Dollar General 2013 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. Commitments and contingencies (Continued)

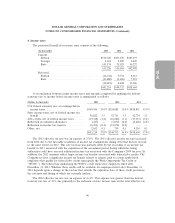

Rent expense under all operating leases is as follows:

(In thousands) 2013 2012 2011

Minimum rentals(a) ....................... $674,849 $599,138 $525,486

Contingent rentals ........................ 12,058 15,150 16,856

$686,907 $614,288 $542,342

(a) Excludes amortization of leasehold interests of $11.9 million, $16.9 million and

$21.0 million included in rent expense for the years ended January 31, 2014, February 1,

2013, and February 3, 2012, respectively.

Legal proceedings

On August 7, 2006, a lawsuit entitled Cynthia Richter, et al. v. Dolgencorp, Inc., et al. was filed in

the United States District Court for the Northern District of Alabama (Case No. 7:06-cv-01537-LSC)

(‘‘Richter’’) in which the plaintiff alleges that she and other current and former Dollar General store

managers were improperly classified as exempt executive employees under the Fair Labor Standards

Act (‘‘FLSA’’) and seeks to recover overtime pay, liquidated damages, and attorneys’ fees and costs. On

August 15, 2006, the Richter plaintiff filed a motion in which she asked the court to certify a nationwide

class of current and former store managers. The Company opposed the plaintiff’s motion. On

March 23, 2007, the court conditionally certified a nationwide class. On December 2, 2009, notice was

mailed to over 28,000 current or former Dollar General store managers. Approximately 3,950

individuals opted into the lawsuit, approximately 1,000 of whom have been dismissed for various

reasons, including failure to cooperate in discovery.

On April 2, 2012, the Company moved to decertify the class. The plaintiff’s response to that

motion was filed on May 9, 2012.

On October 22, 2012, the court entered a Memorandum Opinion granting the Company’s

decertification motion. On December 19, 2012, the court entered an Order decertifying the matter and

stating that a separate Order would be entered regarding the opt-in plaintiffs’ rights and Cynthia

Richter’s individual claims. To date, the court has not entered such an Order.

The parties agreed to mediate the matter, and the court informally stayed the action pending the

results of the mediation. Mediations were conducted in January, April and August 2013. On August 10,

2013, the parties reached a preliminary agreement, which has been formalized and submitted to the

court for approval, to resolve the matter for up to $8.5 million. The Company has deemed the

settlement probable and recorded such amount as the estimated expense in the second quarter of 2013.

The Company believes that its store managers are and have been properly classified as exempt

employees under the FLSA and that the Richter action is not appropriate for collective action

treatment. The Company has obtained summary judgment in some, although not all, of its pending

individual or single-plaintiff store manager exemption cases in which it has filed such a motion.

At this time, although probable, it is not certain that the court will approve the settlement. If it

does not, and the case proceeds, it is not possible to predict whether Richter ultimately will be

permitted to proceed collectively, and no assurances can be given that the Company will be successful

76

10-K