Dollar General 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

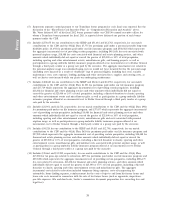

January 31, 2014 for the 2013 PSUs and before payment, the participant will

receive the one-third of the 2013 PSUs earned that are described above, without

proration.

✓If such retirement occurs after March 20, 2013 for the 2012 PSUs or March 18,

2014 for the 2013 PSUs, but prior to the 2nd anniversary of the grant date, the

remaining portion of any earned but unvested performance share units from such

awards that would have become vested had such officer remained employed

through the 2nd anniversary of the grant date (one-third of earned performance

share units) shall become vested and nonforfeitable and shall be paid on the date

of such retirement. If such retirement occurs after the 2nd anniversary of the grant

date but prior to the 3rd anniversary of the grant date, the remaining portion of

any earned but unvested performance share units from such awards that would

have become vested had such officer remained employed through the

3rd anniversary of the grant date (one-third of earned performance share units)

shall become vested and nonforfeitable and shall be paid on the date of such

retirement. Otherwise, any earned but unvested performance share units from

such awards shall be forfeited and cancelled on the retirement date.

• Restricted Stock Units. The one-third of the outstanding restricted stock units that would

have become vested and nonforfeitable on the next immediately following vesting date if

such officer had remained employed through such date will become vested and

nonforfeitable upon such retirement (provided that if the retirement occurs on a vesting

date no accelerated vesting will occur, but rather the officer shall be entitled only to the

portion of the restricted stock units that were scheduled to vest on such vesting date), and

will be paid 6 months and 1 day following the date of termination of employment due to

retirement.

For purposes of each named executive officer’s agreements governing stock options and

performance share units granted after 2011, ‘‘retirement’’ means such officer’s voluntary termination of

employment with us on or after reaching the minimum age of 62 and achieving 5 consecutive years of

service, but only if (1) the sum of such officer’s age plus years of service (counting whole years only)

equals at least 70 and (2) there is no basis for us to terminate the officer for cause (as defined under

the applicable agreement) at the time of his voluntary termination. For purposes of each named

executive officer’s agreement governing restricted stock units granted after 2011, ‘‘retirement’’ means

such officer’s voluntary termination of employment with us on or after reaching the minimum age of 62

and achieving 5 consecutive years of service, but only if (1) the sum of such officer’s age plus years of

service (counting whole years only) equals at least 70, (2) there is no basis for us to terminate the

officer for cause (as defined under the applicable agreement) at the time of his voluntary termination,

and (3) the termination also constitutes a ‘‘separation from service’’ within the meaning of

Section 409A of the Internal Revenue Code of 1986, as amended.

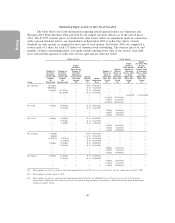

Payments Upon Voluntary Termination

The payments to be made to a named executive officer upon voluntary termination vary

depending upon whether he resigns with or without ‘‘good reason’’ or after our failure to offer to

renew, extend or replace his employment agreement under certain circumstances. ‘‘Good reason’’

generally means (as more fully described in the applicable employment agreement):

• a reduction in the officer’s base salary or target bonus level;

• our material breach of the employment agreement;

• the failure of any successor to all or substantially all of our business and/or assets to

expressly assume and agree to perform the employment agreement in the same manner

47

Proxy