Dollar General 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and snacks contributing the majority of the increase. Tobacco was added in the stores primarily during

the first and second quarters. The expansion of coolers for perishables in over 1,600 existing stores was

completed in the first half of the year while other initiatives, including space optimization in many of

our smaller stores, were implemented throughout the year.

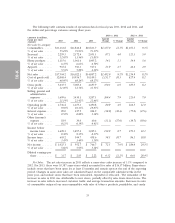

The net sales increase in 2012 reflects a same-store sales increase of 4.7% compared to 2011. For

2012, there were 9,783 same-stores which accounted for sales of $14.99 billion. The remainder of the

increase in sales in 2012 was attributable to new stores, partially offset by sales from closed stores. The

increase in sales reflects increased customer traffic and average transaction amounts, as a result of the

refinement of our merchandise offerings, improvements in our category management processes and

store standards, and increased utilization of square footage in our stores. Increases in sales of

consumables outpaced our non-consumables, with sales of snacks, candy, beverages and perishables

contributing the majority of the increase throughout the year.

Of our four major merchandise categories, the consumables category, which generally has a lower

gross profit rate than the other three categories, has grown most significantly over the past several

years. Because of the impact of sales mix on gross profit, we continually review our merchandise mix

and strive to adjust it when appropriate.

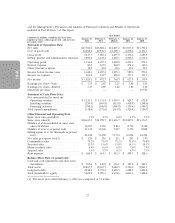

Gross Profit. The gross profit rate as a percentage of sales was 31.1% in 2013 compared to 31.7%

in 2012. Gross profit increased by 6.9% in 2013, and as a percentage of sales, decreased by 69 basis

points. The majority of the gross profit rate decrease in 2013 as compared to 2012 was due to

consumables comprising a larger portion of our net sales, primarily as the result of increased sales of

lower margin consumables including tobacco products and expanded perishables offerings, all of which

contributed to lower initial inventory markups. In addition, we experienced a higher inventory

shrinkage rate, partially attributable to the addition of certain consumable products with relatively

higher retail prices. These factors were partially offset by a reduction in net purchase costs on certain

products. The Company recorded a LIFO benefit of $11.0 million in 2013 compared to a LIFO

provision of $1.4 million in 2012.

The gross profit rate as a percentage of sales was 31.7% in both 2012 and 2011. Factors favorably

impacting our gross profit rate include a significantly lower LIFO provision, higher inventory markups,

and improved transportation efficiencies due in part to a decrease in average miles per delivery enabled

by our new distribution centers and other logistics initiatives. These positive factors were offset by

higher markdowns, a reduction in price increases and a modest increase in our inventory shrinkage rate

compared to 2011. In addition, consumables, which generally have lower markups than

non-consumables, represented a greater percentage of sales in 2012 than in 2011. We recorded a LIFO

provision of $1.4 million in 2012 compared to a $47.7 million provision in 2011, primarily as a result of

lower inflation on commodities.

SG&A Expense. SG&A expense was 21.1% as a percentage of sales in 2013 compared to 21.4%

in 2012, an improvement of 27 basis points. We had a significant decrease in incentive compensation

expense, as 2013 financial performance did not satisfy certain performance requirements under our

cash incentive compensation program. Retail labor expense increased at a rate lower than our increase

in sales. Declines in workers’ compensation and general liability expenses also contributed to the

overall decrease in SG&A expense as a percentage of sales. The above items were partially offset by

certain costs that increased from 2012 to 2013 at a rate higher than our increase in sales, including

depreciation and amortization and fees associated with the increased volume of customer purchases

transacted with debit cards.

SG&A expense was 21.4% as a percentage of sales in 2012 compared to 21.7% in 2011, an

improvement of 25 basis points. Retail labor expense increased at a lower rate than our increase in

sales, partially due to ongoing benefits of our workforce management system coupled with savings due

to various store work simplification initiatives. Also positively impacting SG&A expense was lower legal

34

10-K