GameStop 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.financial assets and non-financial liabilities, except those that are recognized or disclosed at fair value in the

financial statements on a recurring basis. The adoption of SFAS 157 for our financial assets and liabilities did not

have a material impact on the Company’s financial condition and results of operations. We do not believe the

adoption of SFAS 157 for our non-financial assets and liabilities, effective February 1, 2009, will have a material

impact on our consolidated financial statements.

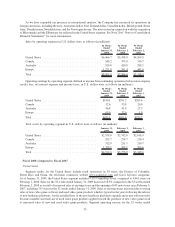

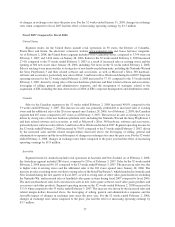

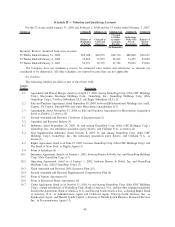

Seasonality

Our business, like that of many retailers, is seasonal, with the major portion of sales and operating profit

realized during the fourth quarter which includes the holiday selling season. Results for any quarter are not

necessarily indicative of the results that may be achieved for a full fiscal year. Quarterly results may fluctuate

materially depending upon, among other factors, the timing of new product introductions and new store openings,

sales contributed by new stores, increases or decreases in comparable store sales, adverse weather conditions, shifts

in the timing of certain holidays or promotions and changes in our merchandise mix.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Exposure

We do not use derivative financial instruments to hedge interest rate exposure. We limit our interest rate risks

by investing our excess cash balances in short-term, highly-liquid instruments with a maturity of one year or less. In

addition, the Senior Notes outstanding issued in connection with the EB merger carry a fixed interest rate. We do not

expect any material losses from our invested cash balances, and we believe that our interest rate exposure is modest.

Foreign Currency Risk

The Company follows the provisions of Statement of Financial Accounting Standards No. 133, Accounting for

Derivative Instruments and Hedging Activities (“SFAS 133”), as amended by Statement of Financial Accounting

Standards No. 138, Accounting for Certain Derivative Instruments and Certain Hedging Activities and Statement of

Financial Accounting Standards No. 157, Fair Value Measurements (“SFAS 157”). SFAS 133 requires that all

derivative instruments be recorded on the balance sheet at fair value, while SFAS 157 defines fair value, establishes

a framework for measuring fair value and expands disclosures about fair value measurements. Changes in the fair

value of derivatives are recorded each period in current earnings or other comprehensive income, depending on

whether the derivative is designated as part of a hedge transaction, and if it is, depending on the type of hedge

transaction.

The Company uses forward exchange contracts, foreign currency options and cross-currency swaps, (together,

the “Foreign Currency Contracts”) to manage currency risk primarily related to intercompany loans denominated in

non-functional currencies and certain foreign currency assets and liabilities. These Foreign Currency Contracts are

not designated as hedges and, therefore, changes in the fair values of these derivatives are recognized in earnings,

thereby offsetting the current earnings effect of the re-measurement of related intercompany loans and foreign

currency assets and liabilities. The aggregate fair value of the Foreign Currency Contracts as of January 31, 2009

was an asset of $0.3 million as measured by observable inputs obtained from market news reporting services, such

as Bloomberg and The Wall Street Journal, and industry-standard models that consider various assumptions,

including quoted forward prices, time value, volatility factors, and contractual prices for the underlying instru-

ments, as well as other relevant economic measures. A hypothetical strengthening or weakening of 10% in the

foreign exchange rates underlying the Foreign Currency Contracts from the market rate as of January 31, 2009

would result in a (loss) or gain in value of the forwards, options and swaps of ($17.7 million) or $17.7 million,

respectively.

Item 8. Consolidated Financial Statements and Supplementary Data

See Item 15(a)(1) and (2) of this Form 10-K.

45