GNC 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

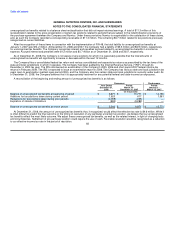

Revenue Recognition. The Company operates predominately as a retailer, through Company-owned stores, franchised stores and sales

through its website, www.gnc.com and to a lesser extent through wholesale operations. For all years and periods presented herein, the

Company has complied with and adopted Securities and Exchange Commission ("SEC") Staff Accounting Bulletin ("SAB") No. 104, "Revenue

Recognition."

The Retail segment recognizes revenue at the moment a sale to a customer is recorded. These revenues are recorded via the Company's

point of sale system. Gross revenues are netted against actual customer returns and an allowance for expected customer returns. The

Company records a reserve for expected customer returns based on management's estimate, which is derived from historical return data.

Revenue is deferred on sales of the Company's Gold Cards and subsequently amortized over 12 months. The length of the amortization period

is determined based on matching the discounts associated with the Gold Card program to the revenue deferral during the twelve month

membership period. For an annual fee, the card provides customers with a 20% discount on all products purchased, both on the date the card

is purchased and certain specified days of every month.

The Company also sells gift cards to its customers. Revenue from gift cards is recognized when the gift card is redeemed. These gift cards

do not have expiration dates. Based upon historical redemption rates, a small percentage of gift cards will never be redeemed, referred to as

"breakage". The Company first sold gift cards in late 2001 and the Company began to recognize gift card breakage revenue in 2008, when the

likelihood of redemption became remote. Total revenue for 2008 includes $0.6 million related to this initial recognition of gift card breakage

revenue.

The Franchise segment generates revenues through product sales to franchisees, royalties, franchise fees and interest income on the

financing of the franchise locations. See the footnote, "Franchise Revenue". These revenues are netted by actual franchisee returns and an

allowance for projected returns. The franchisees purchase a majority of the products they sell from the Company at wholesale prices. Revenue

on product sales to franchisees is recognized when risk of loss, title and insurable risks have transferred to the franchisee. Franchise fees are

recognized by the Company at the time of a franchise store opening. Interest on the financing of franchisee notes receivable is recognized as it

becomes due and payable. Gains from the sale of company-owned stores to franchisees are recognized in accordance with SFAS No. 66,

"Accounting for Sales of Real Estate". This standard requires gains on sales of corporate stores to franchisees to be deferred until certain

criteria are satisfied regarding the collectibility of the related receivable and the seller's remaining obligations. Remaining sources of franchise

income, including royalties, are recognized as earned.

The Manufacturing/Wholesale segment sells product primarily to the other Company segments, third-party customers and historically to

certain related parties. Revenue is recognized when risk of loss, title and insurable risks have transferred to the customer. The Company also

has a consignment arrangement with certain customers and revenue is recognized when products are sold to the ultimate customer.

Cost of Sales. The Company purchases products directly from third party manufacturers as well as manufactures its own products. The

Company's cost of sales includes product costs, costs of warehousing and distribution and occupancy costs. The cost of manufactured

products includes depreciation expense related to the manufacturing facility and related equipment.

Vendor Allowances. The Company enters into two main types of arrangements with certain vendors, the most significant of which results in

the Company receiving credits as sales rebates based on arrangements with such vendors ("sales rebates"). The Company also enters into

arrangements with certain vendors through which the Company receives rebates for purchases during the year typically based on volume

discounts ("volume rebates"). As the right of offset exists under these arrangements, rebates received under both arrangements are recorded

as a reduction in the vendors' accounts payable balances on the balance sheet and represent the estimated amounts due to GNC under the

rebate provisions of such 74