GNC 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

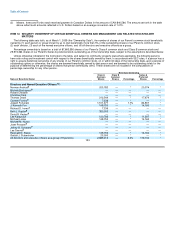

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE.

Management Services Agreement

Upon completion of the Merger, we entered into a management services agreement with our Parent. Under the agreement, our Parent

agreed to provide us and our subsidiaries with certain services in exchange for an annual fee of $1.5 million, as well as customary fees for

services rendered in connection with certain major financial transactions, plus reimbursement of expenses and a tax gross-up relating to a non-

tax deductible portion of the fee. Under the terms of the management services agreement, we have agreed to provide customary

indemnification to our Parent and its affiliates and those providing services on its behalf. In addition, upon completion of the Merger, we

incurred an aggregate fee of $10.0 million, plus reimbursement of expenses, payable to our Parent for services rendered in connection with the

Merger. In 2008, we paid $1.5 million under this agreement.

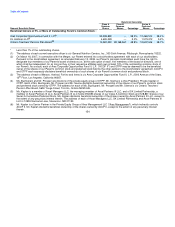

Stockholders' Agreement

Upon completion of the Merger, our Parent entered into a stockholders agreement with each of its stockholders, which includes certain of

our directors, employees, and members of our management and our principal stockholders. The stockholders agreement was amended and

restated as of February 12, 2008. Through a voting agreement, the amended and restated stockholders agreement gives each of ACOF and

OTPP, our Parent's principal stockholders, the right to designate four members of our Parent's board of directors (or, at the sole option of each,

five members of the board of directors, one of which shall be independent) for so long as they or their respective affiliates each own at least

10% of the outstanding common stock of our Parent. The voting agreement also provides for election of our Parent's then-current chief

executive officer to our Parent's board of directors. Under the terms of the amended and restated stockholders agreement, certain significant

corporate actions require the approval of a majority of directors on the board of directors, including a majority of the directors designated by

ACOF and a majority of the directors designated by OTPP. The amended and restated stockholders agreement also contains significant

transfer restrictions and certain rights of first offer, tag-along, and drag-along rights. In addition, the amended and restated stockholders

agreement contains registration rights that require our Parent to register common stock held by the stockholders who are parties to the

stockholders agreement in the event our Parent registers for sale, either for its own account or for the account of others, shares of its common

stock.

Lease Agreements

General Nutrition Centres Company, a wholly owned subsidiary of the Company, is party to 21 lease agreements, as lessee, with Cadillac

Fairview Corporation, as lessor, with respect to properties located in Canada. Cadillac Fairview Corporation is a direct, wholly owned subsidiary

of OTPP, one of the principal stockholders of our parent. See "—Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters". The aggregate value of the leases is approximately $10.4 million, together with certain future landlord related

costs, of which $2.5 million was paid during the 2008 fiscal year. Each lease was negotiated in the ordinary course of business on an arm's

length basis.

Stock Purchase

During the third and fourth quarter of 2008, Axcel Partners III, LLC purchased 273,215 shares of Common Stock of our parent at a price of

$6.82 per share, for an aggregate purchase price of $1.9 million, and 45,478 shares of Common Stock of our parent at a price of $7.08 per

share, for an aggregate purchase price of $0.3 million, respectively, and 110,151 and 18,710 shares of Preferred Stock of our parent at a price

of $5.00 per share plus accrued and unpaid dividends through the dates of purchase, for an aggregate purchase price of $0.6 million and

$0.1 million, respectively. Ms. Kaplan, who serves as a director and as our President and Chief Merchandising and Marketing Officer, is a

member of Axcel Managers LLC, the managing member of Axcel Partners III LLC, and of SK Limited Partnership, a member of Axcel Partners

III LLC.

Apollo Management and Advisory Services

Immediately prior to the completion of the Numico acquisition, we, together with GNC Corporation, entered into a management services

agreement with Apollo Management V, L.P., which controlled the principal stockholder of GNC Parent Corporation until the consummation of

the Merger. Under this management services agreement, Apollo Management V agreed to provide to GNC Corporation and us investment

banking, management, consulting, and financial planning services on an ongoing basis and financial advisory and investment banking services

in connection with major financial transactions that may be undertaken by us or our subsidiaries in exchange for a fee of $1.5 million per year,

plus reimbursement of expenses. Under the management services agreement, GNC Corporation and us agreed to provide customary

indemnification.

The merger agreement required the management services agreement to be terminated on or before the closing of the Merger. Our board of

directors and the board of directors of GNC Corporation approved the termination of the management services agreement in exchange for a

one-time payment to Apollo Management V of $7.5 million, representing approximately the present value of the management fees payable for

the remaining term of the management services agreement, which was paid upon closing of the Merger.

156