GameStop 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Pre-Opening Expenses

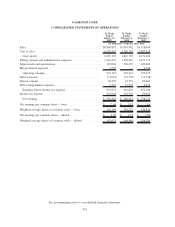

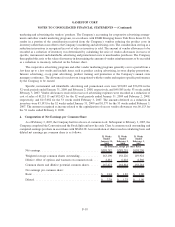

All costs associated with the opening of new stores are expensed as incurred. Pre-opening expenses are

included in selling, general and administrative expenses in the accompanying consolidated statements of

operations.

Closed Store Expenses

Upon a formal decision to close or relocate a store, the Company charges unrecoverable costs to expense. Such

costs include the net book value of abandoned fixtures and leasehold improvements and, once the store is vacated, a

provision for future lease obligations, net of expected sublease recoveries. Costs associated with store closings are

included in selling, general and administrative expenses in the accompanying consolidated statements of

operations.

Advertising Expenses

The Company expenses advertising costs for newspapers and other media when the advertising takes place.

Advertising expenses for television, newspapers and other media during the 52 weeks ended January 31, 2009,

52 weeks ended February 2, 2008 and the 53 weeks ended February 3, 2007 were $46,708, $26,243 and $16,043,

respectively. During fiscal 2007, the Company launched a new marketing campaign for television, radio and print to

promote the GameStop brand and its brand tagline, “Power to the Players.”

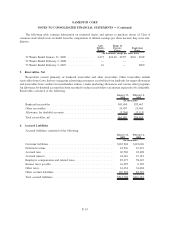

Income Taxes

The Company accounts for income taxes in accordance with the provisions of Statement of Financial

Accounting Standards No. 109, Accounting for Income Taxes (“SFAS 109”). SFAS 109 utilizes an asset and

liability approach, and deferred taxes are determined based on the estimated future tax effect of differences between

the financial reporting and tax bases of assets and liabilities using enacted tax rates. On February 4, 2007, the

Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes,to

account for uncertainty in income taxes recognized in the Company’s financial statements (see Note 12).

U.S. income taxes have not been provided on $204,649 of undistributed earnings of foreign subsidiaries as of

January 31, 2009. The Company reinvests earnings of foreign subsidiaries in foreign operations and expects that

future earnings will also be reinvested in foreign operations indefinitely.

Lease Accounting

The Company’s method of accounting for rent expense (and related deferred rent liability) and leasehold

improvements funded by landlord incentives for allowances under operating leases (tenant improvement allow-

ances) is in conformance with GAAP. For leases that contain predetermined fixed escalations of the minimum rent,

the Company recognizes the related rent expense on a straight-line basis and includes the impact of escalating rents

for periods in which it is reasonably assured of exercising lease options and the Company includes in the lease term

any period during which the Company is not obligated to pay rent while the store is being constructed.

Foreign Currency Translation

GameStop has determined that the functional currencies of its foreign subsidiaries are the subsidiaries’ local

currencies. The accounts of the foreign subsidiaries are translated in accordance with Statement of Financial

Accounting Standards No. 52, Foreign Currency Translation. The assets and liabilities of the subsidiaries are

translated at the applicable exchange rate as of the end of the balance sheet date and revenue and expenses are

translated at an average rate over the period. Currency translation adjustments are recorded as a component of other

comprehensive income. Transaction gains and (losses) are included in net income and amounted to ($9,993), $8,575

and ($962) for the 52 weeks ended January 31, 2009, the 52 weeks ended February 2, 2008 and the 53 weeks ended

F-12

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)