Dollar General 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

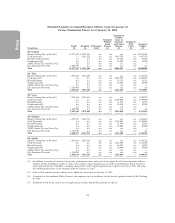

SECURITY OWNERSHIP

For purposes of the tables below, a person is a ‘‘beneficial owner’’ of a security over which that

person has or shares voting or investment power or which that person has the right to acquire

beneficial ownership within 60 days. Unless otherwise noted, to our knowledge these persons have sole

voting and investment power over the shares listed. Percentage computations are based on 309,973,026

shares of our common stock outstanding as of March 21, 2014.

Security Ownership of Certain Beneficial Owners

The following table shows the amount of our common stock beneficially owned as of March 21,

2014 by those known by us to beneficially own more than 5% of our common stock.

Amount and Nature of Percent of

Name and Address of Beneficial Owner Beneficial Ownership Class

Soroban Master Fund LP(1) 20,934,124 6.75%

Lone Pine Capital LLC(2) 18,904,632 6.10%

The Vanguard Group(3) 17,783,665 5.74%

FMR LLC(4) 16,219,434 5.23%

(1) Soroban Master Fund LP, Soroban Capital Partners LLC and Eric W. Mandelblatt share the power to vote or to direct the voting of and the

power to dispose or to direct the disposition of the shares. The address for Soroban Master Fund LP is Gardenia Court, Suite 3307,

45 Market Street, Camana Bay, Grand Cayman KY1-1103, Cayman Islands. The address for Soroban Capital Partners LLC and

Mr. Mandelblatt is 444 Madison Avenue, 21st Floor, New York, New York 10022. All information is based solely on Amendment No. 1 to

Statement on Schedule 13G filed on February 14, 2014.

(2) These shares are directly held by various entities for which Lone Pine Capital LLC serves as investment manager with power to direct

investments and/or power to vote the shares. Stephen F. Mandel, Jr. is the managing member of Lone Pine Managing Member LLC, which is

the Managing Member of Lone Pine Capital LLC. Lone Pine Capital LLC and Mr. Mandel share voting and dispositive power with respect

to the shares. The address of each of Lone Pine Capital LLC and Mr. Mandel is Two Greenwich Plaza, Greenwich, Connecticut 06830. All

information is based solely on Amendment No. 1 to Statement on Schedule 13G filed on February 14, 2014.

(3) The Vanguard Group has sole power to vote or direct the vote over 491,251 shares, sole power to dispose of or to direct the disposition of

17,323,514 shares, and shared power to dispose or to direct the disposition of 460,151 shares. Vanguard Fiduciary Trust Company (‘‘VFTC’’),

a wholly owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 382,351 shares, as a result of its serving as investment

manager of collective trust assets, and Vanguard Investments Australia, Ltd. (‘‘VIA’’), a wholly-owned subsidiary of The Vanguard

Group, Inc., is the beneficial owner of 186,700 shares, as a result of its serving as investment manager of Australian investment offerings. The

address of The Vanguard Group is 100 Vanguard Blvd, Malvern, Pennsylvania 19355. All information is based solely on Statement on

Schedule 13G filed on February 12, 2014.

(4) The shares beneficially owned by FMR LLC consist of the following: (a) 13,076,487 shares beneficially owned by Fidelity Management &

Research Company (‘‘Fidelity’’), a wholly-owned subsidiary of FMR LLC, as a result of its acting as investment advisor to various investment

companies (the ‘‘Funds’’); (b) 528,643 shares beneficially owned by Fidelity SelectCo, LLC (‘‘SelectCo’’), a wholly-owned subsidiary of

FMR LLC, as a result of its acting as investment adviser to various investment companies; (c) 93,026 shares beneficially owned by Fidelity

Management Trust Company (‘‘Fidelity Trust’’), a wholly-owned subsidiary of FMR LLC, as a result of its acting as investment manager of

certain institutional account(s); (d) 20,360 shares owned through Strategic Advisers, Inc. (‘‘Strategic Advisers’’), a wholly-owned subsidiary of

FMR LLC and a registered investment adviser that provides investment advisory services to individuals; (e) 84,504 shares beneficially owned

by Pyramis Global Advisors Trust Company (‘‘PGATC’’), an indirect wholly-owned subsidiary of FMR LLC, as a result of its serving as

investment manager of institutional accounts owning such shares; and (f) 2,416,414 shares beneficially owned by FIL Limited (‘‘FIL’’) which

provides investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors.

Edward C. Johnson 3d, Chairman of FMR LLC, and FMR LLC, through its control of Fidelity, and the Funds each has sole power to

dispose of 13,076,487 shares owned by the Funds. Mr. Johnson and FMR LLC, through its control of SelectCo, and the SelectCo Funds each

has sole power to dispose of the 528,643 shares owned by the SelectCo Funds. Members of Mr. Johnson’s family are the predominant owners

of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all

other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted

in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and

the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed to form a controlling group with respect

to FMR LLC. Neither FMR LLC nor Mr. Johnson has the sole power to vote or direct the voting of the shares owned directly by the

Fidelity Funds, which power resides with the Funds’ Board of Trustees. Fidelity votes the shares under written guidelines established by the

Funds’ Board of Trustees. Mr. Johnson and FMR LLC, through its control of Fidelity Trust, each has sole dispositive power over and sole

power to vote or direct the voting of 93,026 shares owned by the institutional account(s). Mr. Johnson and FMR LLC, through its control of

PGATC, each has sole dispositive power over and sole power to vote or direct the voting of 84,506 shares owned by the institutional accounts

managed by PGATC. Partnerships controlled predominantly by members of Mr. Johnson’s family and FIL, or trusts for their benefit, own

shares of FIL voting stock. While the percentage of total voting power represented by these shares may fluctuate, it normally represents more

than 25% and less than 50% of the total votes which may be cast by all holders of FIL voting stock. FMR LLC and FIL are separate and

independent corporate entities, and their Boards of Directors are generally composed of different individuals. FMR LLC and FIL take the

view that they are not acting as a ‘‘group’’ for purposes of Section 13(d) under the Exchange Act and that they are not otherwise required to

attribute to each other the beneficial ownership of securities beneficially owned by the other entity within the meaning of Rule 13d-3 of the

Exchange Act and that, therefore, the shares held by the other entity need not be aggregated for purposes of Section 13(d). The address of

FMR LLC, Fidelity, Fidelity Trust and Strategic Advisers is 245 Summer Street, Boston, Massachusetts 02210. The address of SelectCo is

1225 17th Street, Suite 1100, Denver, Colorado 80202. The address of PGATC is 900 Salem Street, Smithfield, Rhode Island 02917. The

address of FIL is Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda. All information is based solely on Statement on Schedule 13G filed on

February 14, 2014.

56

Proxy