Dollar General 2013 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Share-based payments (Continued)

Plan provides for the granting of equity appreciation rights to nonexecutive managerial employees.

During 2011, 818,847 equity appreciation rights were granted, 768,561 of such rights vested, primarily in

conjunction with the Company’s December 2011 stock offering and 50,286 of such rights were

cancelled. No such rights are outstanding as of January 31, 2014.

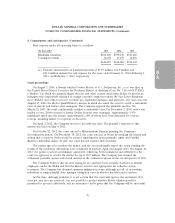

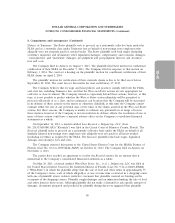

The fair value method of accounting for share-based awards resulted in share-based compensation

expense (a component of SG&A expenses) and a corresponding reduction in net income before income

taxes as follows:

Equity

Stock Performance Restricted Appreciation

(In thousands) Options Share Units Stock Units Rights Total

Year ended January 31, 2014

Pre-tax ........................... $ 7,634 $3,448 $9,879 $ — $20,961

Net of tax ........................ $ 4,649 $2,100 $6,016 $ — $12,765

Year ended February 1, 2013

Pre-tax ........................... $14,078 $4,082 $3,504 $ — $21,664

Net of tax ........................ $ 8,578 $2,487 $2,135 $ — $13,200

Year ended February 3, 2012

Pre-tax ........................... $15,121 $ — $ 129 $8,731 $23,981

Net of tax ........................ $ 9,208 $ — $ 79 $5,317 $14,604

11. Related party transactions

From time to time the Company has conducted business with entities deemed to be related parties

under U.S. GAAP, including Kohlberg Kravis Roberts & Co. L.P. or ‘‘KKR’’ and Goldman,

Sachs & Co. For purposes of this disclosure, reference to these entities includes their respective

affiliates. In recent years, KKR and Goldman Sachs & Co. owned a significant percentage of the

Company’s common stock, and collectively held three seats on the Company’s Board of Directors. As

of January 31, 2014, KKR and Goldman, Sachs & Co. have liquidated their investment in the

Company’s common stock and no one directly employed by either KKR or Goldman, Sachs & Co.

remained on the Company’s Board of Directors.

KKR and Goldman, Sachs & Co. served in various capacities related to the amendments and

refinancing of the Company’s debt discussed in further detail in Note 5. In connection with these

efforts in 2013 and 2012, the Company paid KKR fees of $0.7 million and $1.6 million, respectively,

and paid Goldman, Sachs & Co. fees of $2.2 million and $1.7 million, respectively.

KKR and Goldman, Sachs & Co. served as underwriters in connection with multiple secondary

offerings of the Company’s common stock held by certain existing shareholders that were executed at

various dates in 2013, 2012 and 2011. The Company did not sell shares of common stock, receive

proceeds from such shareholders’ sales of shares of common stock or pay any underwriting fees in

connection with any of the secondary offerings. Certain members of the Company’s management

exercised registration rights in connection with such offerings.

86

10-K