Dollar General 2013 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

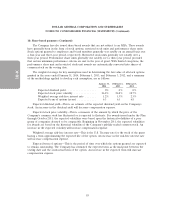

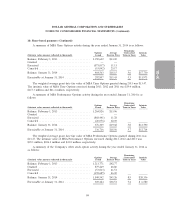

14. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended January 31,

2014 and February 1, 2013. Each quarterly period listed below was a 13-week accounting period. The

sum of the four quarters for any given year may not equal annual totals due to rounding.

First Second Third Fourth

(In thousands) Quarter Quarter Quarter Quarter

2013:

Net sales ............................... $4,233,733 $4,394,651 $4,381,838 $4,493,945

Gross profit ............................. 1,295,148 1,377,290 1,328,493 1,434,811

Operating profit .......................... 395,000 412,822 390,241 538,122

Net income ............................. 220,083 245,475 237,385 322,173

Basic earnings per share .................... 0.67 0.76 0.74 1.01

Diluted earnings per share .................. 0.67 0.75 0.74 1.01

First Second Third Fourth

(In thousands) Quarter Quarter Quarter Quarter

2012:

Net sales ............................... $3,901,205 $3,948,655 $3,964,647 $4,207,621

Gross profit ............................. 1,228,256 1,263,223 1,226,123 1,367,799

Operating profit .......................... 384,324 387,214 361,389 522,349

Net income ............................. 213,415 214,140 207,685 317,422

Basic earnings per share .................... 0.64 0.64 0.62 0.97

Diluted earnings per share .................. 0.63 0.64 0.62 0.97

As discussed in Note 5, in the first quarter of 2013, the Company terminated its senior secured

credit facilities, resulting in a pretax loss of $18.9 million ($11.5 million net of tax, or $0.04 per diluted

share) which was recognized as Other (income) expense.

As discussed in Note 8, in the second quarter of 2013, the Company recorded expenses associated

with an agreement to settle a legal matter, resulting in a pretax loss of $8.5 million ($5.2 million net of

tax, or $0.02 per diluted share) which was recognized as Selling, general and administrative expense.

As discussed in Note 5, in the second quarter of 2012, the Company redeemed its outstanding

senior subordinated notes due 2017, resulting in a pretax loss of $29.0 million ($17.7 million net of tax,

or $0.05 per diluted share) which was recognized as Other (income) expense.

88

10-K