Dollar General 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

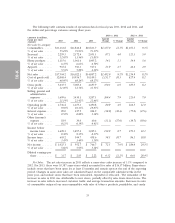

total cost of $26.8 million including associated premiums. A portion of the July 2011 redemption of

senior notes due 2015 was financed by borrowings under our senior secured revolving credit facility.

Net borrowings under such facility were $184.7 million during 2011. In December 2011, we repurchased

4.9 million outstanding shares of our common stock at a total cost of $185.0 million.

Critical Accounting Policies and Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to

make estimates and assumptions that affect reported amounts and related disclosures. In addition to

the estimates presented below, there are other items within our financial statements that require

estimation, but are not deemed critical as defined below. We believe these estimates are reasonable and

appropriate. However, if actual experience differs from the assumptions and other considerations used,

the resulting changes could have a material effect on the financial statements taken as a whole.

Management believes the following policies and estimates are critical because they involve

significant judgments, assumptions, and estimates. Management has discussed the development and

selection of the critical accounting estimates with the Audit Committee of our Board of Directors, and

the Audit Committee has reviewed the disclosures presented below relating to those policies and

estimates. See Note 1 to the consolidated financial statements for a detailed discussion of our principal

accounting policies.

Merchandise Inventories. Merchandise inventories are stated at the lower of cost or market

(‘‘LCM’’) with cost determined using the retail last in, first out (‘‘LIFO’’) method. We use the retail

inventory method (‘‘RIM’’) to calculate gross profit and the resulting valuation of inventories at cost,

which are computed by applying a calculated cost-to-retail inventory ratio to the retail value of sales at

a department level. The RIM is an averaging method that has been widely used in the retail industry

due to its practicality. Also, the use of the RIM will result in valuing inventories at LCM if markdowns

are currently taken as a reduction of the retail value of inventories. Inherent in the retail inventory

method calculation are certain significant management judgments and estimates including, among

others, initial markups, markdowns, and shrinkage, which significantly impact the gross profit

calculation as well as the ending inventory valuation at cost. These significant estimates, coupled with

the fact that the RIM is an averaging process, can, under certain circumstances, produce distorted cost

figures. Factors that can lead to distortion in the calculation of the inventory balance include:

• applying the RIM to a group of products that is not fairly uniform in terms of its cost and

selling price relationship and turnover;

• applying the RIM to transactions over a period of time that include different rates of gross

profit, such as those relating to seasonal merchandise;

• inaccurate estimates of inventory shrinkage between the date of the last physical inventory at a

store and the financial statement date; and

• inaccurate estimates of LCM and/or LIFO reserves.

Factors that reduce potential distortion include the use of historical experience in estimating the

shrink provision (see discussion below) and an annual LIFO analysis whereby all SKUs are considered

for inclusion in the index formulation. An actual valuation of inventory under the LIFO method is

made at the end of each year based on the inventory levels and costs at that time. Accordingly, interim

LIFO calculations are based on management’s estimates of expected year-end inventory levels, sales for

the year and the expected rate of inflation/deflation for the year and are thus subject to adjustment in

the final year-end LIFO inventory valuation. We also perform interim inventory analysis for

determining obsolete inventory. Our policy is to write down inventory to an LCM value based on

various management assumptions including estimated markdowns and sales required to liquidate such

43

10-K