GameStop 2008 Annual Report Download - page 81

Download and view the complete annual report

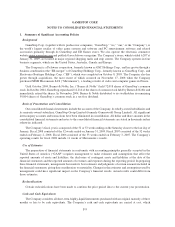

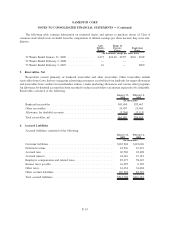

Please find page 81 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition to requiring companies to recognize the estimated fair value of share-based payments in earnings,

companies now have to present tax benefits received in excess of amounts determined based on the compensation

expense recognized on the statements of cash flows. Such tax benefits are presented as a use of cash in the operating

section and a source of cash in the financing section of the Statement of Cash Flows. Note 13 provides additional

information regarding the Company’s stock option plan.

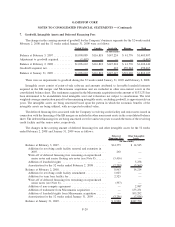

Fair Values of Financial Instruments

The carrying values of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities

reported in the accompanying consolidated balance sheets approximate fair value due to the short-term maturities of

these assets and liabilities. The fair value of the Company’s senior notes payable in the accompanying consolidated

balance sheets is estimated based on recent quotes from brokers. As of January 31, 2009, the senior notes payable

had a carrying value of $545,712 and a fair value of $547,250. As of February 2, 2008, the senior notes payable had a

carrying value of $574,473 and a fair value of $591,600.

Effective February 3, 2008, the Company implemented FASB Statement of Financial Accounting Standards

No. 157, Fair Value Measurements (“SFAS 157”), which defines fair value, establishes a framework for its

measurement and expands disclosures about fair value measurements. The Company elected to implement

SFAS 157 with the one-year deferral permitted by FASB Staff Position (“FSP”) 157-2 for nonfinancial assets

and nonfinancial liabilities measured at fair value, except those that are recognized or disclosed on a recurring basis

(at least annually). We do not expect any significant impact to our consolidated financial statements when we

implement SFAS 157 for these assets and liabilities.

Due to our election under FSP 157-2, for fiscal 2008, SFAS 157 applies to our Foreign Currency Contracts,

Company-owned life insurance policies with a cash surrender value and certain nonqualified deferred compen-

sation liabilities that are measured at fair value on a recurring basis in periods subsequent to initial recognition. The

implementation of SFAS 157 did not result in a significant change in the method of calculating fair value of assets or

liabilities. The primary impact from adoption was additional disclosures.

In October 2008, the FASB issued FSP 157-3, Determining the Fair Value of a Financial Asset When The

Market for That Asset Is Not Active (“FSP 157-3”), to clarify how an entity would determine fair value in an inactive

market. FSP 157-3 is effective immediately and applies to our financial statements for the period ended November 1,

2008. The application of the provisions of FSP 157-3 did not materially impact our consolidated financial

statements for the period ended November 1, 2008. The Company does not currently own any securities, including

cash equivalents, for which a dislocated market or other liquidity problems are known to exist.

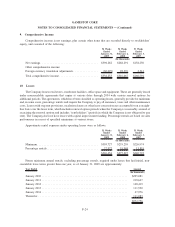

SFAS 157 requires disclosures that categorize assets and liabilities measured at fair value into one of three

different levels depending on the observability of the inputs employed in the measurement. Level 1 inputs are

quoted prices in active markets for identical assets or liabilities. Level 2 inputs are observable inputs other than

quoted prices included within Level 1 for the asset or liability, either directly or indirectly through market-

corroborated inputs. Level 3 inputs are unobservable inputs for the asset or liability reflecting our assumptions about

pricing by market participants.

We value our Foreign Currency Contracts, Company-owned life insurance policies with cash surrender values

and certain nonqualified deferred compensation liabilities based on Level 2 inputs using quotations provided by

major market news services, such as Bloomberg and The Wall Street Journal, and industry-standard models that

consider various assumptions, including quoted forward prices, time value, volatility factors, and contractual prices

for the underlying instruments, as well as other relevant economic measures. When appropriate, valuations are

adjusted to reflect credit considerations, generally based on available market evidence.

F-14

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)