Dollar General 2013 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182

|

|

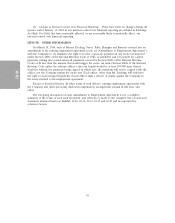

(d) Changes in Internal Control Over Financial Reporting. There have been no changes during the

quarter ended January 31, 2014 in our internal control over financial reporting (as defined in Exchange

Act Rule 13a-15(f)) that have materially affected, or are reasonably likely to materially affect, our

internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

On March 18, 2014, each of Messrs. Dreiling, Vasos, Tehle, Flanigan and Ravener entered into an

amendment to his existing employment agreement (each, an ‘‘Amendment to Employment Agreement’’)

with the Company to (1) eliminate the right to receive a gross-up payment on any excise tax imposed

under Section 280G of the Internal Revenue Code of 1986, as amended; and (2) provide for capped

payments (taking into consideration all payments covered by Section 280G of the Internal Revenue

Code) of $1 less than the amount that would trigger the excise tax under Section 280G of the Internal

Revenue Code unless the relevant officer’s after-tax benefit would be at least $50,000 more than it

would be without the payments being capped, in which case, the payments will not be capped (with the

officer, not the Company paying the excise tax). Each officer, other than Mr. Dreiling, will only have

the right to such uncapped payments if such officer signs a release of claims against the Company in

the form attached to his employment agreement.

Except as described herein, all other terms of such officers’ existing employment agreements with

the Company and other previously disclosed compensatory arrangements remain in full force and

effect.

The foregoing description of each Amendment to Employment Agreement is not a complete

summary of the terms of each such document, and reference is made to the complete text of each such

document attached hereto as Exhibits 10.26, 10.32, 10.34, 10.39 and 10.45 and incorporated by

reference herein.

91

10-K