GNC 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

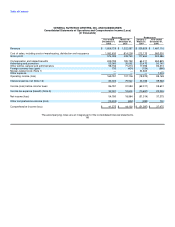

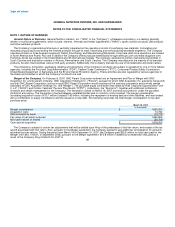

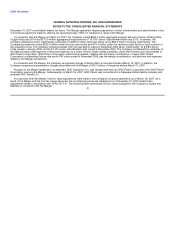

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of

the financial statements, and the reported amounts of revenues and expenses during the reporting period. Some of the most significant

estimates pertaining to the Company include the valuation of inventories, the allowance for doubtful accounts, income tax valuation allowances

and the recoverability of long-lived assets. On a regular basis, management reviews its estimates utilizing currently available information,

changes in facts and circumstances, historical experience and reasonable assumptions. After such reviews and if deemed appropriate, those

estimates are adjusted accordingly. Actual results could differ from those estimates.

Cash and Cash Equivalents. The Company considers cash and cash equivalents to include all cash and liquid deposits and investments

with a maturity of three months or less. The majority of payments due from banks for third-party credit cards process within 24-48 hours, except

for transactions occurring on a Friday, which are generally processed the following Monday. All credit card transactions are classified as cash

and the amounts due from these transactions totaled $2.2 million at December 31, 2008 and $3.6 million at December 31, 2007.

Book overdrafts of $4.2 million and $4.1 million as of December 31, 2008 and 2007, respectively, represent checks issued that had not been

presented for payment to the banks and are classified as accounts payable in the Company's consolidated balance sheet. The Company

typically funds these overdrafts through normal collections of funds or transfers from bank balances at other financial institutions. Under the

terms of the Company's facilities with its banks, the respective financial institutions are not legally obligated to honor the book overdraft

balances as of December 31, 2008 and 2007, or any balance on any given date.

For the year ended December 31, 2008, the Company revised the presentation of changes in book overdrafts from a financing activity to an

operating activity in its consolidated statement of cash flows with a conforming change to the prior period presentation. The effect of this

revision had no impact on the net increase (decrease) in cash; however, it changed the cash provided by (used in) operating activities for the

period from March 16, 2007 through December 31, 2007, the period from January 1, 2007 through March 15, 2007 and the year ended

December 31, 2006 from $87.9 million, $(46.8) million and $74.6 million, respectively, as previously disclosed in the prior year Annual Report

on Form 10-K, to $92.0 million, $(50.9) million and $73.6 million, respectively, with a corresponding change in the cash flows provided by (used

in) financing activities for the period from March 16 through December 31, 2007, the period from January 1, 2007 through March 15, 2007 and

the year ended December 31, 2006 from $1,602.8 million, $38.3 million and $(113.1) million, respectively, to $1,598.7 million, $42.8 million and

$(112.2) million, respectively.

Inventories. Inventory components consist of raw materials, finished product and packaging supplies. Inventories are stated at the lower of

cost or market on a first in/first out ("FIFO") basis. Cost is determined using a standard costing system which approximates actual costs. The

Company regularly reviews its inventory levels in order to identify slow moving and short dated products, expected length of time for product

sell through and future expiring product. Upon analysis, the Company has established certain valuation allowances to reserve for such

inventory. When allowances are considered necessary, after such reviews, the inventory balances are adjusted and reflected net in the

accompanying financial statements.

Accounts Receivable and Allowance for Doubtful Accounts. The Company sells product to its franchisees and, to a lesser extent,

various third parties. See the footnote, "Receivables", for the components of accounts receivable. To determine the allowance for doubtful

accounts in accordance with SFAS No. 114, "Accounting by Creditors for Impairment of a Loan (as amended)", factors that affect collectibility

from the Company's franchisees or third-party customers include their financial strength, payment history, reported sales and the overall retail

economy. The Company establishes an allowance for doubtful accounts for franchisees based on an assessment of the franchisees' operations

which includes analysis of their operating cash flows, sales levels, and status of amounts due to the Company, such as rent, interest and

advertising. In addition, the Company considers the franchisees' inventory and fixed

72