Dollar General 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

Table of contents

-

Page 1

-

Page 2

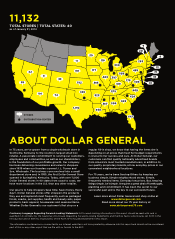

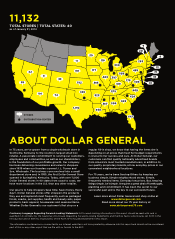

...the U.S. than any other retailer. Our goal is to help shoppers Save time. Save money. Every day®. Dollar General stores offer shoppers the products they use and replenish most frequently, such as packaged foods, snacks, pet supplies, health and beauty aids, paper products, basic apparel, housewares...

-

Page 3

-

Page 4

EXPLORE OUR HISTORY

AT WWW.DOLLARGENERAL75.COM

-

Page 5

...on ensuring that we understand our customers and how best to serve them. For 75 years, Dollar General has helped low and middle income families save money and time by providing them with quality basic merchandise at great prices in convenient neighborhood stores. This unique combination of value and...

-

Page 6

-

Page 7

Proxy Statement & Meeting Notice

-

Page 8

-

Page 9

... materials by mail, you may vote by mail by completing and returning a proxy card. On behalf of the Board of Directors, I would like to express our appreciation for your continued support of Dollar General. Sincerely,

29MAR201117130352

Rick Dreiling Chairman & Chief Executive Officer

April 9, 2014

-

Page 10

-

Page 11

... as directors the 7 nominees listed in the proxy statement To hold an advisory vote to approve named executive officer compensation To ratify the appointment of the independent registered public accounting firm for fiscal 2014 To transact any other business that may properly come before the annual...

-

Page 12

... ...Corporate Governance ...Director Compensation ...Director Independence ...Transactions with Management and Others ...Executive Compensation ...Compensation Discussion and Analysis ...Compensation Committee Report ...Summary Compensation Table ...Grants of Plan-Based Awards in Fiscal 2013...

-

Page 13

... form a part of, this proxy statement. What is Dollar General Corporation and where is it located? We operate conveniently located, small-box stores that deliver everyday low prices on products that families use every day. We are the largest discount retailer in the United States by number of stores...

-

Page 14

... the election of 7 directors; the approval (on an advisory basis) of named executive officer compensation; and the ratification of the appointment of our independent registered public accounting firm (the ''independent auditor'') for 2014.

May other matters be raised at the annual meeting? We are...

-

Page 15

... as you direct on the proxy card or, if you return a signed proxy card without instructions: ''FOR'' all directors nominated; ''FOR'' approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement pursuant to the SEC's compensation disclosure...

-

Page 16

... against it. The vote on the compensation of our named executive officers is advisory and, therefore, not binding on Dollar General, our Board of Directors, or its Compensation Committee. The proposal to ratify the appointment of our independent auditor for 2014 will be approved if the votes cast...

-

Page 17

... as that company's President (August 1999-February 2004), Chief Financial Officer (September 1993-August 1999) and Vice President of Finance (August 1992-September 1993). Ms. Cochran has over 20 years of experience in Age 68 51 55 60 60 48 67 Director Since 2009 2007 2012 2008 2012 2009 2010

Proxy...

-

Page 18

... Caremark Corporation, a retail pharmacy chain and provider of healthcare services and pharmacy benefits management, from September 1999 until his retirement in December 2009. Prior to joining CVS Caremark, Mr. Rickard was the Senior Vice President and Chief Financial Officer of RJR Nabisco Holdings...

-

Page 19

... is committed to representing the long-term interests of all Dollar General shareholders. The Nominating Committee assesses a candidate's independence, background and experience, as well as the current Board's skill needs and diversity. With respect to incumbent directors selected for re-election...

-

Page 20

... business strategies, financial plans and structures, and management teams. Mr. Calbert also has a significant financial and accounting background evidenced by his prior experience as the chief financial officer of a retail company and his 10 years of practice as a certified public accountant...

-

Page 21

... experience in operations, supply chain and finance, among other areas. This background serves as a strong foundation for offering invaluable perspective and expertise to our CEO and our Board. In addition, his experience as a board chairman and chief executive officer of a public retail company and...

-

Page 22

..., posted on the ''Investor Information-Corporate Governance'' portion of our website located at www.dollargeneral.com, for more detailed information regarding the process by which shareholders may nominate directors. No shareholder nominees have been proposed for this year's annual meeting. What if...

-

Page 23

.... Our Board of Directors has a standing Audit Committee, Compensation Committee and Nominating Committee. The Board has adopted a written charter for each of these committees, which are available on the ''Investor Information-Corporate Governance'' section of our website located at www.dollargeneral...

-

Page 24

...such program • Oversees the share ownership guidelines for Board members and senior officers • Oversees the process for evaluating our senior officers • Reviews and discusses with management, prior to the filing of the proxy statement, the disclosure regarding executive compensation, including...

-

Page 25

...of corporate strategy. To promote effective independent oversight, the Board has adopted a number of governance practices, including: • Ensuring opportunity after each regularly scheduled Board meeting for executive sessions of the independent directors and, if not all non-management directors are...

-

Page 26

... long-term management development and succession. Our Board formally reviews our management succession plan at least annually. Our comprehensive program encompasses not only our CEO and other executive officers but all employees through the front-line supervisory level. The program focuses on key...

-

Page 27

... chosen to lead the executive sessions of the non-management directors and of the independent directors. This information is available in print to any shareholder who sends a written request to: Investor Relations, Dollar General Corporation, 100 Mission Ridge, Goodlettsville, TN 37072.

Proxy

15

-

Page 28

...consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended January 31, 2014, filed with the SEC on March 20, 2014 (our ''2013 Form 10-K''). As of January 31, 2014, each of the persons listed in the table above had the following total unvested restricted stock units...

-

Page 29

... approves, the form and amount of director compensation. As part of this process, the Committee may consult with or review information provided by Meridian Compensation Partners (''Meridian''), its independent consultant, and may consider the input of our CEO and our Chief People Officer. However...

-

Page 30

... Guidelines, which are posted on the ''Investor Information-Corporate Governance'' section of our website located at www.dollargeneral.com. The Board first analyzes whether any director or nominee has a relationship covered by the NYSE listing standards that would prohibit an independence finding...

-

Page 31

...comprised of his base salary and bonus compensation) of less than $250,000. In addition, Mr. Brophy received from the Company on March 18, 2013 an equity award of 2,999 non-qualified stock options to purchase shares of Dollar General's common stock, a target award of 707 performance share units (279...

-

Page 32

... to this policy and subject to certain exceptions identified below, all known related party transactions require prior Board approval. In addition, at least annually after receiving a list of immediate family members and affiliates from our directors and executive officers, the Corporate Secretary...

-

Page 33

.... Dollar General did not sell shares of common stock, receive proceeds, or pay any underwriting fees in connection with the secondary offering, but paid resulting expenses of approximately $0.5 million. Certain members of our management, including certain of our executive officers, exercised...

-

Page 34

...a portion of 2013. Buck Holdings, L.P. sold all of its shares in Dollar General in December 2013. See ''Director Independence'' for a discussion of a familial relationship between Ms. Cochran and one of our non-executive officers and compensation paid to that officer during 2013 and 2014. Interlocks...

-

Page 35

... compensation program to incent achievement of both our annual and long-term business strategies, to pay for performance and to maintain our competitive position in the market in which we compete for executive talent. The following are our key financial and operating results for 2013 Total sales...

-

Page 36

... new compensation package for Mr. Vasos based on information derived from market comparator group data which targeted the median range of the market comparator group. We amended our Insider Trading Policy to prohibit our directors and executive officers from hedging their ownership of Dollar General...

-

Page 37

... management, provides market comparator group data to the Committee for use in making decisions on items such as base salary, the Teamshare bonus program, and the long-term incentive program. Meridian did not provide any services to the Company in 2013 unrelated to executive or Board compensation...

-

Page 38

... based upon the Company's level of achievement of a pre-established financial performance measure and the terms of the Teamshare program (see discussion below). Any named executive officer who receives a ''needs improvement'' performance rating also would receive a reduced level of restricted stock...

-

Page 39

... movement in CEO compensation levels within the market comparator group, Meridian provided current survey data from the 2013 market comparator group. Elements of Named Executive Officer Compensation We provide compensation in the form of base salary, short-term cash incentives, long-term equity...

-

Page 40

... Restated Annual Incentive Plan. The Teamshare program provides an opportunity for each named executive officer to receive a cash bonus payment equal to a certain percentage of base salary based upon Dollar General's achievement of one or more pre-established financial performance targets based on...

-

Page 41

.... The bonus payable to each named executive officer if we reached the 2013 target performance level for the adjusted EBIT financial performance measure was equal to the applicable target percentage, as set forth in the chart below, of the applicable salary. For all named executive officers except Mr...

-

Page 42

... percentage of each named executive officer's salary upon which his bonus is based for the 2014 Teamshare program remains unchanged from 2013 (for Mr. Vasos, this means 80%). Following the 2007 merger, to be more consistent with the practices of KKR's other portfolio companies, the threshold for...

-

Page 43

... 2012, the Compensation Committee had not made annual equity awards since our 2007 merger. The options granted to the named executive officers prior to 2012 generally were divided so that half were time-vested (over 4 to 5 years) and half were performance-vested (generally over 5 or 6 years) based...

-

Page 44

...A new long-term equity structure was finalized and implemented in March 2012 to more closely align with typical public company equity structures, and this program was revised in 2013 so that each of the named executive officers now receives restricted stock units, in addition to the time-based stock...

-

Page 45

... number of performance share units earned for 2013 for each of the named executive officers was 14,088 for Mr. Dreiling and 2,562 for each of the other named executive officers. One-third of the performance share units earned based on 2013 financial performance vested on the last day of the one-year...

-

Page 46

...compensation plan) or other derivative instruments related to Dollar General stock. Benefits and Perquisites. Along with certain benefits offered to named executive officers on the same terms that are offered to all of our salaried employees (such as health and welfare benefits, disability insurance...

-

Page 47

... insurance benefit equal to 2.5 times his base salary up to a maximum of $3 million. We eliminated the tax gross-up on this perquisite beginning with tax year 2013. We also provide a relocation assistance program to named executive officers under a policy applicable to officer-level employees and...

-

Page 48

...require in our employment agreements. A change in control, by itself, does not trigger any severance provision applicable to our named executive officers, except for the provisions related to long-term equity incentives under our Amended and Restated 2007 Stock Incentive Plan.

Proxy

Considerations...

-

Page 49

... Financial Officer Todd J. Vasos, Chief Operating Officer John W. Flanigan, Executive Vice President, Global Supply Chain Gregory A. Sparks, Executive Vice President, Store Operations

Year

Salary ($)(2)

Stock Awards ($)(3)

Option Awards ($)(4)

Total ($)

2013 1,291,515 3,440,634 2,059,459 2012...

-

Page 50

... umbrella liability insurance program offered at no incremental cost to Dollar General through a third party vendor at a group rate paid by the executive. (10) Includes $15,663 and $15,202, respectively, for our match contributions to the CDP and the 401(k) Plan; $15,280 for tax gross-ups related to...

-

Page 51

... that vest over time based upon the named executive officer's continued employment by Dollar General. The awards listed in this table were granted pursuant to our Amended and Restated 2007 Stock Incentive Plan. See ''Long-Term Equity Incentive Program'' in ''Compensation Discussion and Analysis...

-

Page 52

Outstanding Equity Awards at 2013 Fiscal Year-End The table below sets forth information regarding awards granted under our Amended and Restated 2007 Stock Incentive Plan and held by our named executive officers as of the end of fiscal 2013. The $7.9975 exercise prices set forth in the table below ...

-

Page 53

... Termination or Change in Control'' below. The market value was computed by multiplying the number of such units by the closing market price of one share of our common stock on January 31, 2014. These options are part of a grant of time-based options which are scheduled to vest 25% per year on each...

-

Page 54

...shown are not reported in the Summary Compensation Table because they do not represent above-market or preferential earnings. (4) Of the amounts reported, the following were previously reported as compensation to the named executive officer for years prior to 2013 in a Summary Compensation Table: Mr...

-

Page 55

...Our employment agreements with our named executive officers, the award agreements for our equity awards, and certain plans and programs offered to or in which our named executive officers participate provide for benefits or payments to the officers upon certain termination of employment or change in...

-

Page 56

... of whether the fiscal 2015 financial performance target has been achieved.

Other 2012 and 2013 Equity Awards. If any of the named executive officers' employment with us terminates due to death or disability: • Stock Options. Any outstanding unvested stock option shall become immediately vested...

-

Page 57

... times the named executive officer's annual base salary, rounded to the next highest $1,000. We have excluded from the tables below amounts that the named executive officer would receive under our disability insurance program since the same benefit level is provided to all of our salaried employees...

-

Page 58

... between the officer and Dollar General, or in the absence of any such agreement, as defined in our long-term disability plan. For purposes of each named executive officer's agreement governing restricted stock units granted after 2011, ''disability'' has the meaning as provided under Section...

-

Page 59

...were scheduled to vest on such vesting date), and will be paid 6 months and 1 day following the date of termination of employment due to retirement.

For purposes of each named executive officer's agreements governing stock options and performance share units granted after 2011, ''retirement'' means...

-

Page 60

... retirement or termination), or (3) in the case of Mr. Dreiling, in the event we elect not to extend his term of employment by providing 60 days prior written notice before the applicable extension date, then in each case the named executive officer will receive the following benefits generally...

-

Page 61

... listed in Mr. Dreiling's employment agreement), or any person then planning to enter the discount consumable basics retail business, if the named executive officer is required to perform services for that person or entity which are substantially similar to those he provided or directed at any time...

-

Page 62

... that were granted prior to 2012, all then unvested performance-based restricted stock, all then unvested performance share units and all then unvested restricted stock units. The named executive officer generally may exercise any vested options that were granted after 2011 up to 90 days following...

-

Page 63

... options, all then unvested performance-based restricted stock, all then unvested performance share units, and all then unvested restricted stock units held by that officer. Generally may exercise any vested options that were granted after 2011 up to 90 days following the termination date and...

-

Page 64

... the Employment Agreement.'' However, the named executive officer will have 1 year from the termination date in which to exercise vested options that were granted after 2011 if he resigns or is involuntarily terminated within 2 years of the change in control under any scenario other than retirement...

-

Page 65

... each of our named executive officers in various termination and change in control scenarios based on compensation, benefit, and equity levels in effect on, and assuming the scenario was effective as of, January 31, 2014. For stock valuations, we have used the closing price of our stock on the NYSE...

-

Page 66

... for fiscal year 2014 and using the closing market price of our common stock on January 31, 2014. None of the named executive officers were eligible for retirement on January 31, 2014. Calculated as the combined Dollar General and employee cost of healthcare for the benefit option selected by Mr...

-

Page 67

... 2014, our Compensation Committee, with the assistance of its compensation consultant and management, reviewed our compensation policies and practices for all employees, including executive officers, to assess the risks that may arise from our compensation programs. The assessment included a review...

-

Page 68

... Market Street, Camana Bay, Grand Cayman KY1-1103, Cayman Islands. The address for Soroban Capital Partners LLC and Mr. Mandelblatt is 444 Madison Avenue, 21st Floor, New York, New York 10022. All information is based solely on Amendment No. 1 to Statement on Schedule 13G filed on February 14, 2014...

-

Page 69

...common stock beneficially owned as of March 21, 2014 by our current directors and named executive officers individually and by our current directors and all of our executive officers as a group. Unless otherwise noted, these persons may be contacted at our executive offices. Name of Beneficial Owner...

-

Page 70

... to guide Dollar General during a period of significant growth and transformation, and have been instrumental in helping us achieve solid financial performance in the last three fiscal years. We are asking our shareholders to indicate their support for our named executive officer compensation as...

-

Page 71

...its management.

•

•

Based on these reviews and discussions, the Audit Committee unanimously recommended to the Board of Directors that Dollar General's audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended January 31, 2014 for filing with the SEC...

-

Page 72

... auditor that is retained to audit our financial statements. Who has the Audit Committee selected as the independent registered public accounting firm? The Audit Committee has selected Ernst & Young LLP as our independent auditor for the 2014 fiscal year. Ernst & Young LLP has served in that...

-

Page 73

... include services relating to the employee benefit plan audit. (3) 2013 and 2012 fees relate primarily to tax compliance services, which represented $1,398,918 and $1,896,318 in 2013 and 2012, respectively, for work related to work opportunity tax credit assistance and foreign sourcing offices' tax...

-

Page 74

... our executive officers, directors, and greater than 10% shareholders to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. Based solely upon a review of these reports furnished to us during and with respect to 2013, or written representations that no Form 5 reports...

-

Page 75

10-K

-

Page 76

-

Page 77

...

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2014 Commission file number: 001-11421

DOLLAR GENERAL CORPORATION

(Exact name of registrant as specified in its charter) TENNESSEE (State or...

-

Page 78

INTRODUCTION General This report contains references to years 2014, 2013, 2012, 2011, 2010, and 2009, which represent fiscal years ending or ended January 30, 2015, January 31, 2014, February 1, 2013, February 3, 2012, January 28, 2011, and January 29, 2010, respectively. Our fiscal year ends on the...

-

Page 79

... a Tennessee corporation. Our common stock was publicly traded from 1968 until July 2007, when we merged with an entity controlled by investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P., or KKR. In November 2009 our common stock again became publicly traded, and in December 2013 the...

-

Page 80

..., or enhance, our gross profit rate; 3) leverage process improvements and information technology to reduce costs; and 4) strengthen and expand Dollar General's culture of serving others. Drive Productive Sales Growth. We believe our customer-driven merchandise mix and attractive value proposition...

-

Page 81

...to the culture of Dollar General for many years and we recognize the importance of this mission to our long-term success. For customers this means helping them ''Save time. Save money. Every day!'' by providing clean, well-stocked stores with quality products at low prices. For employees, this means...

-

Page 82

... and foot care products); pet (including pet supplies and pet food); and tobacco products. Seasonal products include decorations, toys, batteries, small electronics, greeting cards, stationery, prepaid phones and accessories, gardening supplies, hardware, automotive and home office supplies. Home...

-

Page 83

.... Our private brands come from a diversified supplier base. We directly imported approximately $725 million or 6% of our purchases at cost (10% of our purchases based on their retail value) in 2013. Our vendor arrangements generally provide for payment for such merchandise in U.S. dollars. We...

-

Page 84

..., the timing of new store openings and store closings, the amount of sales contributed by new and existing stores, as well as financial transactions such as debt refinancing and stock repurchases. We purchase substantial amounts of inventory in the third quarter and incur higher shipping costs and...

-

Page 85

... to offer competitive everyday low prices to our customers. See ''-Our Business Model'' above for further discussion of our competitive situation. Our Employees As of February 28, 2014, we employed approximately 100,600 full-time and part-time employees, including divisional and regional managers...

-

Page 86

... operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers, such as Dollar General, that file electronically with the SEC. The address of that website...

-

Page 87

...energy costs and interest rates, lack of available credit, consumer debt levels, higher tax rates and other changes in tax laws, concerns over government mandated participation in health insurance programs, and decreases in government subsidies such as unemployment and food assistance programs. Many...

-

Page 88

... availability of attractive store locations; the absence of entitlement process or occupancy delays; the ability to negotiate acceptable lease and development terms; the ability to hire and train new personnel, especially store managers, in a cost effective manner; the ability to identify customer...

-

Page 89

... financial performance. The retail business is highly competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, customer service, aggressive promotional activity, customers, and employees. We compete with retailers operating discount...

-

Page 90

... merchandise out-of-stocks that could lead to lost sales and damage to our reputation. We directly imported approximately 6% of our purchases (measured at cost) in 2013, but many of our domestic vendors directly import their products or components of their products. Changes to the prices and flow of...

-

Page 91

... our effective tax rate. Litigation may adversely affect our business, results of operations and financial condition. Our business is subject to the risk of litigation by employees, consumers, suppliers, competitors, shareholders, government agencies and others through private actions, class actions...

-

Page 92

...support functions to our stores and through lost sales. In addition, these events could result in increases in fuel (or other energy) prices or a fuel shortage, delays in opening new stores, the temporary lack of an adequate work force in a market, the temporary or long-term disruption in the supply...

-

Page 93

... changes in ''entitlement'' programs such as health insurance and paid leave programs). If we are unable to attract and retain adequate numbers of qualified employees, our operations, customer service levels and support functions could suffer. To the extent a significant portion of our employee base...

-

Page 94

... our operations and harm our reputation. In connection with sales, we transmit confidential credit and debit card information. We also have access to, collect or maintain private or confidential information regarding our customers, employees and vendors, as well as our business. We have procedures...

-

Page 95

... strategy or other opportunities or to react to changes in the economy or our industry. We obtain and manage liquidity from the positive cash flow we generate from our operating activities and our access to capital markets, including our credit facility. Changes in the credit and capital markets...

-

Page 96

... or application of existing accounting guidance could adversely affect our financial performance. The implementation of proposed new accounting standards may require extensive systems, internal process and other changes that could increase our operating costs, and may also result in changes to...

-

Page 97

..., an increasing percentage of our new stores have been subject to build-to-suit arrangements. As of February 28, 2014, we operated twelve distribution centers, as described in the following table:

Location Year Opened Approximate Square Footage Approximate Number of Stores Served

Scottsville, KY...

-

Page 98

... 31, 2014, we leased approximately 621,000 square feet of additional temporary warehouse space to support our distribution needs. Our executive offices are located in approximately 302,000 square feet of owned buildings and approximately 56,000 square feet of leased office space in Goodlettsville...

-

Page 99

... President, Division President and Chief Merchandising Officer. He was promoted to Chief Operating Officer in November 2013. Prior to joining Dollar General, Mr. Vasos served in executive positions with Longs Drug Stores Corporation for 7 years, including Executive Vice President and Chief Operating...

-

Page 100

...was promoted to Executive Vice President in March 2010. He has over 25 years of management experience in retail logistics. Prior to joining Dollar General, he was Group Vice President of Logistics and Distribution for Longs Drug Stores Corporation, an operator of a chain of retail drug stores on the...

-

Page 101

Lots, she served as Vice President and Controller for Jitney-Jungle Stores of America, Inc., a grocery retailer, from April 1998 to March 2001. At Jitney-Jungle, Ms. Elliott was responsible for the accounting operations and the internal and external financial reporting functions. Prior to serving at...

-

Page 102

... purchases of our common stock made during the quarter ended January 31, 2014 by or on behalf of Dollar General or any ''affiliated purchaser,'' as defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934:

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs...

-

Page 103

... 1, 2013, have been derived from our historical audited consolidated financial statements included elsewhere in this report. The selected historical statement of operations data and statement of cash flows data for the fiscal years ended January 28, 2011 and January 29, 2010 and balance sheet data...

-

Page 104

... share data, number of stores, selling square feet, and net sales per square foot) January 31, 2014 February 1, 2013 Year Ended February 3, 2012(1) January 28, 2011 January 29, 2010

Statement of Operations Data: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative...

-

Page 105

... the average selling square footage during the period, including the end of the fiscal year, the beginning of the fiscal year, and the end of each of our three interim fiscal quarters.

January 31, 2014 February 1, 2013 Year Ended February 3, 2012 January 28, 2011 January 29, 2010

Ratio of earnings...

-

Page 106

... to national brands. We offer our customers these national brand and private brand products at everyday low prices (typically $10 or less) in our convenient small-box (small store) locations. The customers we serve are value-conscious, many with low or fixed incomes, and Dollar General has always...

-

Page 107

... of sales in 2014 than in 2013. Our fourth priority is to strengthen and expand Dollar General's culture of serving others. For customers this means helping them ''Save time. Save money. Every day!'' by providing clean, well-stocked stores with quality products at low prices. For employees, this...

-

Page 108

..., we plan to continue to repurchase shares of our common stock in 2014. Key Financial Metrics. We have identified the following as our most critical financial metrics:

10-K

• Same-store sales growth; • Sales per square foot; • Gross profit, as a percentage of sales; • Selling, general and...

-

Page 109

... comments on financial performance in the current year periods as compared with the prior year periods. Results of Operations Accounting Periods. The following text contains references to years 2013, 2012, and 2011, which represent fiscal years ended January 31, 2014, February 1, 2013, and February...

-

Page 110

.... 2011 Amount Change % Change

2013

2012

2011

10-K

Net sales by category: Consumables ...% of net sales ...Seasonal ...% of net sales ...Home products ...% of net sales ...Apparel ...% of net sales ...Net sales ...Cost of goods sold . . % of net sales ...Gross profit ...% of net sales ...Selling...

-

Page 111

...with relatively higher retail prices. These factors were partially offset by a reduction in net purchase costs on certain products. The Company recorded a LIFO benefit of $11.0 million in 2013 compared to a LIFO provision of $1.4 million in 2012. The gross profit rate as a percentage of sales was 31...

-

Page 112

...with our 2009 tax year. In addition, 2013 reflects larger income tax benefits associated with federal jobs credits. We receive a significant income tax benefit related to wages paid to certain newly hired employees that qualify for federal jobs credits (principally the Work Opportunity Tax Credit or...

-

Page 113

...of 35% due primarily to the inclusion of state income taxes in the total effective tax rate. Off Balance Sheet Arrangements The entities involved in the ownership structure underlying the leases for three of our distribution centers meet the accounting definition of a Variable Interest Entity (''VIE...

-

Page 114

... each quarter based on our long-term senior unsecured debt ratings. The Term Facility will amortize in quarterly installments of $25.0 million, with the first such payment due on August 1, 2014, and the balance due at maturity. The Facilities can be prepaid in whole or in part at any time. The...

-

Page 115

... reaffirmed our corporate debt rating of BBBÇ, both with a stable outlook. Our current credit ratings, as well as future rating agency actions, could (i) impact our ability to finance our operations on satisfactory terms; (ii) affect our financing costs; and (iii) affect our insurance premiums and...

-

Page 116

...

$3,762,351

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and includes projected interest on variable rate long-term debt, using 2013 year end rates. Variable rate long-term debt includes the balance of the senior revolving credit facility (which...

-

Page 117

... (c) Operating lease obligations are inclusive of amounts included in deferred rent in our consolidated balance sheets. (d) Commercial commitments include information technology license and support agreements, supplies, fixtures, letters of credit for import merchandise, and other inventory purchase...

-

Page 118

... in Accounts payable, which are affected by the timing and mix of merchandise purchases, the most significant category of which were domestic purchases. On an ongoing basis, we closely monitor and manage our inventory balances, and they may fluctuate from period to period based on new store openings...

-

Page 119

... costs associated with the construction of a distribution center in Alabama; $114 million for new leased stores; $80 million for stores purchased or built by us; $28 million for systems-related capital projects; and $15 million for transportation-related projects. During 2011, we opened 625 new...

-

Page 120

... the inventory balance include: • applying the RIM to a group of products that is not fairly uniform in terms of its cost and selling price relationship and turnover; • applying the RIM to transactions over a period of time that include different rates of gross profit, such as those relating to...

-

Page 121

... projections are based on management's projections and represent best estimates taking into account recent financial performance, market trends, strategic plans and other available information, which in recent years have been materially accurate. Although not currently anticipated, changes in these...

-

Page 122

.... We retain a significant portion of the risk for our workers' compensation, employee health, property loss, automobile and general liability. These represent significant costs primarily due to our large employee base and number of stores. Provisions are made for these liabilities on an undiscounted...

-

Page 123

... over the shorter of the life of the applicable lease term or the estimated useful life of the asset. Share-Based Payments. Our share-based stock option awards are valued on an individual grant basis using the Black-Scholes-Merton closed form option pricing model. We believe that this model fairly...

-

Page 124

...10-K

We manage our interest rate risk through the strategic use of fixed and variable interest rate debt and, from time to time, derivative financial instruments. Our principal interest rate exposure relates to outstanding amounts under our unsecured debt Facilities. As of January 31, 2014, we had...

-

Page 125

... the financial position and creditworthiness of such counterparties, monitoring the amount for which we are at risk with each counterparty, and where possible, dispersing the risk among multiple counterparties. There can be no assurance that we will manage or mitigate our counterparty credit risk...

-

Page 126

... Public Accounting Firm

The Board of Directors and Shareholders of Dollar General Corporation We have audited the accompanying consolidated balance sheets of Dollar General Corporation and subsidiaries as of January 31, 2014 and February 1, 2013, and the related consolidated statements of income...

-

Page 127

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts)

January 31, 2014 February 1, 2013

ASSETS Current assets: Cash and cash equivalents ...Merchandise inventories ...Prepaid expenses and other current assets ...Total current assets ...Net ...

-

Page 128

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per share amounts)

For the Year Ended February 1, February 3, 2013 2012

January 31, 2014

Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...

$17,504,...

-

Page 129

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands)

For the Year Ended January 31, February 1, February 3, 2014 2013 2012

Net income ...Unrealized net gain (loss) on hedged transactions, net of related income tax expense (benefit) of $(4,461), ...

-

Page 130

... Loss

Common Stock Shares

Common Stock

Additional Paid-in Capital

Retained Earnings

Total

Balances, January 28, 2011 ...Net income ...Unrealized net gain (loss) on hedged transactions ...Share-based compensation expense Repurchases of common stock ...Tax benefit from stock option exercises...

-

Page 131

...Deferred income taxes ...Tax benefit of share-based awards ...Loss on debt retirement, net ...Noncash share-based compensation ...Other noncash (gains) and losses ...Change in operating assets and liabilities: Merchandise inventories ...Prepaid expenses and other current assets ...Accounts payable...

-

Page 132

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies Basis of presentation These notes contain references to the years 2013, 2012, and 2011, which represent fiscal years ended January 31, 2014, February 1, 2013, and ...

-

Page 133

... market price changes increase or decrease cost of sales (the LIFO provision or benefit). The Company recorded a LIFO provision (benefit) of $(11.0) million in 2013, $1.4 million in 2012, and $47.7 million in 2011, which is included in cost of goods sold in the consolidated statements of income...

-

Page 134

... costs of $1.2 million, $0.6 million and $1.5 million were capitalized in 2013, 2012 and 2011. Impairment of long-lived assets When indicators of impairment are present, the Company evaluates the carrying value of long-lived assets, other than goodwill, in relation to the operating performance...

-

Page 135

...of the related obligations, and utility, security and other deposits. Accrued expenses and other liabilities Accrued expenses and other consist of the following:

(In thousands) January 31, 2014 February 1, 2013

10-K

Compensation and benefits ...Insurance ...Taxes (other than taxes on income) Other...

-

Page 136

... claim costs for the workers' compensation, general liability, and health claim risks are derived using actuarial methods and are recorded as self-insurance reserves pursuant to Company policy. To the extent that subsequent claim costs vary from those estimates, future results of operations will...

-

Page 137

...)

1. Basis of presentation and accounting policies (Continued) Other liabilities Noncurrent Other liabilities consist of the following:

(In thousands) January 31, 2014 February 1, 2013

Compensation and benefits ...Insurance ...Income tax related reserves ...Deferred gain on sale leaseback . Other...

-

Page 138

...Derivative financial instruments The Company accounts for derivative financial instruments in accordance with applicable accounting standards for such instruments and hedging activities, which require that all derivatives are recorded on the balance sheet at fair value. The accounting for changes in...

-

Page 139

... or sale of vendor products for dollar amounts up to but not exceeding actual incremental costs. Advertising costs were $70.5 million, $61.7 million and $50.4 million in 2013, 2012 and 2011, respectively. These costs primarily include promotional circulars, targeted circulars supporting new stores...

-

Page 140

... costs related to new store openings and the related construction periods are expensed as incurred. Income taxes Under the accounting standards for income taxes, the asset and liability method is used for computing the future income tax consequences of events that have been recognized in the Company...

-

Page 141

... and trademarks ...

Indefinite 1 to 10 years Indefinite

$4,338,589 $ 106,917 1,199,700 $1,306,617

$

-

$4,338,589 $ 19,843 1,199,700

$87,074 - $87,074

$1,219,543

The Company recorded amortization expense related to amortizable intangible assets for 2013, 2012 and 2011 of $11.9 million, $16...

-

Page 142

... to purchase shares of common stock that were outstanding at the end of the respective periods, but were not included in the computation of diluted earnings per share because the effect of exercising such options would be antidilutive, were 1.1 million, 0.8 million, and zero in 2013, 2012 and 2011...

-

Page 143

...tax year. In addition, the 2013 amounts reflect larger income tax benefits associated with federal jobs credits. The Company receives a significant income tax benefit related to salaries paid to certain newly hired employees that qualify for federal jobs credits (principally the Work Opportunity Tax...

-

Page 144

...Accrued insurance ...Accrued incentive compensation ...Interest rate hedges ...Tax benefit of income tax and interest reserves related to uncertain tax positions ...Deferred gain on sale-leaseback ...Other ...State tax net operating loss carry forwards, net of federal tax ...State tax credit carry...

-

Page 145

... amended income tax return. The IRS, at its discretion, may also choose to examine the Company's 2010 through 2013 fiscal year income tax filings. The Company has various state income tax examinations that are currently in progress. Generally, the Company's 2010 and later tax years remain open for...

-

Page 146

... income tax rate if the Company were to recognize the tax benefit for these positions. The amounts associated with uncertain tax positions included in income tax expense consists of the following:

(In thousands) 2013 2012 2011

10-K

Income tax expense (benefit) ...Income tax related interest...

-

Page 147

... of debt issuance costs associated with the Facilities which is included in long-term Other assets, net in the consolidated balance sheet. Borrowings under the Facilities bear interest at a rate equal to an applicable margin plus, at the Company's option, either (a) LIBOR or (b) a base rate (which...

-

Page 148

... consolidated statement of income for the year ended February 3, 2012. The Company funded the redemption price for the senior notes due 2015 with cash on hand and borrowings under the ABL Facility. Scheduled debt maturities, including capital lease obligations, for the Company's fiscal years listed...

-

Page 149

... of business and operational risks through management of its core business activities. The Company manages economic risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and duration of its debt funding and the use of derivative financial instruments...

-

Page 150

... income (loss) in the consolidated statements of shareholders' equity. During the years ended January 31, 2014, February 1, 2013, and February 3, 2012, such derivatives were used to hedge the variable cash flows associated with existing variable-rate debt. The ineffective portion of the change...

-

Page 151

... present the pre-tax effect of the Company's derivative financial instruments as reflected in the consolidated statements of comprehensive income and shareholders' equity, as applicable:

(in thousands) 2013 2012 2011

10-K

Derivatives in Cash Flow Hedging Relationships Loss related to effective...

-

Page 152

...debt instrument pertaining to its lease financing obligation. Because a legal right of offset exists, the Company is accounting for the Ardmore Note as a reduction of its outstanding financing obligation in its consolidated balance sheets. Future minimum payments as of January 31, 2014 for operating...

-

Page 153

... employees under the FLSA and that the Richter action is not appropriate for collective action treatment. The Company has obtained summary judgment in some, although not all, of its pending individual or single-plaintiff store manager exemption cases in which it has filed such a motion. At this time...

-

Page 154

... 2011, the Chicago Regional Office of the United States Equal Employment Opportunity Commission (''EEOC'' or ''Commission'') notified the Company of a cause finding related to the Company's criminal background check policy. The cause finding alleges that Dollar General's criminal background check...

-

Page 155

... 11, 2013, the EEOC filed a lawsuit in the United States District Court for the Northern District of Illinois entitled Equal Opportunity Commission v. Dolgencorp, LLC d/b/a Dollar General (Case No. 1:13-cv-04307) in which the Commission alleges that the Company's criminal background check policy has...

-

Page 156

...wage statements and appropriate pay upon termination in violation of California wage and hour laws and seeks to recover alleged unpaid wages, declaratory relief, restitution, statutory penalties and attorneys' fees and costs. The Main plaintiff seeks to represent a putative class of California ''key...

-

Page 157

... for the Southern District of Florida (Case No. 9:11-cv-80601-DMM) (''Winn-Dixie'') in which the plaintiffs allege that the sale of food and other items in approximately 55 of the Company's stores, each of which allegedly is or was at some time co-located in a shopping center with one of plaintiffs...

-

Page 158

...results if changes to the Company's business operation are required. 9. Benefit plans The Dollar General Corporation 401(k) Savings and Retirement Plan, which became effective on January 1, 1998, is a safe harbor defined contribution plan and is subject to the Employee Retirement and Income Security...

-

Page 159

...'') and compensation deferral plan (''CDP''), known as the Dollar General Corporation CDP/SERP Plan, for a select group of management and other key employees. The Company incurred compensation expense for these plans of approximately $1.2 million, $1.4 million and $1.7 million in 2013, 2012 and 2011...

-

Page 160

... awards are based on the historical volatility of the Company's publicly traded common stock. An increase in the expected volatility will increase compensation expense. Weighted average risk-free interest rate-This is the U.S. Treasury rate for the week of the grant having a term approximating the...

-

Page 161

...Share-based payments (Continued) A summary of MSA Time Options activity during the year ended January 31, 2014 is as follows:

Options Issued Average Exercise Price Remaining Contractual Term in Years Intrinsic Value

(Intrinsic value amounts reflected in thousands)

Balance, February 1, 2013 Granted...

-

Page 162

... exercised during 2013, 2012, and 2011 was $0.8 million, $0.3 million and $1.6 million, respectively. The number of performance share unit awards earned is based upon the Company's annual financial performance in the year of grant as specified in the award agreement. A summary of performance share...

-

Page 163

...were executed at various dates in 2013, 2012 and 2011. The Company did not sell shares of common stock, receive proceeds from such shareholders' sales of shares of common stock or pay any underwriting fees in connection with any of the secondary offerings. Certain members of the Company's management...

-

Page 164

... as price, market conditions, compliance with the covenants and restrictions under our debt agreements and other factors. Repurchases under the program may be funded from available cash or borrowings under the Company's credit facilities discussed in further detail in Note 5. During the years ended...

-

Page 165

... period listed below was a 13-week accounting period. The sum of the four quarters for any given year may not equal annual totals due to rounding.

(In thousands) First Quarter Second Quarter Third Quarter Fourth Quarter

2013: Net sales ...Gross profit ...Operating profit ...Net income ...Basic...

-

Page 166

...as amended (the ''Exchange Act''). Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. (b) Management's Annual Report on Internal Control...

-

Page 167

... internal control over financial reporting as of January 31, 2014, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Dollar General Corporation and subsidiaries as...

-

Page 168

... will not be capped (with the officer, not the Company paying the excise tax). Each officer, other than Mr. Dreiling, will only have the right to such uncapped payments if such officer signs a release of claims against the Company in the form attached to his employment agreement. Except as described...

-

Page 169

...on the Investor Information section of our Internet website at www.dollargeneral.com. If we choose to no longer post such Code, we will provide a free copy to any person upon written request to Dollar General Corporation, c/o Investor Relations Department, 100 Mission Ridge, Goodlettsville, TN 37072...

-

Page 170

...2007 Stock Incentive Plan, whether in the form of stock, restricted stock, share units, or other share-based awards or upon the exercise of an option or right. (b) Other Information. The information required by this Item 12 regarding security ownership of certain beneficial owners and our management...

-

Page 171

PART IV ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

(a) Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Comprehensive Income Consolidated Statements of Shareholders' Equity Consolidated ...

-

Page 172

...W. DREILING

Chairman & Chief Executive Officer (Principal Executive Officer)

March 20, 2014

/s/ DAVID M. TEHLE DAVID M. TEHLE

Executive Vice President & Chief Financial Officer (Principal Financial and Accounting Officer)

March 20, 2014

/s/ WARREN F. BRYANT WARREN F. BRYANT

Director

March 20...

-

Page 173

Name

Title

Date

/s/ WILLIAM C. RHODES, III WILLIAM C. RHODES, III

Director

March 20, 2014

/s/ DAVID B. RICKARD DAVID B. RICKARD

Director

March 20, 2014

10-K

96

-

Page 174

... credit parties and lenders party thereto (incorporated by reference to Exhibit 4.3 to Dollar General Corporation's Current Report on Form 8-K dated April 8, 2013 and filed with the SEC on April 11, 2013 (file no. 001-11421)) Amended and Restated 2007 Stock Incentive Plan for Key Employees of Dollar...

-

Page 175

... quarter ended April 29, 2011, filed with the SEC on June 1, 2011 (file no. 001-11421))* Form of Stock Option Award Agreement in connection with grants made to certain employees of Dollar General Corporation pursuant to the Amended and Restated 2007 Stock Incentive Plan (approved March 20, 2012...

-

Page 176

...-11421))* Summary of Dollar General Corporation Life Insurance Program as Applicable to Executive Officers (incorporated by reference to Exhibit 10.19 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended February 2, 2007, filed with the SEC on March 29, 2007) (file no...

-

Page 177

... Policy for Officers (incorporated by reference to Exhibit 10.21 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 28, 2011, filed with the SEC on March 22, 2011 (file no. 001-11421))* Summary of Non-Employee Director Compensation effective February 1, 2014...

-

Page 178

..., among Dollar General Corporation, Buck Holdings, L.P., and Todd Vasos (incorporated by reference to Exhibit 10.37 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 29, 2010, filed with the SEC on March 24, 2009 (file no. 001-11421))* Employment Agreement...

-

Page 179

... 10.41 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 28, 2011, filed with the SEC on March 22, 2011 (file no. 001-11421))* Stock Option Agreement, dated as of March 24, 2010, by and between Dollar General Corporation and Robert Ravener (incorporated by...

-

Page 180

... Ridge, Goodlettsville, Tennessee 37072 (615) 855-4000

Direct Stock Purchase Plan

Wells Fargo Shareowner Services sponsors and administers a direct purchase plan for the shares of Dollar General Corporation. Information on the plan, a copy of the prospectus and enrollment forms are located at www...

-

Page 181

... Street, Goodlettsville, TN 37072

NET SALES (IN BILLIONS)

$17.5 $16.0 $14.8 $13.0 $11.8

Shareholders of record as of March 21, 2014 are entitled to vote at the meeting.

2009 2010 2011 2012 2013

NYSE: DG

The common stock of Dollar General Corporation is traded on the New York Stock Exchange under...

-

Page 182