GNC 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

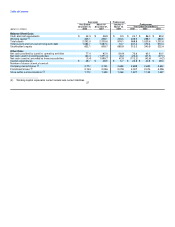

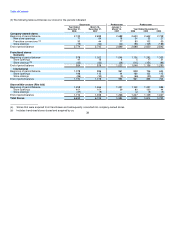

Comparison of the Years Ended December 31, 2008 and 2007

Revenues

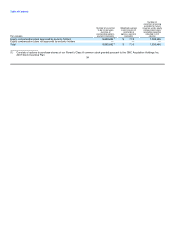

Our consolidated net revenues increased $103.9 million, or 6.7%, to $1,656.7 million for the year ended December 31, 2008 compared to

$1,552.8 million for the same period in 2007, due to increased sales in all of our segments.

Retail. Revenues in our Retail segment increased $50.7 million, or 4.3%, to $1,219.3 million for the year ended December 31, 2008

compared to $1,168.6 million for the same period in 2007. The increase from 2007 to 2008 included an increase of $7.7 million of sales through

www.gnc.com. Sales increases continued to occur in the major product categories of VMHS and sports nutrition. Our domestic company-owned

same store sales, including our internet sales, improved for the year ended December 31, 2008 by 2.7%. Our Canadian company-owned stores

had improved same store sales of 4.1% in the year ended December 31, 2008. Our company-owned store base increased by 16 domestic

stores to 2,614 compared to 2,598 at December 31, 2007, primarily due to new store openings and franchise store acquisitions, and by 13

Canadian stores to 160 at December 31, 2008 compared to 147 at December 31, 2007.

Franchise. Revenues in our Franchise segment increased $16.9 million, or 7.0%, to $258.0 million for the year ended December 31, 2008

compared to $241.1 million for the same period in 2007. Domestic franchise revenue increased $6.1 million as a result of increased product

sales despite operating 24 fewer stores during 2008 compared to 2007. There were 954 stores at December 31, 2008 compared to 978 stores

at December 31, 2007. International franchise revenue increased $10.8 million as a result of increased product sales and royalties. Our

international franchise store base increased by 112 stores to 1,190 at December 31, 2008 compared to 1,078 at December 31, 2007.

Manufacturing/Wholesale. Revenues in our Manufacturing/Wholesale segment, which includes third-party sales from our manufacturing

facilities in South Carolina, as well as wholesale sales to Rite Aid and www.drugstore.com, increased $36.3 million, or 25.4%, to $179.4 million

for the year ended December 31, 2008 compared to $143.1 million in 2007. Sales increased in the South Carolina plant by $32.3 million, and

revenues associated with Rite Aid increased by $4.4 million due primarily to increased license fees as a result of Rite Aid opening 401 stores

for the year ended December 31, 2008 as opposed to 140 stores for the year ended December 31, 2007. This was partially offset by a

decrease in private label sales to Rite Aid in 2008 compared to 2007. Rite Aid purchases in 2007 were above normal to stock product in their

recently acquired Eckerd locations.

Cost of Sales

Consolidated cost of sales, which includes product costs, costs of warehousing and distribution and occupancy costs, increased

$56.2 million, or 5.5%, to $1,082.6 million for the year ended December 31, 2008 compared to $1,026.4 million for the same period in 2007.

Consolidated cost of sales, as a percentage of net revenue, was 65.3% for the year ended December 31, 2008 and 66.1% for the year ended

December 31, 2007.

Product costs. Product costs increased $42.3 million, or 5.5%, to $810.5 million for the year ended December 31, 2008 compared to

$768.2 million for the same period in 2007. Consolidated product costs, as a percentage of net revenue, were 48.9% for the year ended

December 31, 2008 compared to 49.5% for the year ended December 31, 2007. The increased product costs were primarily a result of

increased sales volumes and also, to a lesser extent, due to rising raw material prices. Included in product costs for the year ended

December 31, 2007 is $15.5 million of non-cash expense from amortization of inventory step up to fair value due to the Merger.

44