GNC 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

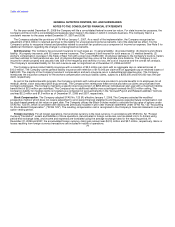

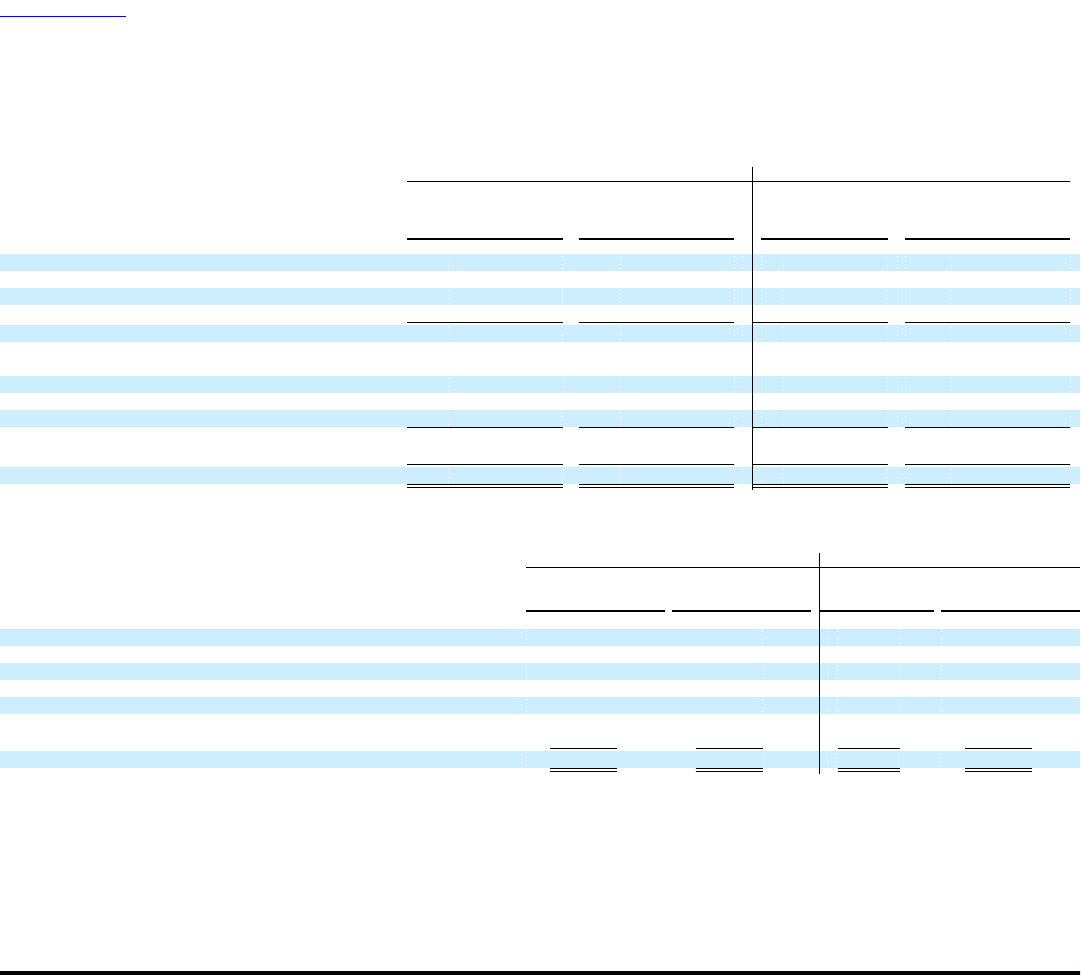

Income tax expense/(benefit) for all periods consisted of the following components:

Successor Predecessor

Period Period

Year ended March 16 - January 1 - Year ended

December 31, December 31, March 15, December 31,

2008 2007 2007 2006

(in thousands)

Current:

Federal $ 3,082 $ — $ (21,547) $ 21,675

State 3,391 462 (279) 2,299

Foreign 1,157 2,835 444 1,840

7,630 3,297 (21,382) 25,814

Deferred:

Federal 22,753 8,266 9,984 (3,695)

State 1,618 1,037 701 107

Foreign — — — —

24,371 9,303 10,685 (3,588)

Income tax expense (benefit) $ 32,001 $ 12,600 $ (10,697) $ 22,226

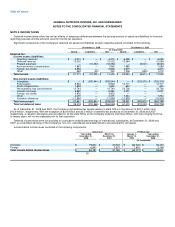

The following table summarizes the differences between the Company's effective tax rate for financial reporting purposes and the federal

statutory tax rate.

Successor Predecessor

Year ended March 16- January 1- Year ended

December 31, December 31, March 15, December 31,

2008 2007 2007 2006

Percent of pretax earnings:

Statutory federal tax rate 35.0% 35.0% 35.0% 35.0%

Increase/(decrease):

Other permanent differences 1.1% 2.0% (17.4%) (1.1%)

State income tax, net of federal tax benefit 3.8% 3.1% (0.4%) 3.5%

Federal tax credits (3.0%) (0.2%) 0.1% (0.1%)

Effective income tax rate 36.9% 39.9% 17.3% 37.3%

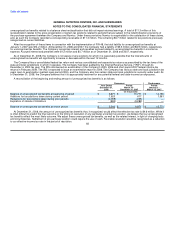

In June 2006, the FASB issued Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement

No. 109," ("FIN 48") which applies to all open tax positions accounted for in accordance with SFAS 109. This Interpretation is intended to result

in increased relevance and comparability in financial reporting of income taxes and to provide more information about the uncertainty in income

tax assets and liabilities.

The Company adopted the provisions of FIN 48 on January 1, 2007. As a result of the implementation of FIN 48, the Company recognized a

$0.4 million increase in the liability for unrecognized tax benefits which was accounted for as a reduction to the January 1, 2007 balance of

retained earnings. Additionally, as a result of the implementation of FIN 48, the Company recorded $15.0 million of

82