GNC 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

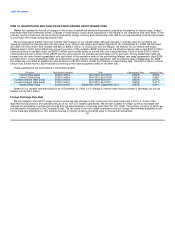

Contractual Obligations

The following table summarizes our future minimum non-cancelable contractual obligations at December 31, 2008:

Payments due by period

Less than

(in millions) Total 1 year 1-3 years 4-5 years After 5 years

Long-term debt obligations (1) $ 1,087.2 $ 13.5 $ 16.6 $ 646.4 $ 410.7

Scheduled interest payments (2) 350.7 67.2 147.1 118.2 18.2

Operating lease obligations (3) 394.7 100.5 145.5 77.2 71.5

Purchase commitments (4)(5) 28.9 11.7 9.0 3.2 5.0

$ 1,861.5 $ 192.9 $ 318.2 $ 845.0 $ 505.4

(1) These balances consist of the following debt obligations: (a) $668.6 million for the Senior Credit Facility based on a variable interest rate;

(b) $300.0 million for our Senior Notes based on a variable interest rate; (c) $110.0 million for our Senior Subordinated Notes with a fixed

interest rate; and (d) $8.6 million for our mortgage with a fixed interest rate. Repayment of the Senior Credit Facility assumes that 1.0% of

the original balance is due and payable annually and does not take into account any unscheduled payments that may occur due to our

future cash positions.

(2) The interest that will accrue on the long-term obligations includes variable rate payments, which are estimated using the associated

LIBOR index as of December 31, 2008. The Senior Credit Facility uses the three month LIBOR index while the Senior Toggle Notes uses

the six month LIBOR index. Also included in the scheduled interest payments is the activity associated with our interest rate swap

agreements which also use the three month LIBOR index.

(3) These balances consist of the following operating leases: (a) $370.0 million for company-owned retail stores; (b) $70.0 million for

franchise retail stores, which is offset by $70.0 million of sublease income from franchisees; and (c) $24.7 million relating to various

leases for tractors/trailers, warehouses, automobiles, and various equipment at our facilities.

(4) These balances consist of $7.6 million of advertising, $1.0 million in inventory commitments, $3.0 million in anticipated legal settlement

costs, $5.0 million of required spending for website redesign and $12.3 million related to a management services agreement. In

connection with the Merger, we entered into a management services agreement with our parent, GNC Acquisition Holdings Inc., pursuant

to which we agreed to pay an annual fee of $1.5 million in consideration for certain management and advisory services. See Item 13,

"Certain Relationships and Related Transactions — Management Services Agreement."

(5) We are unable to make a reasonably reliable estimate as to when cash settlement with taxing authorities may occur for our unrecognized

tax benefits. Also, certain other long term liabilities, included in our consolidated balance sheet relate principally to the fair value of our

interest rate swap agreement, payables to former shareholders, and rent escalation liabilities, and we are unable to estimate the timing of

these payments. Therefore, these long term liabilities are not included in the table above. See Note 5, "Income Taxes," and Note 14,

"Other Long Term Liabilities," to the Consolidated Financial Statements for additional information.

In addition to the obligations scheduled above, we have entered into employment agreements with certain executives that provide for

compensation and certain other benefits. Under certain circumstances, including a change of control, some of these agreements provide for

severance or other payments, if those circumstances would ever occur during the term of the employment agreement.

55