GameStop 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

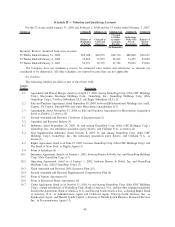

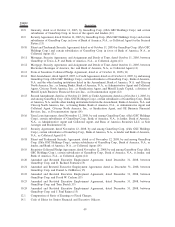

Schedule II — Valuation and Qualifying Accounts

For the 52 weeks ended January 31, 2009 and February 2, 2008 and the 53 weeks ended February 3, 2007:

Balance at

Beginning

of Period

Charged to

Costs and

Expenses

Charged

to Other

Accounts-

Accounts

Payable

Deductions-

Write-Offs

Net of

Recoveries

Balance at

End of

Period

Column A Column B Column C(1) Column C(2) Column D Column E

(In thousands)

Inventory Reserve, deducted from asset accounts

52 Weeks Ended January 31, 2009 . .......... $59,698 $42,979 $34,710 $80,820 $56,567

52 Weeks Ended February 2, 2008 . .......... 53,816 51,879 28,262 74,259 59,698

53 Weeks Ended February 3, 2007 . .......... 53,277 50,779 27,792 78,032 53,816

The Company does not maintain a reserve for estimated sales returns and allowances as amounts are

considered to be immaterial. All other schedules are omitted because they are not applicable.

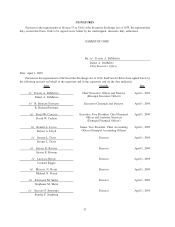

(b) Exhibits

The following exhibits are filed as part of this Form 10-K:

Exhibit

Number Description

2.1 Agreement and Plan of Merger, dated as of April 17, 2005, among GameStop Corp. (f/k/a GSC Holdings

Corp.), Electronics Boutique Holdings Corp., GameStop, Inc., GameStop Holdings Corp. (f/k/a

GameStop Corp.), Cowboy Subsidiary LLC and Eagle Subsidiary LLC.(1)

2.2 Sale and Purchase Agreement, dated September 30, 2008, between EB International Holdings, Inc. and L

Capital, LV Capital, Europ@Web and other Micromania shareholders.(13)

2.3 Amendment, dated November 17, 2008, to Sale and Purchase Agreement for Micromania Acquisition

listed as Exhibit 2.2 above.(14)

3.1 Second Amended and Restated Certificate of Incorporation.(2)

3.2 Amended and Restated Bylaws.(3)

4.1 Indenture, dated September 28, 2005, by and among GameStop Corp. (f/k/a GSC Holdings Corp.),

GameStop, Inc., the subsidiary guarantors party thereto, and Citibank N.A., as trustee.(4)

4.2 First Supplemental Indenture, dated October 8, 2005, by and among GameStop Corp. (f/k/a GSC

Holdings Corp.), GameStop, Inc., the subsidiary guarantors party thereto, and Citibank N.A., as

trustee.(5)

4.3 Rights Agreement, dated as of June 27, 2005, between GameStop Corp. (f/k/a GSC Holdings Corp.) and

The Bank of New York, as Rights Agent.(3)

4.4 Form of Indenture.(6)

10.1 Insurance Agreement, dated as of January 1, 2002, between Barnes & Noble, Inc. and GameStop Holdings

Corp. (f/k/a GameStop Corp.).(7)

10.2 Operating Agreement, dated as of January 1, 2002, between Barnes & Noble, Inc. and GameStop

Holdings Corp. (f/k/a GameStop Corp.).(7)

10.3 Third Amended and Restated 2001 Incentive Plan.(15)

10.4 Second Amended and Restated Supplemental Compensation Plan.(8)

10.5 Form of Option Agreement.(9)

10.6 Form of Restricted Share Agreement.(10)

10.7 Credit Agreement, dated as of October 11, 2005, by and among GameStop Corp. (f/k/a GSC Holdings

Corp.), certain subsidiaries of GameStop Corp., Bank of America, N.A. and the other lending institutions

listed in the Agreement, Bank of America, N.A. and Citicorp North America, Inc., as Issuing Banks, Bank

of America, N.A., as Administrative Agent and Collateral Agent, Citicorp North America, Inc., as

Syndication Agent, and Merrill Lynch Capital, a division of Merrill Lynch Business Financial Services

Inc., as Documentation Agent.(11)

48