GameStop 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the ordinary course of the Company’s business, the Company is, from time to time, subject to various other

legal proceedings. Management does not believe that any such other legal proceedings, individually or in the

aggregate, will have a material adverse effect on the Company’s financial condition or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

There were no matters submitted to a vote of security holders during the 13 weeks ended January 31, 2009.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

Price Range of Common Stock

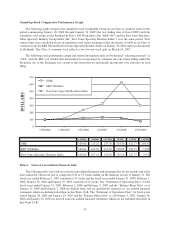

The Company’s Class A common stock is traded on the NYSE under the symbol “GME.” The Company’s

Class B common stock was traded on the NYSE under the symbol “GME.B” until February 7, 2007 when,

immediately following approval by a majority of the Class B common stockholders in a Special Meeting of the

Company’s Class B common stockholders, all outstanding Class B common shares were converted into Class A

common shares on a one-for-one basis.

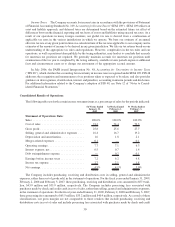

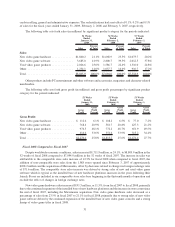

The following table sets forth, for the periods indicated, the high and low sales prices (as adjusted for the Stock

Split) of the Class A common stock on the NYSE Composite Tape:

High Low

Fiscal 2008

Fourth Quarter .................................................. $28.23 $16.91

Third Quarter ................................................... $47.69 $24.09

Second Quarter.................................................. $56.00 $37.62

First Quarter.................................................... $59.13 $40.78

High Low

Fiscal 2007

Fourth Quarter .................................................. $63.77 $44.76

Third Quarter ................................................... $60.80 $37.40

Second Quarter.................................................. $44.00 $32.31

First Quarter.................................................... $35.85 $24.95

The following table sets forth, for the periods indicated, the high and low sales prices of the Class B common

stock on the NYSE Composite Tape:

High Low

Fiscal 2007

First Quarter.................................................... $53.96 $52.25

The high and low sales prices of the Class B shares do not include the effects of the February 7, 2007

conversion of all outstanding Class B common shares into Class A common shares on a one-for-one basis (the

“Conversion”) or the Stock Split.

Approximate Number of Holders of Common Equity

As of March 6, 2009, there were approximately 1,358 record holders of the Company’s Class A common stock,

par value $.001 per share.

22