GNC 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 GNC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

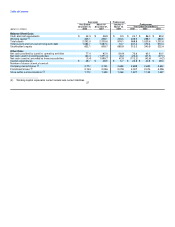

Table of Contents

Interest Expense

Interest expense decreased $35.5 million, or 30.0%, to $83.0 million for the year ended December 31, 2008 compared to $118.5 million for

the same period in 2007. This decrease was primarily attributable to $34.8 million in call premiums and deferred fee write offs in 2007 and

decreases in interest rates on our variable rate debt in 2008 as compared to 2007 due to the decline in LIBOR rates.

Income Tax Expense

We recognized $32.0 million of consolidated income tax expense during the year ended December 31, 2008 compared to $1.9 million for the

same period of 2007. The effective tax rate for the year ended December 31, 2008, was approximately 36.9%; which includes discrete tax

benefits of $2.0 million.

Net Income

As a result of the foregoing, consolidated net income increased $87.1 million to $54.8 million for the year ended December 31, 2008

compared to a loss of $32.3 million for the same period in 2007. Net income as a percentage of net revenue was 3.3% for the year ended

December 31, 2008, compared to (2.1)% for the year ended December 31, 2007.

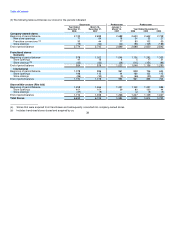

Comparison of the Years Ended December 31, 2007 and 2006

Revenues

Our consolidated net revenues increased $65.7 million, or 4.4%, to $1,552.8 million for the year ended December 31, 2007 compared to

$1,487.1 million for the same period in 2006. The increase was the result of increased same store sales in our Retail segment, increased

product sales in our Franchise segment, and increased revenue in our Manufacturing/Wholesale segment.

Retail. Revenues in our Retail segment increased $45.9 million, or 4.1%, to $1,168.6 million for the year ended December 31, 2007

compared to $1,122.7 million for the same period in 2006. Included as part of the revenue increase was $28.3 million in revenue for sales

through www.gnc.com compared to $17.1 million in 2006. In 2007, our domestic company-owned same store sales improved by 1.4% and our

Canadian company-owned stores improved by 8.5% for the same period. Our company-owned store base increased by 44 stores to 2,598

domestically, and our Canadian store base increased by 13 stores to 147 at December 31, 2007.

Franchise. Revenues in our Franchise segment increased $8.8 million, or 3.8%, to $241.1 million for the year ended December 31, 2007

compared to $232.3 million for the same period in 2006. This increase is due to increases in our international franchise revenue of $11.3 million

as a result of higher product sales and royalties, offset by a $2.4 million decrease in domestic franchise revenue, the result of operating 68

fewer domestic franchise stores in the year ended December 31, 2007 compared to the same period in 2006. There were 978 domestic

franchise stores at December 31, 2007 compared to 1,046 at December 31, 2006. Our international franchise store base increased by 117

stores to 1,078 at December 31, 2007 compared to 961 at December 31, 2006.

Manufacturing/Wholesale. Revenues in our Manufacturing/Wholesale segment, which includes third-party sales from our manufacturing

facility in South Carolina, as well as wholesale sales to Rite Aid and www.drugstore.com, increased $11.0 million, or 8.3%, to $143.1 million for

the year ended December 31, 2007 compared to $132.1 million for the same period in 2006. Wholesale sales to Rite Aid and

www.drugstore.com increased by $12.3 million, primarily a result of 131 net store-within-a-store openings in 2007. Sales in the South Carolina

plant increased by $4.3 million, as available capacity in the plant was utilized for third party contracts. Additionally, we had $5.7 million in sales

in the year ended December 31, 2006 from our Australia facility, which was sold in November 2006.

47