Comcast 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

65

Comcast 2009 Annual Report on Form 10-

K

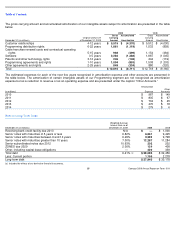

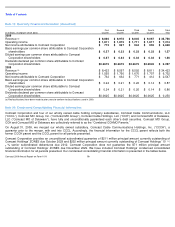

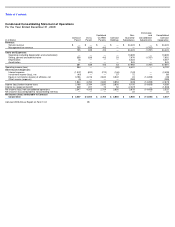

Components of Net Deferred Tax Liability

Changes in net deferred income tax liabilities in 2009 that

were not recorded as deferred income tax expense are

related to increases of approximately $37 million associated

with items included in other comprehensive income (loss).

Our net deferred tax liability includes approximately $23

billion related to franchise rights that will remain unchanged

unless we recognize an impairment or dispose of a franchise.

Net deferred tax assets included in current assets are

primarily related to our current investments and current

liabilities. As of December 31, 2009, we had federal net

operating loss carryforwards of $185 million and various state

net operating loss carryforwards that expire in periods

through 2029. The determination of the state net operating

loss carryforwards is dependent on our subsidiaries’ taxable

income or loss, apportionment percentages, and state laws

that can change from year to year and impact the amount of

such carryforwards. We recognize a valuation allowance if

we determine it is more likely than not that some portion, or

all, of a deferred tax asset will not be realized. As of

December 31, 2009 and 2008, our valuation allowance was

related primarily to state net operating loss carryforwards. In

2009, 2008 and 2007, income tax benefits attributable to

share-based compensation of approximately $14 million, $28

million, and $49 million, respectively, were allocated to

shareholders’ equity.

Uncertain Tax Positions

On January 1, 2007, we recorded a cumulative effect

adjustment related to the adoption of new accounting

guidance related to uncertain tax positions that increased

retained earnings by $60 million. Our uncertain tax positions

as of December 31, 2009

December 31 (in millions)

2009

2008

Deferred Tax Assets:

Net operating loss

carryforwards

$

375

$

445

Differences between book and

tax basis of long

-

term debt

137

153

Nondeductible accruals and

other

1,188

1,351

Less: Valuation allowance

(214

)

(225

)

1,486

1,724

Deferred Tax Liabilities:

Differences between book and

tax basis of property and

equipment and intangible

assets

27,870

27,354

Differences between book and

tax basis of investments

662

588

Differences between book and

tax basis of indexed debt

securities

514

472

29,046

28,414

Net deferred tax liability

$

27,560

$

26,690

totaled $1.185 billion, excluding the federal benefits on state

tax positions that have been recorded as deferred income

taxes. If we were to recognize the tax benefit for such

positions in the future, approximately $941 million would

impact our effective tax rate with the remaining amount

increasing our deferred income tax liability.

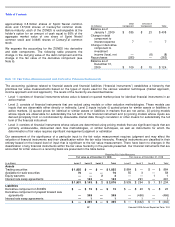

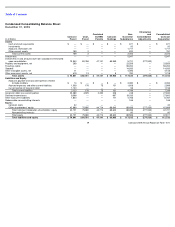

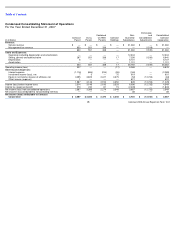

Reconciliation of Unrecognized Tax Benefits

As of December 31, 2009 and 2008, we had accrued

approximately $519 million and $787 million, respectively, of

interest associated with our uncertain tax positions.

During 2009, we recognized approximately $566 million of

income tax benefits primarily due to the recognition of tax

benefits associated with uncertain tax positions and related

interest, and certain subsidiary reorganizations. The primary

impacts of these adjustments were reductions to our deferred

income tax and other long-term liabilities. During 2008, we

recognized approximately $411 million of income tax benefits

as a result of the settlement of an uncertain tax position of an

acquired entity. The tax position related to the deductibility of

certain costs incurred in connection with a business

acquisition. The primary impacts of the settlement were

reductions to our deferred income tax and other long-term

liabilities of approximately $542 million, a reduction to

goodwill of approximately $477 million and a reduction to

income tax expense of approximately $65 million.

The Internal Revenue Service (“IRS”) and various states are

currently examining our 2007 and 2008 tax returns. During

2009, the IRS completed its examination of our income tax

returns for 2005 and 2006. During 2007, the IRS completed

its examination of our income tax returns for the years 2000

through 2004. The IRS proposed certain adjustments that

relate primarily to certain financing transactions. We are

currently disputing those proposed adjustments, but if the

adjustments are sustained, they would not have a material

impact on our effective tax rate.

(in millions)

2009

2008

2007

Balance as of

January 1

$

1,450

$

1,921

$

2,099

Additions based on

tax positions

related to the

current year

57

55

65

Additions based on

tax positions

related to prior

years

—

30

18

Reductions for tax

positions of prior

years

(257

)

(411

)

(157

)

Reductions due to

expiration of statute

of limitations

—

(

3

)

(3

)

Settlements with

taxing authorities

(65

)

(142

)

(101

)

Balance as of

December 31

$

1,185

$

1,450

$

1,921