GameStop 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

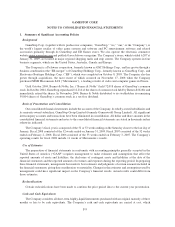

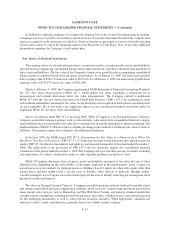

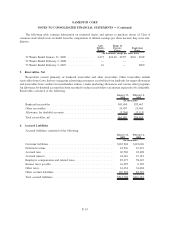

The following table provides the fair value of our financial assets and liabilities measured on a recurring basis

and recorded on our condensed consolidated balance sheet as of January 31, 2009:

January 31, 2009

Level 2

(In thousands)

Assets

Foreign Currency Contracts .......................................... $12,104

Company-owned life insurance ........................................ 2,134

Total assets ...................................................... $14,238

Liabilities

Foreign Currency Contracts .......................................... $11,766

Non-qualified deferred compensation ................................... 905

Total liabilities .................................................... $12,671

Guarantees

The Company had bank guarantees relating to international store leases totaling $12,930 as of January 31,

2009.

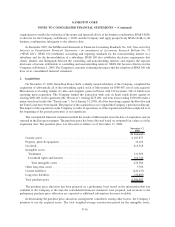

Vendor Concentration

The Company’s largest vendors worldwide are Nintendo, Sony Computer Entertainment, Microsoft and

Electronic Arts, Inc., which accounted for 25%, 13%, 13% and 11%, respectively, of the Company’s new product

purchases in fiscal 2008, 21%, 17%, 16% and 11%, respectively, in fiscal 2007 and 11%, 13%, 14% and 10%,

respectively, in fiscal 2006.

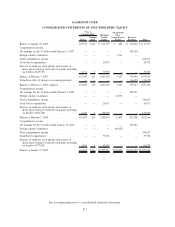

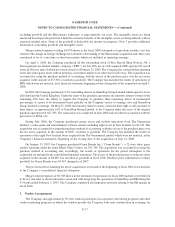

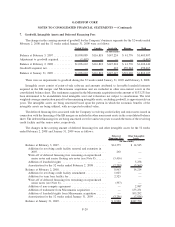

Stock Conversion and Stock Split

On February 7, 2007, following approval by a majority of the Class B common stockholders in a special

meeting of the Company’s Class B common stockholders, all outstanding Class B common shares were converted

into Class A common shares on a one-for-one basis (the “Conversion”). In addition, on February 9, 2007, the Board

of Directors of the Company authorized a two-for-one stock split, effected by a one-for-one stock dividend to

stockholders of record at the close of business on February 20, 2007, paid on March 16, 2007 (the “Stock Split”).

The effect of the Conversion and the Stock Split has been retroactively applied to all periods presented in the

consolidated financial statements and notes thereto.

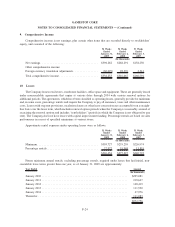

New Accounting Pronouncements

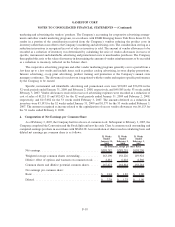

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about

Derivative Instruments and Hedging Activities — an amendment of FASB Statement No. 133 (“SFAS 161”).

SFAS 161 requires enhanced disclosures about how and why an entity uses derivative instruments, how derivative

instruments and related hedged items are accounted for and their effect on an entity’s financial position, financial

performance, and cash flows. SFAS 161 is effective for the Company on February 1, 2009. The Company is

currently evaluating the impact that the adoption of SFAS 161 will have on its consolidated financial statements.

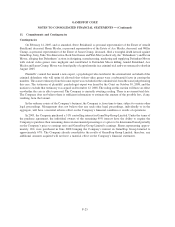

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (revised 2007),

Business Combinations (“SFAS 141(R)”). SFAS 141(R) amends the principles and requirements for how an

acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed,

any noncontrolling interest in the acquiree and the goodwill acquired. SFAS 141(R) also establishes disclosure

F-15

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)