Dollar General 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

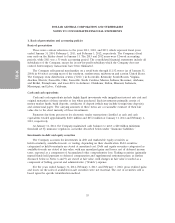

1. Basis of presentation and accounting policies (Continued)

future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or

payments). The variable cash receipts (or payments) are based on an expectation of future interest

rates (forward curves) derived from observable market interest rate curves.

The Company incorporates credit valuation adjustments (CVAs) to appropriately reflect both its

own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value

measurements. In adjusting the fair value of its derivative contracts for the effect of nonperformance

risk, the Company has considered the impact of netting and any applicable credit enhancements, such

as collateral postings, thresholds, mutual puts, and guarantees.

In connection with accounting standards for fair value measurement, the Company has made an

accounting policy election to measure the credit risk of its derivative financial instruments that are

subject to master netting agreements on a net basis by counterparty portfolio. The Company has

determined that the majority of the inputs used to value its derivatives fall within Level 2 of the fair

value hierarchy. However, the CVAs associated with its derivatives utilize Level 3 inputs, such as

estimates of current credit spreads to evaluate the likelihood of default by itself and its counterparties.

As of January 31, 2014, the Company has assessed the significance of the impact of the CVAs on the

overall valuation of its derivative positions and has determined that the CVAs are not significant to the

overall valuation of its derivatives. Based on the Company’s review of the CVAs by counterparty

portfolio, the Company has determined that the CVAs are not significant to the overall portfolio

valuations, as the CVAs are deemed to be immaterial in terms of basis points and are a very small

percentage of the aggregate notional value of the derivative instruments. Although some of the CVAs

as a percentage of termination value appear to be more significant, primary emphasis was placed on a

review of the CVA in basis points and the percentage of the notional value. As a result, the Company

has determined that its derivative valuations in their entirety are classified in Level 2 of the fair value

hierarchy.

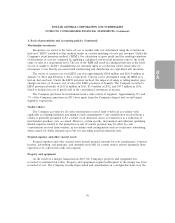

Derivative financial instruments

The Company accounts for derivative financial instruments in accordance with applicable

accounting standards for such instruments and hedging activities, which require that all derivatives are

recorded on the balance sheet at fair value. The accounting for changes in the fair value of derivatives

depends on the intended use of the derivative, whether the Company has elected to designate a

derivative in a hedging relationship and apply hedge accounting and whether the hedging relationship

has satisfied the criteria necessary to apply hedge accounting.

Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an

asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are

considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to

variability in expected future cash flows, or other types of forecasted transactions, are considered cash

flow hedges. Derivatives may also be designated as hedges of the foreign currency exposure of a net

investment in a foreign operation. Hedge accounting generally provides for the matching of the timing

of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair

value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or

the earnings effect of the hedged forecasted transactions in a cash flow hedge. The Company may enter

into derivative contracts that are intended to economically hedge a certain portion of its risk, even

61

10-K