GNC 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

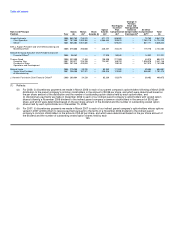

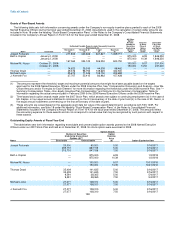

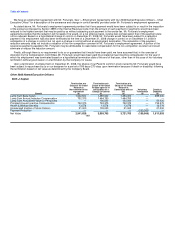

The following table identifies the 2008 Named Executive Officers who participate in the plan, their contributions, our contributions and the

earnings in 2008, and their aggregate balance at the end of 2008.

Aggregate

Executive Registrant Aggregate Aggregate Balance

Contributions in Contributions in Earnings Withdrawals/ at Last Fiscal

Last Fiscal Year Last Fiscal Year in Last Fiscal Year Distributions Year-End

Name ($) ($) ($) ($) ($)

Joseph Fortunato — — — — —

Beth J. Kaplan — — — — —

Michael M. Nuzzo — — — — —

Thomas Dowd 10,372 — — — 46,584

Michael Locke — — — — —

J. Kenneth Fox — — — — —

Employment and Separation Agreements with our 2008 Named Executive Officers

Chief Executive Officer

On March 16, 2007, we entered into an employment agreement with Mr. Fortunato that provides for a five-year term with automatic annual

one-year renewals thereafter unless we or Mr. Fortunato provide at least one-year advance notice of termination, and an annual base salary of

not less than $800,000, subject to certain upward adjustments. Effective January 1, 2009, Mr. Fortunato's employment agreement was

amended to comply with Section 409A of the Internal Revenue Code, as amended. Effective January 1, 2009, Mr. Fortunato's annual base

salary was increased to $860,000. The employment agreement provides for an annual performance bonus with a target bonus of 75% and a

maximum bonus of 125% of Mr. Fortunato's annual base salary based upon our attainment of annual goals established by the Company Board

or the Compensation Committee. The employment agreement also provides that Mr. Fortunato will receive certain fringe benefits and

perquisites similar to those provided to our other executive officers. The employment agreement provides that upon a change in control all of

Mr. Fortunato's stock options will fully vest and become immediately exercisable and all restrictions with respect to restricted stock, if any,

granted to Mr. Fortunato will lapse.

Upon Mr. Fortunato's termination for death or total disability we will be required to pay to him (or his guardian or personal representative):

• a lump sum equal to two times his base salary plus the annualized value of his perquisites; and

• a prorated share of the annual bonus he would have received had he worked the full year, provided bonus targets are met for such

year.

We will also pay the monthly cost of COBRA coverage for Mr. Fortunato to the same extent we paid for such coverage prior to the termination

date for the period permitted by COBRA or, in the case of disability, until Mr. Fortunato obtains other employment offering substantially similar

or improved group health benefits. In addition, Mr. Fortunato's outstanding stock options will vest and restrictions on restricted stock awards will

lapse as of the date of termination, in each case, assuming he had continued employment during the calendar year in which termination occurs

and for the year following such termination.

If Mr. Fortunato's employment is terminated without cause, he resigns for good reason or we decline to renew the employment term for

reasons other than those that would constitute cause after the initial five-year employment term, then, subject to Mr. Fortunato's execution of a

release: 140