GameStop 2008 Annual Report Download - page 55

Download and view the complete annual report

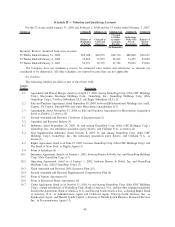

Please find page 55 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Term Loans were outstanding, the amendment increased the applicable margin under the Revolver (i) payable on

LIBO rate loans to a range of 1.5% to 2.0% from the current range of 1.0% to 1.5% and (ii) payable on prime rate

loans to a range of 0.5% to 0.75% from the current range of 0.0% to 0.25%. The margins applicable prior to the entry

into the amendment apply once the Term Loans are no longer outstanding. The Term Loans were outstanding during

the fourth quarter of fiscal 2008.

In November 2008, in connection with the acquisition of Micromania, the Company entered into a Term Loan

Agreement (the “Term Loan Agreement”) with Bank of America, N.A and Banc of America Securities LLC. The

Term Loan Agreement provided for Term Loans in the aggregate of $150.0 million, consisting of a $50.0 million

secured term loan (“Term Loan A”) and a $100.0 million unsecured term loan (“Term Loan B”). The Term Loan

Agreement provided that the principal of Term Loan B was to be repaid in four equal installments of $25.0 million a

week for four consecutive weeks, commencing on December 3, 2008. Term Loan A was scheduled to mature on

March 31, 2009. Amounts borrowed under the Term Loan Agreement may not be reborrowed once repaid.

Borrowings made pursuant to the Term Loan Agreement bore interest, payable quarterly or, if earlier, at the end of

any interest period, at a per annum rate equal to either (a) the prime loan rate, described in the Term Loan

Agreement as the higher of (i) Bank of America N.A.’s prime rate or (ii) the federal funds rate plus 0.50%, in each

case plus 1.75%, or (b) the LIBO rate (a publicly published rate) plus 3.75%. The effective interest rate on Term

Loan A was 5.75% per annum and the effective rate on Term Loan B ranged from 5% to 5.75% per annum.

The Term Loan Agreement contained customary affirmative and negative covenants, including limitations on

GameStop and its subsidiaries with respect to indebtedness, liens, investments, distributions, mergers and acqui-

sitions, dispositions of assets, changes of business and transactions with affiliates. In addition, the Company was

subject to a fixed charge coverage ratio covenant of 1.5:1.0. The covenants permitted the Company to use proceeds

of the Term Loans for working capital, capital expenditures, payment of transaction costs and a portion of the

consideration in connection with the acquisition of Micromania and for all other lawful corporate purposes.

In November 2008, the Company borrowed $275.0 million under the Revolver and borrowed $150.0 million

under the Term Loans in order to complete the acquisition of Micromania. As of January 31, 2009, the Revolver and

the Term Loans were repaid in full.

In September 2007, the Company’s Luxembourg subsidiary entered into a discretionary $20.0 million

Uncommitted Line of Credit (the “Line of Credit”) with Bank of America. There is no term associated with

the Line of Credit and Bank of America may withdraw the facility at any time without notice. The Line of Credit

will be made available to the Company’s foreign subsidiaries for use primarily as a bank overdraft facility for short-

term liquidity needs and for the issuance of bank guarantees and letters of credit to support operations. As of

January 31, 2009, there were $5.6 million of cash overdrafts outstanding under the Line of Credit and bank

guarantees outstanding totaled $4.9 million.

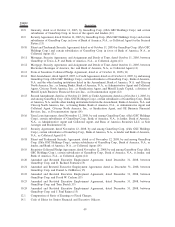

In September 2005, the Company, along with GameStop, Inc. as co-issuer (together with the Company, the

“Issuers”), completed the offering of $300 million aggregate principal amount of Senior Floating Rate Notes due

2011 (the “Senior Floating Rate Notes”) and $650 million aggregate principal amount of Senior Notes due 2012

(the “Senior Notes” and, together with the Senior Floating Rate Notes, the “Notes”). The Notes were issued under

an Indenture, dated September 28, 2005 (the “Indenture”), by and among the Issuers, the subsidiary guarantors party

thereto, and Citibank, N.A., as trustee (the “Trustee”). The net proceeds of the offering were used to pay the cash

portion of the merger consideration paid to the stockholders of EB in connection with the EB merger. In November

2006, Wilmington Trust Company was appointed as the new Trustee for the Notes.

The Senior Notes bear interest at 8.0% per annum, mature on October 1, 2012 and were priced at 98.688%,

resulting in a discount at the time of issue of $8.5 million. The discount is being amortized using the effective

interest method. As of January 31, 2009, the unamortized original issue discount was $4.3 million. The Issuers pay

interest on the Senior Notes semi-annually, in arrears, every April 1 and October 1, to holders of record on the

immediately preceding March 15 and September 15, and at maturity.

The Indenture contains affirmative and negative covenants customary for such financings, including, among

other things, limitations on (1) the incurrence of additional debt, (2) restricted payments, (3) liens, (4) sale and

leaseback transactions and (5) asset sales. Events of default provided for in the Indenture include, among other

40