GNC 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

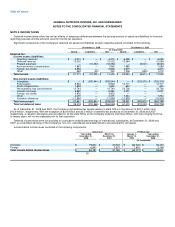

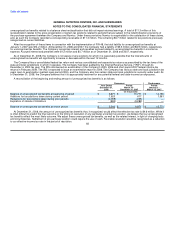

NOTE 6. OTHER CURRENT ASSETS

Other current assets at each respective period consisted of the following:

December 31, December 31,

2008 2007

(in thousands)

Current portion of franchise note receivables $ 871 $ 1,598

Less: allowance for doubtful accounts (240) (256)

Prepaid rent 12,992 12,806

Prepaid insurance 5,590 5,877

Prepaid income tax 11,138 3,122

Prepaid payroll tax 3,684 —

Other current assets 13,917 10,327

$ 47,952 $ 33,474

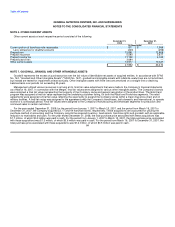

NOTE 7. GOODWILL, BRANDS, AND OTHER INTANGIBLE ASSETS

Goodwill represents the excess of purchase price over the fair value of identifiable net assets of acquired entities. In accordance with SFAS

No. 142, "Goodwill and Other Intangible Assets" ("SFAS No. 142"), goodwill and intangible assets with indefinite useful lives are not amortized,

but instead are tested for impairment at least annually. Other intangible assets with finite lives are amortized on a straight-line or declining

balance basis over periods not exceeding 35 years.

Management utilized various resources in arriving at its, final fair value adjustments that were made to the Company's financial statements

as of March 16, 2007. In connection with the Merger, final fair values were assigned to various other intangible assets. The Company's brands

were assigned a final fair value representing the longevity of the Company name and general recognition of the product lines. The Gold Card

program was assigned a final fair value representing the underlying customer listing, for both the Retail and Franchise segments. The retail

agreements were assigned a final fair value reflecting the opportunity to expand the Company stores within a major drug store chain and on

military facilities. A final fair value was assigned to the agreements with the Company's franchisees, both domestic and international, to operate

stores for a contractual period. Final fair values were assigned to the Company's manufacturing and wholesale segments for production and

continued sales to certain customers.

For the year ended December 31, 2008, for the period from January 1, 2007 to March 15, 2007, and the period from March 16, 2007 to

December 31, 2007, the Company acquired 33, 17 and 44 franchise stores, respectively. These acquisitions are accounted for utilizing the

purchase method of accounting and the Company records the acquired inventory, fixed assets, franchise rights and goodwill, with an applicable

reduction to receivables and cash. For the year ended December 31, 2008, the total purchase price associated with these acquisitions was

$1.7 million, of which $0.3 million was paid in cash. For the period from January 1, 2007 to March 15, 2007, the total purchase price associated

with these acquisitions was $1.3 million, of which $0.6 million was paid in cash. For the period from March 16, 2007 to December 31, 2007, the

total purchase price associated with these acquisitions was $1.2 million, of which $0.5 million was paid in cash.

84