GameStop 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximates market value, and consist primarily of time deposits with highly rated commercial banks. From time

to time depending upon interest rates, credit worthiness and other factors, the Company invests in money market

investment funds holding direct U.S. Treasury obligations. The Company held such cash equivalents as of

February 2, 2008.

Merchandise Inventories

The Company’s merchandise inventories are carried at the lower of cost or market generally using the average

cost method. Under the average cost method, as new product is received from vendors, its current cost is added to

the existing cost of product on-hand and this amount is re-averaged over the cumulative units. Used video game

products traded in by customers are recorded as inventory at the amount of the store credit given to the customer. In

valuing inventory, management is required to make assumptions regarding the necessity of reserves required to

value potentially obsolete or over-valued items at the lower of cost or market. Management considers quantities on

hand, recent sales, potential price protections and returns to vendors, among other factors, when making these

assumptions. The Company’s ability to gauge these factors is dependent upon the Company’s ability to forecast

customer demand and to provide a well-balanced merchandise assortment. Inventory is adjusted based on

anticipated physical inventory losses or shrinkage and actual losses resulting from periodic physical inventory

counts. Inventory reserves as of January 31, 2009 and February 2, 2008 were $56,567 and $59,698, respectively.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation and amortization. Depreciation on

furniture, fixtures and equipment is computed using the straight-line method over their estimated useful lives

ranging from two to eight years. Maintenance and repairs are expensed as incurred, while betterments and major

remodeling costs are capitalized. Leasehold improvements are capitalized and amortized over the shorter of their

estimated useful lives or the terms of the respective leases, including option periods in which the exercise of the

option is reasonably assured (generally ranging from three to ten years). Costs incurred in purchasing management

information systems are capitalized and included in property and equipment. These costs are amortized over their

estimated useful lives from the date the systems become operational.

The Company periodically reviews its property and equipment when events or changes in circumstances

indicate that their carrying amounts may not be recoverable or their depreciation or amortization periods should be

accelerated. The Company assesses recoverability based on several factors, including management’s intention with

respect to its stores and those stores’ projected undiscounted cash flows. An impairment loss would be recognized

for the amount by which the carrying amount of the assets exceeds their fair value, as approximated by the present

value of their projected cash flows. Write-downs incurred by the Company through January 31, 2009 have not been

material.

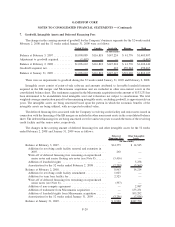

Goodwill

Goodwill represents the excess purchase price over tangible net assets and identifiable intangible assets

acquired. The Company does not amortize goodwill, instead it evaluates it for impairment on at least an annual

basis. The Company completed its annual impairment test of goodwill on the first day of the fourth quarter of fiscal

2006, fiscal 2007 and fiscal 2008 and concluded that none of its goodwill was impaired. Note 7 provides additional

information concerning the changes in goodwill for the consolidated financial statements presented.

Other Intangible Assets

Other intangible assets consist primarily of tradenames, leasehold rights and amounts attributed to favorable

leasehold interests recorded as a result of the Micromania acquisition and the EB merger. Intangible assets are

recorded consistent with the provisions of Statement of Financial Accounting Standards No. 141, Business

Combinations (“SFAS 141”), which requires that intangible assets shall be recognized as an asset apart from

F-10

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)