Dollar General 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

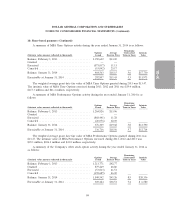

8. Commitments and contingencies (Continued)

in its defense of the action on the merits or otherwise. Similarly, at this time the Company cannot

estimate either the size of any potential class or the value of the claims asserted if this action were to

proceed. For these reasons, the Company is unable to estimate any potential loss or range of loss in

such a scenario; however, if the Company is not successful in its defense efforts, the resolution of

Richter could have a material adverse effect on the Company’s consolidated financial statements as a

whole.

On April 9, 2012, the Company was served with a lawsuit filed in the United States District Court

for the Eastern District of Virginia entitled Jonathan Marcum v. Dolgencorp. Inc. (Civil Action

No. 3:12-cv-00108-JRS) in which the plaintiffs, one of whose conditional offer of employment was

rescinded, allege that certain of the Company’s background check procedures violate the Fair Credit

Reporting Act (‘‘FCRA’’). Plaintiff Marcum also alleges defamation. According to the complaint and

subsequently filed first and second amended complaints, the plaintiffs seek to represent a putative class

of applicants in connection with their FCRA claims. The Company responded to the complaint and

each of the amended complaints. The plaintiffs’ certification motion was due to be filed on or before

April 5, 2013; however, plaintiffs asked the court to stay all deadlines in light of the parties’ ongoing

settlement discussions (as more fully described below). On November 12, 2013, the court entered an

order lifting the stay. The court has not issued a new scheduling order but has set a pre-trial

conference for March 27, 2014.

The parties have engaged in formal settlement discussions on three occasions, once in January

2013 with a private mediator, and again in March 2013 and July 2013 with a federal magistrate. On

February 18, 2014, the parties reached a preliminary agreement to resolve the matter for up to

$4.08 million, which must be submitted to and approved by the court. Based on this preliminary

settlement agreement, the Company believes, but cannot guarantee, that the court will not proceed

with the March 27, 2014, pre-trial conference.

The Company’s Employment Practices Liability Insurance (‘‘EPLI’’) carrier has been placed on

notice of this matter and participated in both the formal and informal settlement discussions. The EPLI

Policy covering this matter has a $2 million self-insured retention. Because the Company believes that it

was likely to expend the balance of its self-insured retention in settlement of this litigation or

otherwise, it accrued $1.8 million in the fourth quarter of 2012, an amount that is immaterial to the

Company’s consolidated financial statements as a whole.

At this time, although probable, it is not certain that the court will approve the settlement. If the

court does not approve the settlement and the case proceeds, it is not possible to predict whether

Marcum ultimately will be permitted to proceed as a class action under the FCRA, and no assurances

can be given that the Company will be successful in the defense on the merits or otherwise. At this

stage in the proceedings, the Company cannot estimate either the size of any potential class or the

value of the claims asserted by the plaintiffs.

In September 2011, the Chicago Regional Office of the United States Equal Employment

Opportunity Commission (‘‘EEOC’’ or ‘‘Commission’’) notified the Company of a cause finding related

to the Company’s criminal background check policy. The cause finding alleges that Dollar General’s

criminal background check policy, which excludes from employment individuals with certain criminal

convictions for specified periods, has a disparate impact on African-American candidates and

employees in violation of Title VII of the Civil Rights Act of 1964, as amended (‘‘Title VII’’).

77

10-K