GNC 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

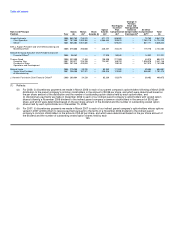

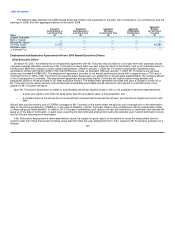

(1) Time-based stock option awards made under the 2007 Stock Plan, which awards vest subject to continuing employment, other than the

stock options granted to Mr. Fortunato and Ms. Kaplan, in five equal annual installments commencing on the first anniversary of the date

of grant. For the stock options granted to Mr. Fortunato and Ms. Kaplan, such stock options vest in four equal annual installments

commencing on the first anniversary of the date of grant.

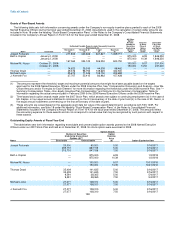

Option Exercises and Stock Vested

No stock options were exercised in 2008. We have not issued, nor are there any outstanding, shares of restricted stock.

Pension Benefits

The Company did not have a pension plan in effect for the benefit of its 2008 Named Executive Officers for the fiscal year ending

December 31, 2008.

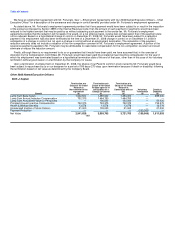

Non-qualified Deferred Compensation

One of our subsidiaries maintains the GNC Live Well Later Non-qualified Deferred Compensation Plan for the benefit of a select group of

management or highly compensated employees. Under the deferred compensation plan, an eligible employee of such subsidiary or a

participating affiliate may elect to defer a portion of his or her future compensation under the plan by electing such deferral prior to the

beginning of the calendar year during which the deferral amount would be earned (or, if applicable, within 30 days of the date on which the

employee first becomes eligible to participate in the plan). The minimum amount of salary that may be deferred by an eligible employee for a

calendar year is $200, subject to a maximum of 25% of the employee's salary otherwise payable for the year and the minimum amount of

bonus that may be deferred by an eligible employee for a calendar year is $2,000, subject to a maximum of 25% of the employee's bonus

otherwise payable for the year. The employers participating in the plan may in their discretion elect to make a matching contribution to the plan

for a calendar year, based on amounts deferred by eligible employees for that year. An eligible employee may elect at the time amounts are

deferred under the plan to have such amounts credited to an in-service account, which is payable (subject to certain special elections for 2006

and 2007 pursuant to rules issued by the Internal Revenue Service under Section 409A of the Internal Revenue Code) on a future date

selected by the employee at the time the employee first elects to defer compensation under the plan, or to a retirement account, which is

payable (subject to the special elections described above) upon the employee's retirement (as defined in the plan). Payments will be made

earlier than the dates described above as a result of the death or disability of an employee participating in the plan. If a participating employee

dies before retirement, a death benefit will be paid to the employee's beneficiaries in certain cases. For purposes of applying the provisions of

the Internal Revenue Code and the Employee Retirement Income Security Act to the plan, the plan is intended to be an unfunded arrangement.

139