Dollar General 2013 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Share-based payments (Continued)

The Company has also issued share-based awards that are not subject to an MSA. These awards

have generally been in the form of stock options, restricted stock units and performance share units.

Stock options granted to employees and board members generally vest ratably on an annual basis over

a four-year and three-year period, respectively. Restricted stock units generally vest ratably over a

three-year period. Performance share units generally vest ratably over a three-year period, provided

that certain minimum performance criteria are met in the year of grant. With limited exceptions, the

performance share unit and restricted stock unit awards are automatically converted into shares of

common stock on the vesting date.

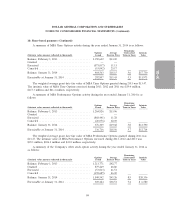

The weighted average for key assumptions used in determining the fair value of all stock options

granted in the years ended January 31, 2014, February 1, 2013, and February 3, 2012, and a summary

of the methodology applied to develop each assumption, are as follows:

January 31, February 1, February 3,

2014 2013 2012

Expected dividend yield ................... 0% 0% 0%

Expected stock price volatility .............. 26.2% 26.8% 38.7%

Weighted average risk-free interest rate ....... 1.2% 1.5% 2.3%

Expected term of options (years) ............ 6.3 6.3 6.8

Expected dividend yield—This is an estimate of the expected dividend yield on the Company’s

stock. An increase in the dividend yield will decrease compensation expense.

Expected stock price volatility—This is a measure of the amount by which the price of the

Company’s common stock has fluctuated or is expected to fluctuate. For awards issued under the Plan

through October 2011, the expected volatilities were based upon the historical volatilities of a peer

group of companies deemed to be comparable. Beginning in November 2011, the expected volatilities

for awards are based on the historical volatility of the Company’s publicly traded common stock. An

increase in the expected volatility will increase compensation expense.

Weighted average risk-free interest rate—This is the U.S. Treasury rate for the week of the grant

having a term approximating the expected life of the option. An increase in the risk-free interest rate

will increase compensation expense.

Expected term of options—This is the period of time over which the options granted are expected

to remain outstanding. The Company has estimated the expected term as the mid-point between the

vesting date and the contractual term of the option. An increase in the expected term will increase

compensation expense.

83

10-K