GNC 2009 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

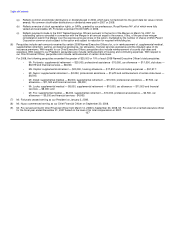

• Mr. Fortunato will receive payment of a lump sum amount of two times his base salary and the annualized value of his perquisites;

• Mr. Fortunato will receive payment of a lump sum amount of two times his average annual bonus paid or payable with respect to the

most recent three fiscal years;

• we will pay the monthly cost of COBRA coverage for Mr. Fortunato to the same extent we paid for such coverage prior to the

termination date for the period permitted by COBRA or until Mr. Fortunato obtains other employment offering substantially similar or

improved group health benefits; and

• Mr. Fortunato's outstanding stock options will vest and restrictions on restricted stock awards will lapse if they would have otherwise

done so in the 24 months following the termination had Mr. Fortunato continued to be employed (36 months if such termination

occurs in anticipation of a change in control, or within the six months prior to, or at any time following, an initial public offering of our

Parent's common stock).

If such termination occurs in anticipation of or during the two-year period following a change in control, or within six months prior to or at any

time following the completion of an initial public offering of our Parent's common stock, the multiple of base salary and annualized perquisites

and of average annual bonus will increase from two times to three times. A termination of Mr. Fortunato's employment will be deemed to have

been in anticipation of a change in control if such termination occurs at any time from and after the period beginning six months prior to a

change in control and such termination occurs (i) after we or our Parent enter into a definitive agreement that provides for a change in control or

(ii) at the request of an unrelated third party who has taken steps reasonably calculated to effect a change in control.

As of the date of termination, all of Mr. Fortunato's outstanding stock options will vest and all restrictions on restricted stock awards will

lapse, in each case assuming he had continued his employment during the calendar year in which such termination occurs and for the twenty-

four month period following such termination (36 months if such termination occurs in anticipation of a change in control, or within the six

months prior to, or at any time following, an initial public offering of our Parent's common stock).

For purposes of Mr. Fortunato's employment agreement, "cause" generally means any of the following events as determined in good faith by

a 2/3 vote of the Parent Board, Mr. Fortunato's:

• conviction of, or plea of nolo contendere to, a crime which constitutes a felony;

• willful disloyalty or deliberate dishonesty with respect to the Company or our Parent that is injurious to our or our Parent's financial

condition, business or reputation;

• commission of an act of fraud or embezzlement against us or our Parent;

• material breach of any provision of his employment agreement or any other written contract or agreement with us or our Parent that

is not cured; or

• willful and continued failure to materially perform his duties or his continued failure to substantially perform duties requested or

prescribed by the Parent Board or the Company Board which is not cured.

For purposes of Mr. Fortunato's employment agreement, "good reason" generally means, without Mr. Fortunato's consent:

• our failure to comply with any material provision of his employment agreement which is not cured;

141