Dollar General 2013 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Share-based payments (Continued)

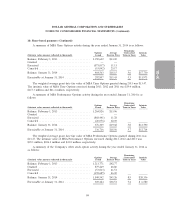

The weighted average grant date fair value of other options granted was $13.86, $13.54 and $13.14

during 2013, 2012 and 2011, respectively. The intrinsic value of other options exercised during 2013,

2012, and 2011 was $0.8 million, $0.3 million and $1.6 million, respectively.

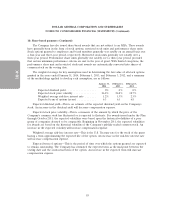

The number of performance share unit awards earned is based upon the Company’s annual

financial performance in the year of grant as specified in the award agreement. A summary of

performance share unit award activity during the year ended January 31, 2014 is as follows:

Units Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Value

Balance, February 1, 2013 ............................. 162,688

Granted .......................................... 72,846

Converted to common stock ........................... (54,973)

Canceled ......................................... (21,142)

Balance, January 31, 2014 ............................. 159,419 $8,978

The weighted average grant date fair value of performance share units granted was $48.11 and

$45.25 during 2013 and 2012, respectively. No performance share units were granted during 2011.

A summary of restricted stock unit award activity during the year ended January 31, 2014 is as

follows:

Units Intrinsic

(Intrinsic value amounts reflected in thousands) Issued Value

Balance, February 1, 2013 ............................. 288,927

Granted .......................................... 509,440

Converted to common stock ........................... (98,063)

Canceled ......................................... (83,777)

Balance, January 31, 2014 ............................. 616,527 $34,723

The weighted average grant date fair value of restricted stock units granted was $48.20, $45.33 and

$33.16 during 2013, 2012 and 2011, respectively.

In March 2012, the Company issued a performance-based award of 326,037 shares of restricted

stock to its Chairman and Chief Executive Officer. This restricted stock award had a fair value on the

grant date of $45.25 per share and may vest in the future if certain specified earnings per share targets

for fiscal years 2014 and 2015 are achieved.

The Company currently believes that the performance targets related to the unvested MSA

Performance Options and restricted stock will be achieved. If such goals are not met, and no event

occurs which would result in the acceleration of vesting of these awards as specified in the underlying

agreements, future compensation cost relating to these unvested awards will not be recognized.

At January 31, 2014, the total unrecognized compensation cost related to nonvested stock-based

awards was $53.5 million with an expected weighted average expense recognition period of 1.5 years.

In October 2007, the Company’s Board of Directors adopted an Equity Appreciation Rights Plan,

which plan was later amended and restated (as amended and restated, the ‘‘Rights Plan’’). The Rights

85

10-K