Dollar General 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

credit valuation adjustment is reflected in our derivative valuations. The total expected exposure of a

derivative is derived using market-observable inputs, such as yield curves and volatilities. The inputs

utilized for our own credit spread are based on implied spreads from our publicly-traded debt. For

counterparties with publicly available credit information, the credit spreads over LIBOR used in the

calculations represent implied credit default swap spreads obtained from a third party credit data

provider. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk,

we have considered the impact of netting and any applicable credit enhancements, such as collateral

postings, thresholds, mutual puts, and guarantees. Additionally, we actively monitor counterparty credit

ratings for any significant changes.

As of January 31, 2014, the net credit valuation adjustments had an insignificant impact on the

settlement values of our derivative liabilities. Various factors impact changes in the credit valuation

adjustments over time, including changes in the credit spreads of the parties to the contracts, as well as

changes in market rates and volatilities, which affect the total expected exposure of the derivative

instruments. When appropriate, valuations are also adjusted for various factors such as liquidity and

bid/offer spreads, which factors we deemed to be immaterial as of January 31, 2014.

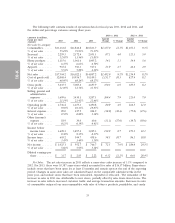

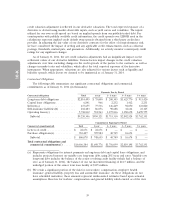

Contractual Obligations

The following table summarizes our significant contractual obligations and commercial

commitments as of January 31, 2014 (in thousands):

Payments Due by Period

Contractual obligations Total 1 year 1 - 3 years 3 - 5 years 5+ years

Long-term debt obligations .......... $2,814,495 $ 75,000 $ 200,305 $1,625,770 $ 913,420

Capital lease obligations ............ 6,841 966 2,232 1,412 2,231

Interest(a) ...................... 437,655 75,536 146,249 92,050 123,820

Self-insurance liabilities(b) .......... 232,483 86,056 90,688 32,614 23,125

Operating leases(c) ............... 5,738,832 712,563 1,275,836 1,050,678 2,699,755

Subtotal ...................... $9,230,306 $950,121 $1,715,310 $2,802,524 $3,762,351

Commitments Expiring by Period

Commercial commitments(d) Total 1 year 1 - 3 years 3 - 5 years 5+ years

Letters of credit ................ $ 22,671 $ 22,671 $ — $ — $ —

Purchase obligations(e) .......... 783,407 725,984 40,749 16,674 —

Subtotal .................... $ 806,078 $ 748,655 $ 40,749 $ 16,674 $ —

Total contractual obligations and

commercial commitments(f) ..... $10,036,384 $1,698,776 $1,756,059 $2,819,198 $3,762,351

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and

includes projected interest on variable rate long-term debt, using 2013 year end rates. Variable rate

long-term debt includes the balance of the senior revolving credit facility (which had a balance of

zero as of January 31, 2014), the balance of our tax increment financing of $14.5 million, and the

unhedged portion of the senior term loan facility of $125 million.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health

insurance, general liability, property loss and automobile insurance. As these obligations do not

have scheduled maturities, these amounts represent undiscounted estimates based upon actuarial

assumptions. Reserves for workers’ compensation and general liability which existed as of the date

39

10-K