Dollar General 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

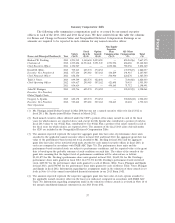

(b) Mr. Dreiling. In determining Mr. Dreiling’s 2013 and 2014 base salary, the Compensation

Committee took into account Mr. Dreiling’s performance assessment, the amount budgeted for our

entire U.S.-based employee population (see ‘‘Use of Performance Evaluations’’), and the benchmarking

data of the market comparator group (see ‘‘Use of Market Benchmarking Data’’). With respect to

Mr. Dreiling’s 2013 and 2014 base salary increases, the Committee determined that Mr. Dreiling should

receive the same 2.75% (2013) and 2.45% (2014) increase that was awarded to each of the other

named executive officers which, along with the other components of Mr. Dreiling’s 2013 compensation,

maintained his total compensation at the median range of the market comparator group.

Short-Term Cash Incentive Plan. Our short-term cash incentive plan, called Teamshare, is

established under our shareholder-approved Amended and Restated Annual Incentive Plan. The

Teamshare program provides an opportunity for each named executive officer to receive a cash bonus

payment equal to a certain percentage of base salary based upon Dollar General’s achievement of one

or more pre-established financial performance targets based on any of the performance measures listed

in the Amended and Restated Annual Incentive Plan.

As a threshold matter, a named executive officer’s eligibility to receive a bonus under the

Teamshare program depends upon his receiving an overall individual performance rating of satisfactory

(see ‘‘Use of Performance Evaluations’’). Accordingly, Teamshare fulfills an important part of our pay

for performance philosophy while aligning the interests of our named executive officers and our

shareholders.

(a) 2013 Teamshare Structure. The Compensation Committee selected adjusted EBIT as the

financial performance measure for the 2013 Teamshare program. The Committee believes that EBIT is

a comprehensive measure of the Company’s performance and provides a different but complementary

focus for the short-term incentive program than that used for the long-term incentive program.

For purposes of the 2013 Teamshare program, adjusted EBIT is defined as the Company’s

operating profit as calculated in accordance with U.S. generally accepted accounting principles

(‘‘GAAP’’), but shall exclude:

• the impact of (a) all consulting, accounting, legal, valuation, banking, filing, disclosure and

similar costs, fees and expenses directly related to the consideration, negotiation, approval

and consummation of the proposed acquisition and related financing of the Company by

affiliates of KKR (including without limitation any costs, fees and expenses relating to any

refinancings) and any litigation or settlement of any litigation related thereto; (b) any costs,

fees and expenses directly related to the consideration, negotiation, preparation, or

consummation of any asset sale, merger or other transaction that results in a Change in

Control (within the meaning of our Amended and Restated 2007 Stock Incentive Plan) of

the Company or any primary or secondary offering of our common stock or other security;

(c) any gain or loss recognized as a result of derivative instrument transactions or other

hedging activities; (d) any gains or losses associated with the early retirement of debt

obligations; (e) charges resulting from significant natural disasters; and (f) any significant

gains or losses associated with our LIFO computation; and

• unless the Committee disallows any such item, (a) non-cash asset impairments; (b) any

significant loss as a result of an individual litigation, judgment or lawsuit settlement

(including a collective or class action lawsuit and security holder lawsuit, among others);

(c) charges for business restructurings; (d) losses due to new or modified tax or other

legislation or accounting changes enacted after the beginning of the 2013 fiscal year;

(e) significant tax settlements; and (f) any significant unplanned items of a non-recurring or

extraordinary nature.

28

Proxy