Dollar General 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

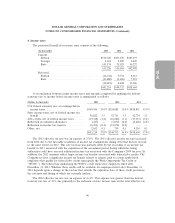

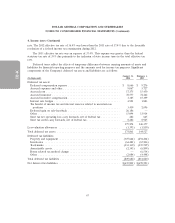

5. Current and long-term obligations (Continued)

Collectively, the 2017 Senior Notes, the 2018 Senior Notes and the 2023 Senior Notes comprise the

‘‘Senior Notes’’, each of which were issued pursuant to an indenture as modified by supplemental

indentures relating to each series of Senior Notes (as so supplemented, the ‘‘Senior Indenture’’). The

Company capitalized $10.1 million of debt issuance costs associated with the 2018 Senior Notes and the

2023 Senior Notes. Interest on the 2018 Senior Notes and 2023 Senior Notes is payable in cash on

April 15 and October 15 of each year and commenced on October 15, 2013.

The Company may redeem some or all of its Senior Notes at any time at redemption prices set

forth in the Senior Indenture. Upon the occurrence of a change of control triggering event, which is

defined in the Senior Indenture, each holder of the Senior Notes has the right to require the Company

to repurchase some or all of such holder’s Senior Notes at a purchase price in cash equal to 101% of

the principal amount thereof, plus accrued and unpaid interest, if any, to the repurchase date.

The Senior Indenture contains covenants limiting, among other things, the ability of the Company

(subject to certain exceptions) to consolidate, merge, sell or otherwise dispose of all or substantially all

of the Company’s assets; and the ability of the Company and its subsidiaries to incur or guarantee

indebtedness secured by liens on any shares of voting stock of significant subsidiaries.

The Senior Indenture also provides for events of default which, if any of them occurs, would

permit or require the principal of and accrued interest on the Senior Notes to become or to be

declared due and payable.

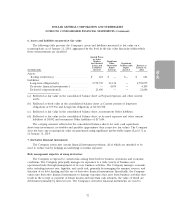

On July 15, 2012, the Company redeemed $450.7 million aggregate principal amount of

outstanding senior subordinated notes due 2017 at a premium, resulting in a pretax loss of

$29.0 million which is reflected in Other (income) expense in the consolidated statement of income for

the year ended February 1, 2013. The Company funded the redemption price for the senior

subordinated notes due 2017 with proceeds from the issuance of the 2017 Senior Notes.

In 2011, the Company repurchased or redeemed $864.3 million aggregate principal amount of

outstanding senior notes due 2015 at a premium, resulting in pretax losses totaling $60.3 million which

are reflected in Other (income) expense in the consolidated statement of income for the year ended

February 3, 2012. The Company funded the redemption price for the senior notes due 2015 with cash

on hand and borrowings under the ABL Facility.

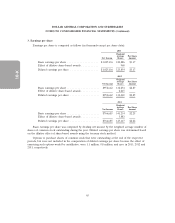

Scheduled debt maturities, including capital lease obligations, for the Company’s fiscal years listed

below are as follows (in thousands): 2014—$75,966; 2015—$101,158; 2016—$101,379; 2017—$601,290;

2018—$1,025,892; thereafter—$915,651.

71

10-K