GNC 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GENERAL NUTRITION CENTERS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

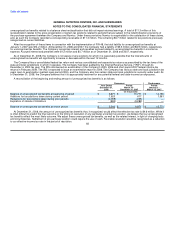

unrecognized tax benefits related to a balance sheet reclassification that did not impact retained earnings. A total of $11.3 million of this

reclassification relates to the gross presentation of certain tax positions related to periods that are subject to the indemnification provisions of

the purchase agreement between the Company and Numico. Under these provisions Numico is responsible for the satisfaction of these claims,

and, as such the Company recorded a corresponding receivable of $11.3 million. The remaining $3.7 million related to tax positions previously

categorized as current liabilities.

After the recognition of these items in connection with the implementation of FIN 48, the total liability for unrecognized tax benefits at

January 1, 2007 was $14.2 million. At December 31, 2008 and 2007, the Company had a liability of $5.5 million and $6.9 million, respectively,

for unrecognized tax benefits. The Company recognizes interest and penalties accrued related to unrecognized tax benefits in income tax

expense. Accrued interest and penalties were $1.2 million and $0.7 million as of December 31, 2008 and 2007, respectively.

As of December 31, 2008, the Company is not aware of any positions for which it is reasonably possible that the total amounts of

unrecognized tax benefits will significantly increase or decrease within the next 12 months.

The Company files a consolidated federal tax return and various consolidated and separate tax returns as prescribed by the tax laws of the

state and local jurisdictions in which it operates. The Company has been audited by the Internal Revenue Service, ("IRS"), through its

December 4, 2003 tax year. The IRS commenced an examination of the Company's 2005, 2006 and short period 2007 federal income tax

returns in February 2008. The IRS is expected to issue an examination report in 2009. The Company has various state and local jurisdiction tax

years open to examination (earliest open period 2003), and the Company also has certain state and local jurisdictions currently under audit. As

of December 31, 2008, the Company believes that it is appropriately reserved for any potential federal and state income tax exposures.

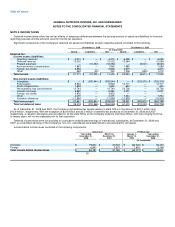

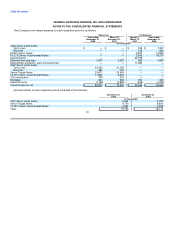

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Successor Predecessor

Year Ended Period Period

December 31, March 16 - January 1 -

2008 December 31, 2007 March 15, 2007

(in thousands)

Balance of unrecognized tax benefits at beginning of period $ 6,871 $ 15,771 $ 14,190

Additions for tax positions taken during current period 1,620 617 1,581

Reductions for tax positions taken during prior periods (2,059) (235) —

Expiration of statute of limitations (890) (9,282) —

Balance of unrecognized tax benefits at end of period $ 5,542 $ 6,871 $ 15,771

At December 31, 2008, the amount of unrecognized tax benefits that, if recognized, would affect the effective tax rate is $4.6 million. While it

is often difficult to predict the final outcome or the timing of resolution of any particular uncertain tax position, we believe that our unrecognized

tax benefits reflect the most likely outcome. We adjust these unrecognized tax benefits, as well as the related interest, in light of changing facts

and circumstances. Settlement of any particular position could require the use of cash. Favorable resolution would be recognized as a reduction

to our effective income tax rate in the period of resolution. 83