Dollar General 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

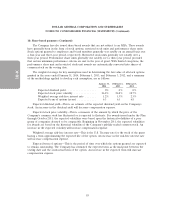

12. Segment reporting

The Company manages its business on the basis of one reportable segment. See Note 1 for a brief

description of the Company’s business. As of January 31, 2014, all of the Company’s operations were

located within the United States with the exception of a Hong Kong subsidiary, and a liaison office in

India, the collective assets and revenues of which are not material. The following net sales data is

presented in accordance with accounting standards related to disclosures about segments of an

enterprise.

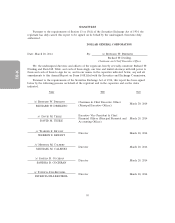

(In thousands) 2013 2012 2011

Classes of similar products:

Consumables .................... $13,161,825 $11,844,846 $10,833,735

Seasonal ........................ 2,259,516 2,172,399 2,051,098

Home products ................... 1,115,648 1,061,573 1,005,219

Apparel ........................ 967,178 943,310 917,136

Net sales ...................... $17,504,167 $16,022,128 $14,807,188

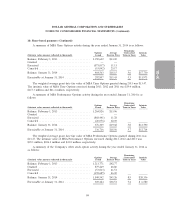

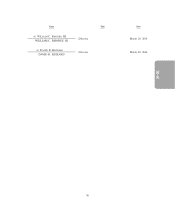

13. Common stock transactions

On August 29, 2012, the Company’s Board of Directors authorized a common stock repurchase

program, which was increased on March 19, 2013 and again on December 4, 2013. As of January 31,

2014, a total of $2.0 billion had been authorized under the program and $1.02 billion remained

available for repurchase. The repurchase authorization has no expiration date and allows repurchases

from time to time in the open market or in privately negotiated transactions. The timing and number

of shares purchased depends on a variety of factors, such as price, market conditions, compliance with

the covenants and restrictions under our debt agreements and other factors. Repurchases under the

program may be funded from available cash or borrowings under the Company’s credit facilities

discussed in further detail in Note 5.

During the years ended January 31, 2014, February 1, 2013, and February 3, 2012, the Company

repurchased approximately 11.0 million shares of its common stock at a total cost of $620.1 million,

approximately 14.4 million shares at a total cost of $671.4 million, and approximately 4.9 million shares

of its common stock at a total cost of $185.0 million, respectively, pursuant to its common stock

repurchase programs.

87

10-K