Dollar General 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

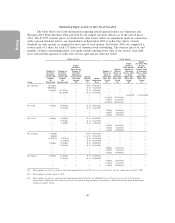

is calculated as (a) the result of (x) the sum of (i) our operating income, plus (ii) depreciation and

amortization, plus (iii) minimum rentals, minus (y) taxes, divided by (b) the result of (x) the sum of the

averages of: (i) total assets, plus (ii) accumulated depreciation and amortization, minus (y) (i) cash,

minus (ii) goodwill, minus (iii) accounts payable, minus (iv) other payables, minus (v) accrued liabilities,

plus (vi) 8x minimum rentals (with all of the foregoing terms as determined per our financial

statements) but excludes the impact of all items excluded from the 2013 Teamshare program adjusted

EBIT calculation outlined above, as well as share-based compensation charges.

The restricted stock units awarded are time-based awards, payable in shares of our common

stock and vest in equal installments over 3 years from the grant date, subject to continued employment

with us and certain accelerated vesting conditions.

Upon his promotion to Chief Operating Officer, Mr. Vasos received an additional stock option

grant. The amount of the equity grant was derived from market comparator group data and targeted

the median range for the comparable position and was prorated for the portion of fiscal year 2013 that

he served as Chief Operating Officer.

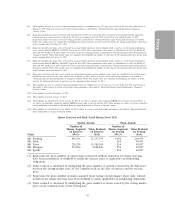

(c) 2014 Equity Awards. The Compensation Committee authorized additional long-term

equity incentive awards to our named executive officers in March 2014 on substantially similar terms as

those set forth above. The threshold and maximum levels of performance criteria for performance

share units were revised from 95% and 110% of target, respectively, for adjusted EBITDA, and 97.51%

and 104.98% of target, respectively, for ROIC, to 90% and 120% of target, respectively, for adjusted

EBITDA, and 94.86% and 110.29% of target, respectively, for ROIC, with performance in between

such levels to be determined on the same graduated scale used to determine incentive cash payouts

under our 2014 Teamshare program discussed above between 50% for threshold performance and

300% for maximum performance. This change reflects the Committee’s desire to align the payout and

performance scale of the short-term and long-term incentive programs.

Share Ownership Guidelines. We have adopted share ownership guidelines for Board members

and senior officers. See ‘‘Are there share ownership guidelines for Board members and senior officers?’’

in ‘‘Corporate Governance’’ above for more information.

Policy Against Hedging and Pledging Transactions. Our Insider Trading Policy prohibits Board

members and executive officers from pledging Dollar General securities as collateral, from holding

Dollar General securities in a margin account, and from hedging their ownership of Dollar General

stock. Examples of hedging ownership include entering into or trading prepaid variable forward

contracts, equity swaps, collars, puts, calls, options (other than those granted under a Dollar General

compensation plan) or other derivative instruments related to Dollar General stock.

Benefits and Perquisites. Along with certain benefits offered to named executive officers on the

same terms that are offered to all of our salaried employees (such as health and welfare benefits,

disability insurance and matching contributions under our 401(k) plan), we provide our named

executive officers with certain additional benefits and perquisites for retention and recruiting purposes

and to replace benefit opportunities lost due to regulatory limits. We also provide named executive

officers with benefits and perquisites as additional forms of compensation that we believe to be

consistent and competitive with benefits and perquisites provided to executives with similar positions in

our market comparator group and in our industry.

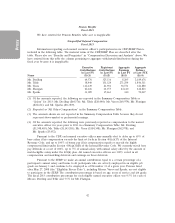

The named executive officers have the opportunity to participate in the Compensation Deferral

Plan (the ‘‘CDP’’) and, other than Messrs. Sparks and Vasos, the defined contribution Supplemental

Executive Retirement Plan (the ‘‘SERP’’, and together with the CDP, the ‘‘CDP/SERP Plan’’). SERP

participation is not available to persons to whom employment offers are made after May 28, 2008,

including Messrs. Sparks and Vasos.

34

Proxy