GNC 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 22. RETIREMENT PLANS

The Company sponsors a 401(k) defined contribution savings plan covering substantially all employees. Full time employees who have

completed 30 days of service and part time employees who have completed 1,000 hours of service are eligible to participate in the plan. The

plan provides for employee contributions of 1% to 80% of individual compensation into deferred savings, subject to IRS limitations. The plan

provides for Company contributions upon the employee meeting the eligibility requirements. The contribution match was temporarily suspended

as of June 30, 2003, and was reinstated in January 2004. Effective April 1, 2005, the Company match consists of both a fixed and a

discretionary match which is based on a specified financial target for all participants in the plan. The fixed match is 50% on the first 3% of the

salary that an employee defers and the discretionary match could be up to an additional 100% match on the 3% deferral. A discretionary match

can be approved at any time by the Company.

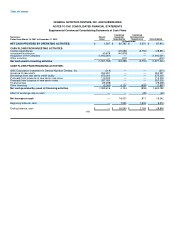

An employee becomes vested in the Company match portion as follows:

Percent

Years of Service Vested

0-1 0%

1-2 33%

2-3 66%

3+ 100%

The Company made cash contributions of $1.2 million for the year ended December 31, 2008, $0.3 million for the period January 1 to

March 15, 2007, $0.9 million for the period March 16 to December 31, 2007 and $1.2 million for the year ended December 31, 2006. In

addition, the Company made a discretionary match for the 2006 plan year of $1.2 million in February 2007, for the 2007 plan year of

$0.6 million in April 2008 and for the 2008 plan year of $0.6 million in March 2009.

The Company has a Non-qualified Executive Retirement Arrangement Plan that covers key employees. Under the provisions of this plan,

certain eligible key employees are granted cash compensation, which in the aggregate was not significant for any year presented.

The Company has a Non-qualified Deferred Compensation Plan that provides benefits payable to certain qualified key employees upon their

retirement or their designated beneficiaries upon death. This plan allows participants the opportunity to defer pretax amounts ranging from 2%

to 100% of their base compensation plus bonuses. The plan is funded entirely by elective contributions made by the participants. The Company

has elected to finance any potential plan benefit obligations using corporate owned life insurance policies.

NOTE 23. FAIR VALUE MEASUREMENTS

As described in Note 2, the Company adopted the provisions of SFAS 157 as of January 1, 2008. SFAS 157 defines fair value, establishes a

consistent framework for measuring fair value, and expands disclosures for each major asset and liability category measured at fair value on

either a recurring or nonrecurring basis. SFAS 157 clarifies that fair value is an exit price, representing the amount that would be received to sell

an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement

that should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering

such assumptions, SFAS 157 establishes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows:

Level 1

—

observable inputs such as quoted prices in active markets for identical assets and liabilities;

109