Dollar General 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

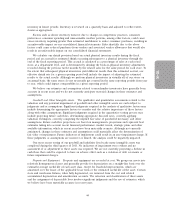

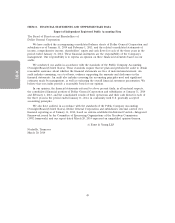

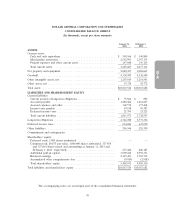

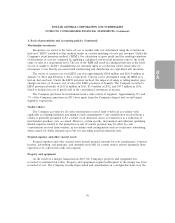

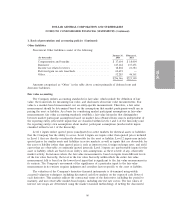

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

January 31, February 1,

2014 2013

ASSETS

Current assets:

Cash and cash equivalents .................................. $ 505,566 $ 140,809

Merchandise inventories .................................... 2,552,993 2,397,175

Prepaid expenses and other current assets ....................... 147,048 139,129

Total current assets ....................................... 3,205,607 2,677,113

Net property and equipment .................................. 2,080,305 2,088,665

Goodwill ................................................. 4,338,589 4,338,589

Other intangible assets, net ................................... 1,207,645 1,219,543

Other assets, net ........................................... 35,378 43,772

Total assets ............................................... $10,867,524 $10,367,682

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term obligations ........................ $ 75,966 $ 892

Accounts payable ......................................... 1,286,484 1,261,607

Accrued expenses and other ................................. 368,578 357,438

Income taxes payable ...................................... 59,148 95,387

Deferred income taxes ..................................... 21,795 23,223

Total current liabilities ..................................... 1,811,971 1,738,547

Long-term obligations ....................................... 2,742,788 2,771,336

Deferred income taxes ....................................... 614,026 647,070

Other liabilities ............................................ 296,546 225,399

Commitments and contingencies

Shareholders’ equity:

Preferred stock, 1,000 shares authorized ........................ — —

Common stock; $0.875 par value, 1,000,000 shares authorized, 317,058

and 327,069 shares issued and outstanding at January 31, 2014 and

February 1, 2013, respectively .............................. 277,424 286,185

Additional paid-in capital ................................... 3,009,226 2,991,351

Retained earnings ........................................ 2,125,453 1,710,732

Accumulated other comprehensive loss ......................... (9,910) (2,938)

Total shareholders’ equity ................................... 5,402,193 4,985,330

Total liabilities and shareholders’ equity .......................... $10,867,524 $10,367,682

The accompanying notes are an integral part of the consolidated financial statements.

50

10-K