GameStop 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

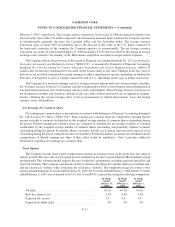

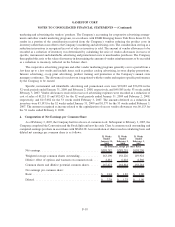

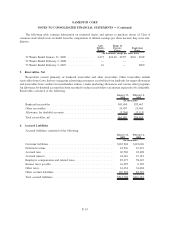

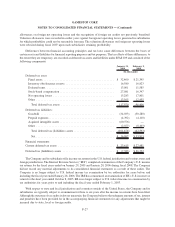

7. Goodwill, Intangible Assets and Deferred Financing Fees

The changes in the carrying amount of goodwill for the Company’s business segments for the 52 weeks ended

February 2, 2008 and the 52 weeks ended January 31, 2009 were as follows:

United States Canada Australia Europe Total

(In thousands)

Balance at February 3, 2007 ............ $1,098,089 $116,818 $147,224 $ 41,776 $1,403,907

Adjustment to goodwill acquired ......... (1,467) — — — (1,467)

Balance at February 2, 2008 ............ $1,096,622 $116,818 $147,224 $ 41,776 $1,402,440

Goodwill acquired, net ................ — — 423 459,244 459,667

Balance at January 31, 2009 ............ $1,096,622 $116,818 $147,647 $501,020 $1,862,107

There were no impairments to goodwill during the 52 weeks ended January 31, 2009 and February 2, 2008.

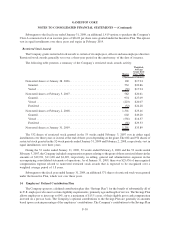

Intangible assets consist of point-of-sale software and amounts attributed to favorable leasehold interests

acquired in the EB merger and Micromania acquisition and are included in other non-current assets in the

consolidated balance sheet. The tradename acquired in the Micromania acquisition in the amount of $133,231 has

been determined to be an indefinite lived intangible asset and is therefore not subject to amortization. The total

weighted-average amortization period for the remaining intangible assets, excluding goodwill, is approximately ten

years. The intangible assets are being amortized based upon the pattern in which the economic benefits of the

intangible assets are being utilized, with no expected residual value.

The deferred financing fees associated with the Company’s revolving credit facility and senior notes issued in

connection with the financing of the EB merger are included in other noncurrent assets in the consolidated balance

sheet. The deferred financing fees are being amortized over five and seven years to match the terms of the revolving

credit facility and the senior notes, respectively.

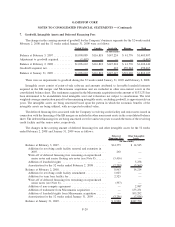

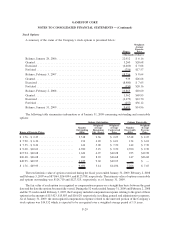

The changes in the carrying amount of deferred financing fees and other intangible assets for the 52 weeks

ended February 2, 2008 and January 31, 2009 were as follows:

Deferred

Financing Fees

Other Intangible

Assets

(In thousands)

Balance at February 3, 2007 .............................. $14,375 $ 14,545

Addition for revolving credit facility renewal and extension in

2007 ............................................ 263 —

Write-off of deferred financing fees remaining on repurchased

senior notes and senior floating rate notes (see Note 8)....... (3,416) —

Addition of leasehold rights ............................ — 5,238

Amortization for the 52 weeks ended February 2, 2008 ........ (2,259) (5,569)

Balance at February 2, 2008 .............................. 8,963 14,214

Addition for revolving credit facility amendment ............. 1,025 —

Addition for term loan facility fee ........................ 2,525 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 8) ............................. (337) —

Addition of non-compete agreement ...................... — 2,987

Addition of tradename from Micromania acquisition .......... — 133,231

Addition of leasehold rights from Micromania acquisition ...... — 105,292

Amortization for the 52 weeks ended January 31, 2009 ........ (3,256) (7,934)

Balance at January 31, 2009 .............................. $ 8,920 $247,790

F-20

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)