Dollar General 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the transportation industry or long-term disruptions to the national and international transportation

infrastructure that lead to delays or interruptions of deliveries or which would necessitate our securing

alternative labor or shipping suppliers could also increase our costs or otherwise negatively affect our

business.

We maintain a network of distribution facilities and have plans to build new facilities to support

our growth objectives. Delays in opening distribution centers could adversely affect our future financial

performance by slowing store growth, which may in turn reduce revenue growth, or by increasing

transportation costs. In addition, distribution-related construction or expansion projects entail risks that

could cause delays and cost overruns, such as: shortages of materials or skilled labor; work stoppages;

unforeseen construction, scheduling, engineering, environmental or geological problems; weather

interference; fires or other casualty losses; and unanticipated cost increases. The completion date and

ultimate cost of these projects could differ significantly from initial expectations due to construction-

related or other reasons. We cannot guarantee that any project will be completed on time or within

established budgets.

Risks associated with or faced by our suppliers could adversely affect our financial performance.

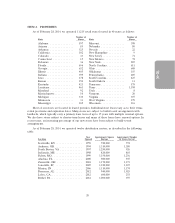

The products we sell are sourced from a wide variety of domestic and international suppliers, and

we are dependent on our vendors to supply merchandise in a timely and efficient manner. In 2013, our

largest supplier accounted for 8% of our purchases, and our next largest supplier accounted for

approximately 7% of such purchases. We have not experienced any difficulty in obtaining sufficient

quantities of core merchandise and believe that, if one or more of our current sources of supply

became unavailable, we would generally be able to obtain alternative sources without experiencing a

substantial disruption of our business. However, such alternative sources could increase our

merchandise costs and reduce the quality of our merchandise, and an inability to obtain alternative

sources could adversely affect our sales. Additionally, if a supplier fails to deliver on its commitments,

whether due to financial difficulties or other reasons, we could experience merchandise out-of-stocks

that could lead to lost sales and damage to our reputation.

We directly imported approximately 6% of our purchases (measured at cost) in 2013, but many of

our domestic vendors directly import their products or components of their products. Changes to the

prices and flow of these goods for any reason, such as political and economic instability in the countries

in which foreign suppliers are located, the financial instability of suppliers, suppliers’ failure to meet

our standards, issues with labor practices of our suppliers or labor problems they may experience (such

as strikes, stoppages or slowdowns, which could also increase labor costs during and following the

disruption), the availability and cost of raw materials to suppliers, increased import duties, merchandise

quality or safety issues, currency exchange rates, transport availability and cost, transport security,

inflation, and other factors relating to the suppliers and the countries in which they are located or from

which they import, are beyond our control and could adversely affect our operations and profitability.

Because a substantial amount of our imported merchandise comes from China, a change in the Chinese

currency or other policies could negatively impact our merchandise costs. In addition, the United

States’ foreign trade policies, tariffs and other impositions on imported goods, trade sanctions imposed

on certain countries, the limitation on the importation of certain types of goods or of goods containing

certain materials from other countries and other factors relating to foreign trade are beyond our

control. These and other factors affecting our suppliers and our access to products could adversely

affect our business and financial performance. As we increase our imports of merchandise from foreign

vendors, the risks associated with foreign imports will increase.

13

10-K