GNC 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231

|

|

Table of Contents

PART II

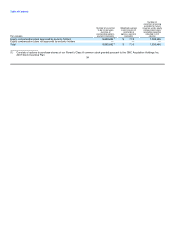

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

SECURITIES.

There is no established public trading market for our common stock. As of March 1, 2009, 100 shares of our Common Stock were

outstanding, all of which are held by our Parent. As of December 31, 2008, there was one holder of our common stock and there were 41

holders of our ultimate Parent's common stock. See Item 12, "Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters" included in this report.

Dividends

We did not pay dividends on our common stock during the 2008 or 2007 fiscal years. We do not presently intend to declare any cash

dividends. We intend to retain our earnings to fund the operation of our business, to service and repay our debt, and to make strategic

investments as they arise. Moreover, we are subject to certain restrictions on our ability to pay dividends under the terms of the 2007 Senior

Credit Facility, Senior Toggle Notes, and 10.75% Senior Subordinated Notes.

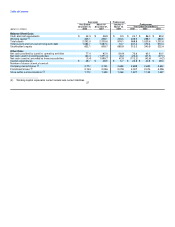

Securities Authorized for Issuance under Equity Compensation Plans

Upon completion of the Merger, our Parent adopted the GNC Acquisition Holdings Inc. 2007 Stock Incentive Plan (the "2007 Plan"). The

purpose of the 2007 Plan is to enable us to attract, retain, and reward highly qualified personnel who will contribute to our success. The 2007

Plan provides for the granting of stock options, restricted stock, and certain other stock-based awards. Awards under the 2007 Plan may be

granted to certain eligible employees, directors, consultants, or advisors as determined by the administering committee of our ultimate Parent's

board of directors. At December 31, 2008 the total number of shares of our ultimate Parent's Class A common stock reserved and available

under the 2007 Plan is 10,419,178 shares. Stock options granted under the 2007 Plan are granted at not less than fair market value (or, in the

case of persons holding more than 10% of the voting power of us, our ultimate Parent, or our subsidiaries, less than 110% of fair market value),

generally vest over a five-year vesting schedule, and expire after ten years from date of grant. If any award granted under the 2007 Plan

expires, terminates, is canceled, or is forfeited for any reason, the number of shares underlying such award will become available for future

awards under the 2007 Plan. No awards other than stock options have been granted under the 2007 Plan.

33