GNC 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

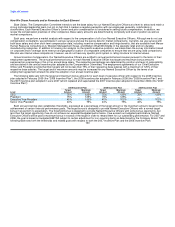

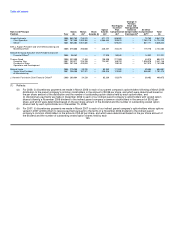

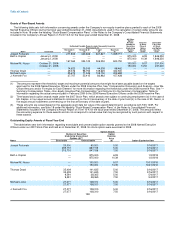

Change in

Pension

Non-Equity Value and

Incentive Non-qualified

Option Plan Deferred All Other

Name and Principal Salary Bonus Stock Awards Compensation Compensation Compensation Total

Position Year ($) ($)1 Awards ($) ($)2 ($)3 Earnings ($)4 ($)5,6 ($)

Joseph Fortunato 2008 855,769 216,573 — 971,172 928,509 — 70,753 3,042,776

Chief Executive 2007 787,500 1,909,384 — 4,066,464 700,875 — 7,260,110 14,724,333

Officer7 2006 565,384 2,967,386 — — 678,461 — 837,111 5,048,342

Beth J. Kaplan President and Chief Merchandising and

Marketing Officer 2008 675,000 250,000 — 345,257 732,375 — 119,770 2,122,402

Michael M. Nuzzo Executive Vice President and Chief

Financial Officer8 2008 98,462 — — 17,325 80,542 — 14,992 211,321

Thomas Dowd 2008 332,500 17,404 — 138,308 271,985 — 44,015 804,212

Executive Vice 2007 293,077 226,708 — 724,581 168,702 — 1,028,078 2,441,146

President of Store 2006 251,346 425,093 — — 138,240 — 347,819 1,162,498

Operations and Development

Michael Locke 2008 270,250 39,239 — 83,269 171,339 — 40,584 604,681

Senior Vice President 2007 238,450 107,321 — 435,946 123,006 — 846,651 1,751,374

of Manufacturing

J. Kenneth Fox Interim Chief Financial Officer9 2008 209,904 34,239 — 83,269 133,079 — 30,482 490,973

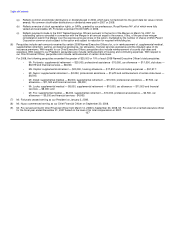

(1) Reflects:

(a) For 2006: (i) discretionary payments we made in March 2006 to each of our parent company's optionholders following a March 2006

distribution to the parent company's common stockholders in the amount of $0.99 per share, and which were determined based on

the per share amount of the distribution and the number of outstanding option shares held by each optionholder, and

(ii) discretionary payments we made in December 2006 to each of our indirect parent company's optionholders with vested option

shares following a November 2006 dividend to the indirect parent company's common stockholders in the amount of $5.42 per

share, and which were determined based on the per share amount of the dividend and the number of outstanding vested option

shares held by each optionholder as of December 15, 2006.

(b) For 2007: (i) discretionary payments we made in March 2007 to each of our indirect parent company's optionholders whose options

vested in 2007 entitling them to receive payment pursuant to the terms of a November 2006 dividend to the indirect parent

company's common stockholders in the amount of $5.42 per share, and which were determined based on the per share amount of

the dividend and the number of outstanding vested option shares held by each

135