,324 25,292 236

Merger-related interest expense(3) .... — — — 7,518 —

Debt extinguishment expense ....... 2,331 12,591 6,059 — —

Earnings before income taxes ....... 633,951 441,056 254,296 159,922 98,911

Income tax expense. . ............. 235,669 152,765 96,046 59,138 37,985

Net earnings .................... $ 398,282 $ 288,291 $ 158,250 $ 100,784 $ 60,926

Net earnings per common share —

basic(4)...................... $ 2.44 $ 1.82 $ 1.06 $ 0.87 $ 0.56

Weighted average shares

outstanding — basic(4) .......... 163,190 158,226 149,924 115,840 109,324

Net earnings per common share —

diluted(4) .................... $ 2.38 $ 1.75 $ 1.00 $ 0.81 $ 0.53

Weighted average shares

outstanding — diluted(4) ......... 167,671 164,844 158,284 124,972 115,592

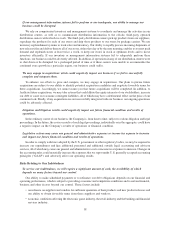

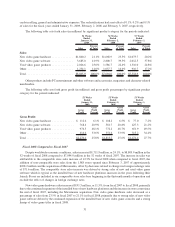

Store Operating Data:

Number of stores by segment

United States.................. 4,331 4,061 3,799 3,624 1,801

Canada ...................... 325 287 267 261 —

Australia ..................... 350 280 219 177 —

Europe ...................... 1,201 636 493 428 25

Total ........................ 6,207 5,264 4,778 4,490 1,826

Comparable store sales increase

(decrease)(5) .................. 12.3% 24.7% 11.9% (1.4)% 1.7%

Inventory turnover . . ............. 5.8 6.0 5.2 5.0 5.4

Balance Sheet Data:

Working capital ................. $ 255,330 $ 534,160 $ 353,284 $ 234,293 $ 111,093

Total assets ..................... 4,512,590 3,775,891 3,349,584 3,015,821 915,983

Total debt ...................... 545,712 574,473 855,484 975,990 36,520

Total liabilities .................. 2,212,909 1,913,445 1,973,706 1,901,108 372,972

Stockholders’ equity . ............. 2,299,681 1,862,446 1,375,878 1,114,713 543,011

(1) Includes the results of operations of EB from October 9, 2005, the day after completion of the EB merger,

through January 28, 2006. The addition of EB’s results affects the comparability of amounts from fiscal periods

before the 52 weeks ended January 28, 2006 (“fiscal 2005”).

25