GNC 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We have an employment agreement with Mr. Fortunato. See "—Employment Agreements with Our 2008 Named Executive Officers – Chief

Executive Officer" for a description of the severance and change in control benefits provided under Mr. Fortunato's employment agreement.

As stated above, Mr. Fortunato's employment agreement provides that if any payment would have been subject to or result in the imposition

of the excise tax imposed by Section 4999 of the Internal Revenue Code, then the amount of such payment or payments would have been

reduced to the highest amount that may be paid by us without subjecting such payment to the excise tax. Mr. Fortunato's employment

agreement provides that the reduction will not apply if he would, on a net after-tax basis, receive less compensation than if the payment were

not so reduced. Based on a hypothetical change in control on December 31, 2008, Mr. Fortunato would have been subject to a reduction

payment if his employment had also been terminated at the time of a December 31, 2008 change in control or on December 31, 2008 in

anticipation of a change in control, but not upon a change in control without an employment termination. The calculation of the payment

reduction amounts does not include a valuation of the non-competition covenant in Mr. Fortunato's employment agreement. A portion of the

severance payments payable to Mr. Fortunato may be attributable to reasonable compensation for the non-competition covenant and could

eliminate or reduce the reduction amount.

Finally, although there is no requirement to do so or guarantee that it would have been paid, we have assumed that, in the exercise of

discretion by the Compensation Committee, Mr. Fortunato would have been paid his prorated annual incentive compensation for the year in

which his employment was terminated based on a hypothetical termination date of the end of that year, other than in this case of his voluntary

termination without good reason or a termination by the Company for cause.

Upon a termination of employment on December 31, 2008, the shares of our Parent's common stock owned by Mr. Fortunato would have

been subject to repurchase by us or our designee for a period of 180 days (270 days upon termination because of death or disability) following

the termination based on fair value as determined by the Company Board.

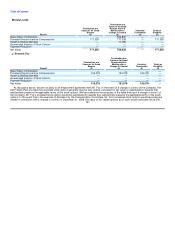

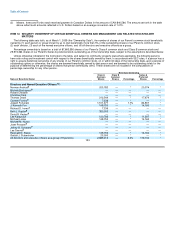

Other 2008 Named Executive Officers

Beth J. Kaplan

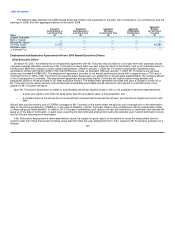

Termination w/o Termination w/o Termination w/o

Cause or for Good Cause or for Good Cause or for Good

Reason or Reason upon or in Reason in

Non-renewal of the anticipation of a Connection with an Voluntary Death or

Agreement Change in Control IPO Termination Disability

Benefit ($) ($) ($) ($) ($)

Lump Sum Base Salary 1,042,500 1,390,000 1,390,000 — 695,000

Lump Sum Annual Incentive Compensation 732,375 1,464,750 1,464,750 — —

Lump Sum Annualized Value or Perquisites — 100,000 100,000 — 50,000

Prorated Annual Incentive Compensation 732,375 732,375 732,375 — 732,375

Health & Welfare Benefits 13,578 13,578 13,578 — 13,578

Accelerated Vesting of Stock Options 21,000 105,000 21,000 — 21,000

Payment Reduction — — — (150,000) —

Net Value 2,541,828 3,805,703 3,721,703 (150,000) 1,511,953

149