Dollar General 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

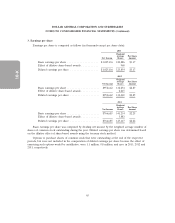

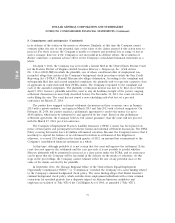

4. Income taxes (Continued)

rate. The 2012 effective tax rate of 36.4% was lower than the 2011 rate of 37.4% due to the favorable

resolution of a federal income tax examination during 2012.

The 2011 effective tax rate was an expense of 37.4%. This expense was greater than the federal

statutory tax rate of 35% due primarily to the inclusion of state income taxes in the total effective tax

rate.

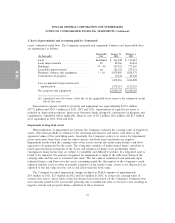

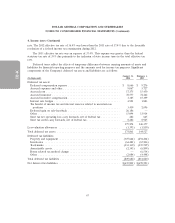

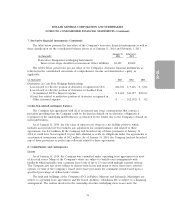

Deferred taxes reflect the effects of temporary differences between carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities are as follows:

January 31, February 1,

(In thousands) 2014 2013

Deferred tax assets:

Deferred compensation expense ................................. $ 8,666 $ 9,276

Accrued expenses and other .................................... 9,067 5,727

Accrued rent ............................................... 17,375 15,450

Accrued insurance ........................................... 78,557 72,442

Accrued incentive compensation ................................. 3,385 15,399

Interest rate hedges .......................................... 4,921 1,883

Tax benefit of income tax and interest reserves related to uncertain tax

positions ................................................ 3,439 2,696

Deferred gain on sale-leaseback ................................. 26,186 —

Other .................................................... 15,094 13,914

State tax net operating loss carry forwards, net of federal tax ............ 282 645

State tax credit carry forwards, net of federal tax ..................... 8,282 8,925

175,254 146,357

Less valuation allowances ....................................... (1,393) (1,830)

Total deferred tax assets ........................................ 173,861 144,527

Deferred tax liabilities:

Property and equipment ....................................... (307,644) (294,204)

Inventories ................................................ (64,481) (67,246)

Trademarks ................................................ (433,130) (435,529)

Amortizable assets ........................................... (2,343) (6,809)

Bonus related tax method change ................................ — (6,534)

Other .................................................... (2,084) (4,498)

Total deferred tax liabilities ...................................... (809,682) (814,820)

Net deferred tax liabilities ....................................... $(635,821) $(670,293)

67

10-K